Enlarge image

New Hampshire

202

Department of *0DP1212411862*

Revenue Administration DP-121 0DP1212411862

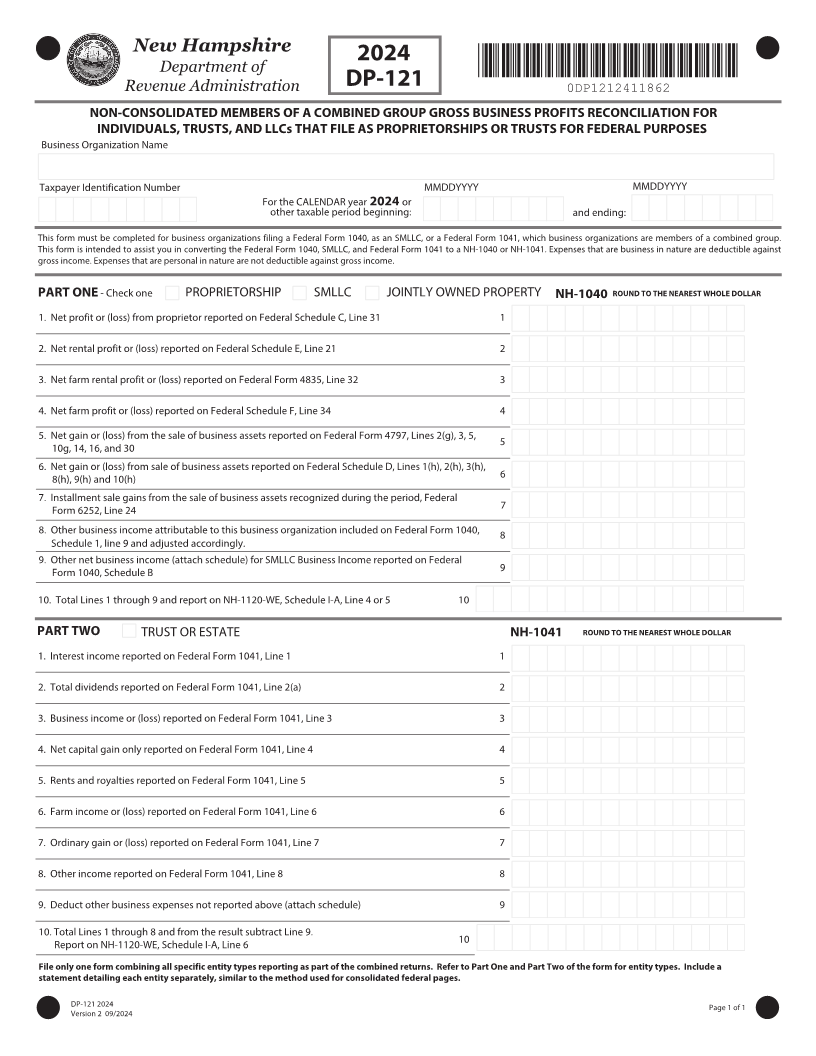

NON-CONSOLIDATED MEMBERS OF A COMBINED GROUP GROSS BUSINESS PROFITS RECONCILIATION FOR

INDIVIDUALS, TRUSTS, AND LLCs THAT FILE AS PROPRIETORSHIPS OR TRUSTS FOR FEDERAL PURPOSES

Business Organization Name

Taxpayer Identification Number MMDDYYYY MMDDYYYY

For the CALENDAR year 202 or

other taxable period beginning: and ending:

This form must be completed for business organizations filing a Federal Form 1040, as an SMLLC, or a Federal Form 1041, which business organizations are members of a combined group.

This form is intended to assist you in converting the Federal Form 1040, SMLLC, and Federal Form 1041 to a NH-1040 or NH-1041. Expenses that are business in nature are deductible against

gross income. Expenses that are personal in nature are not deductible against gross income.

PART ONE - Check one PROPRIETORSHIP SMLLC JOINTLY OWNED PROPERTY NH-1040 306/% 50 5)& /&"3&45 8)0-& %0--"3

1. Net profit or (loss) from proprietor reported on Federal Schedule C, Line 31 1

2. Net rental profit or (loss) reported on Federal Schedule E, Line 21 2

3. Net farm rental profit or (loss) reported on Federal Form 4835, Line 32 3

4. Net farm profit or (loss) reported on Federal Schedule F, Line 34 4

5. Net gain or (loss) from the sale of business assets reported on Federal Form 4797, Lines 2(g), 3, 5, 5

10g, 14, 16, and 30

6. Net gain or (loss) from sale of business assets reported on Federal Schedule D, Lines 1(h), 2(h), 3(h),

8(h), 9(h) and 10(h) 6

7. Installment sale gains from the sale of business assets recognized during the period, Federal

Form 6252, Line 24 7

8. 0UIFS CVTJOFTT JODPNF BUUSJCVUBCMF UP UIJT CVTJOFTT PSHBOJ[BUJPO JODMVEFE PO 'FEFSBM 'PSN 8

4DIFEVMF MJOF BOE BEKVTUFE BDDPSEJOHMZ

9. Other net business income (attach schedule) for SMLLC Business Income reported on Federal

Form 1040, Schedule B 9

10. Total Lines 1 through 9 and report on NH-1120-WE, Schedule I-A, Line 4 or 5 10

PART TWO TRUST OR ESTATE NH-1041 306/% 50 5)& /&"3&45 8)0-& %0--"3

1. Interest income reported on Federal Form 1041, Line 1 1

2. Total dividends reported on Federal Form 1041, Line 2(a) 2

3. Business income or (loss) reported on Federal Form 1041, Line 3 3

4. Net capital gain only reported on Federal Form 1041, Line 4 4

5. Rents and royalties reported on Federal Form 1041, Line 5 5

6. Farm income or (loss) reported on Federal Form 1041, Line 6 6

7. Ordinary gain or (loss) reported on Federal Form 1041, Line 7 7

8. Other income reported on Federal Form 1041, Line 8 8

9. Deduct other business expenses not reported above (attach schedule) 9

10. Total Lines 1 through 8 and from the result subtract Line 9.

Report on NH-1120-WE, Schedule I-A, Line 6 10

File only one form combining all specific entity types reporting as part of the combined returns. Refer to Part One and Part Two of the form for entity types. Include a

statement detailing each entity separately, similar to the method used for consolidated federal pages.

DP-121 202 1BHF PG

Version 0 /202