Enlarge image

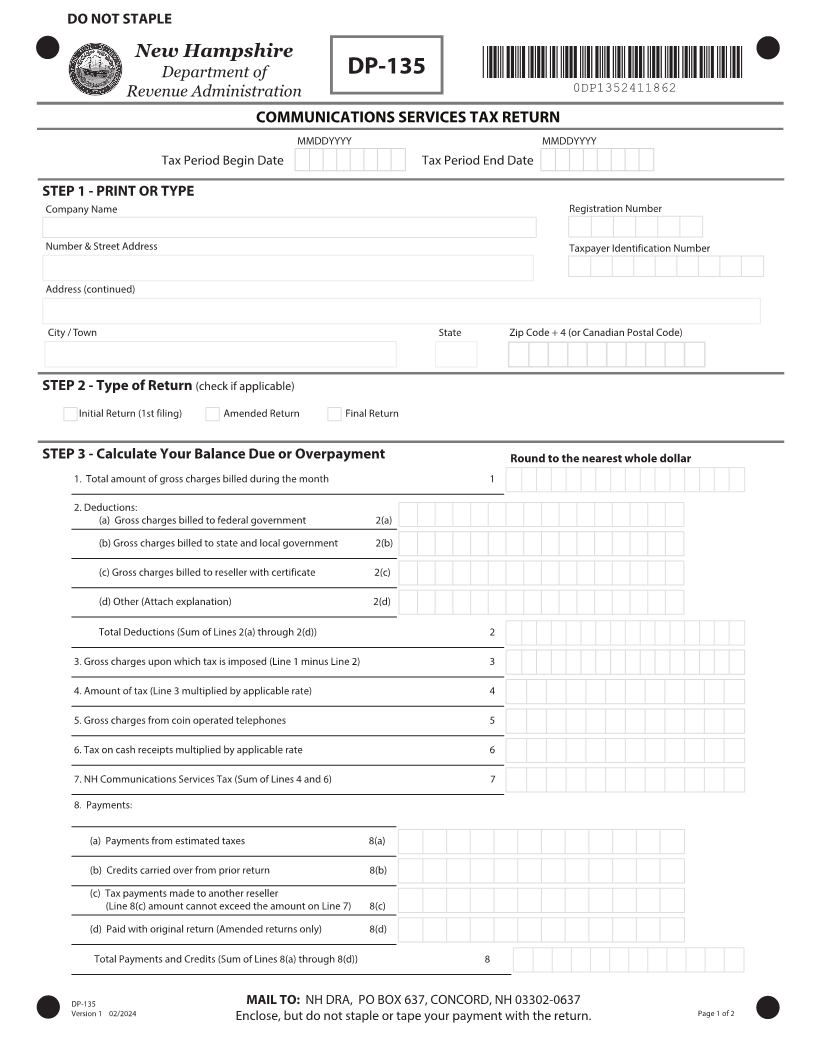

DO NOT STAPLE

New Hampshire

Department of DP-135 *0DP1352411862*

Revenue Administration 0DP1352411862

COMMUNICATIONS SERVICES TAX RETURN

MMDDYYYY MMDDYYYY

Tax Period Begin Date Tax Period End Date

STEP 1 - PRINT OR TYPE

Company Name Registration Number

Number & Street Address Taxpayer Identification Number

Address (continued)

City / Town State Zip Code + 4 (or Canadian Postal Code)

STEP 2 - Type of Return (check if applicable)

Initial Return (1st filing) Amended Return Final Return

STEP 3 - Calculate Your Balance Due or Overpayment Round to the nearest whole dollar

1. Total amount of gross charges billed during the month 1

2. Deductions:

(a) Gross charges billed to federal government 2(a)

(b) Gross charges billed to state and local government 2(b)

(c) Gross charges billed to reseller with certificate 2(c)

(d) Other (Attach explanation) 2(d)

Total Deductions (Sum of Lines 2(a) through 2(d)) 2

3. Gross charges upon which tax is imposed (Line 1 minus Line 2) 3

4. Amount of tax (Line 3 multiplied by applicable rate) 4

5. Gross charges from coin operated telephones 5

6. Tax on cash receipts multiplied by applicable rate 6

7. NH Communications Services Tax (Sum of Lines 4 and 6) 7

8. Payments:

(a) Payments from estimated taxes 8(a)

(b) Credits carried over from prior return 8(b)

(c) Tax payments made to another reseller

(Line 8(c) amount cannot exceed the amount on Line 7) 8(c)

(d) Paid with original return (Amended returns only) 8(d)

Total Payments and Credits (Sum of Lines 8(a) through 8(d)) 8

DP-135 ."*- 50 NH DRA, PO BOX 637, CONCORD, NH 03302-0637

7FSTJPO Enclose, but do not staple or tape your payment with the return Page 1 of