Enlarge image

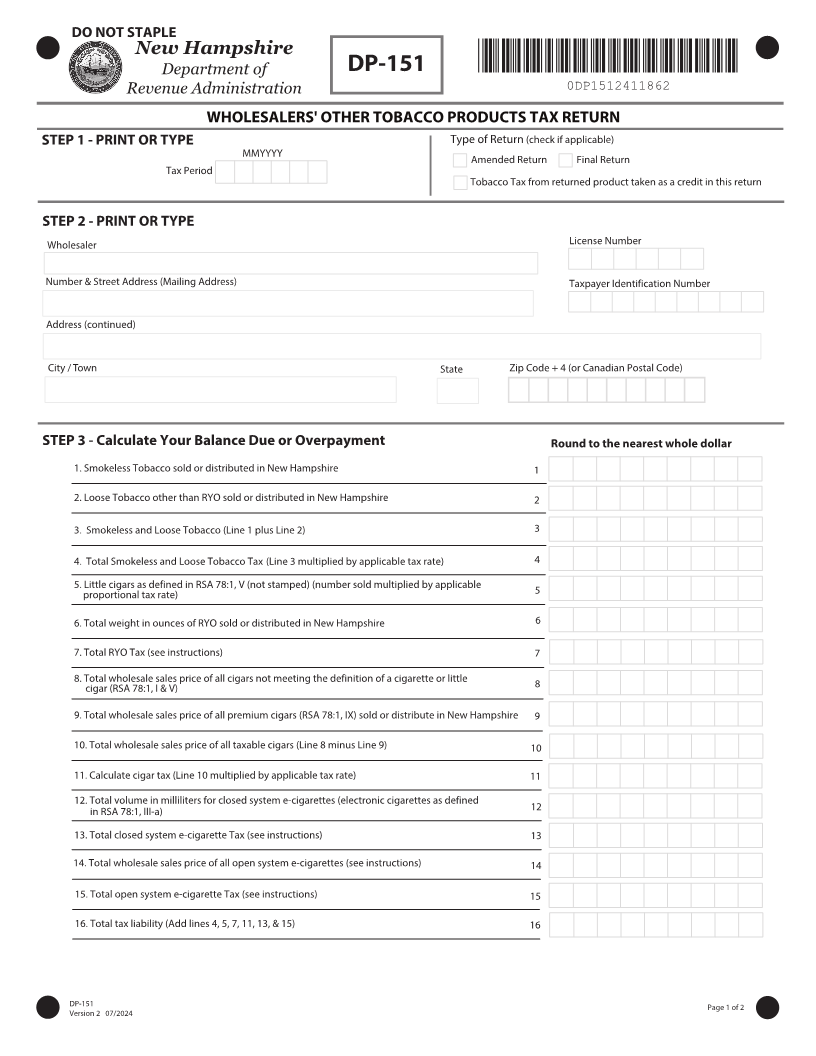

DO NOT STAPLE

New Hampshire

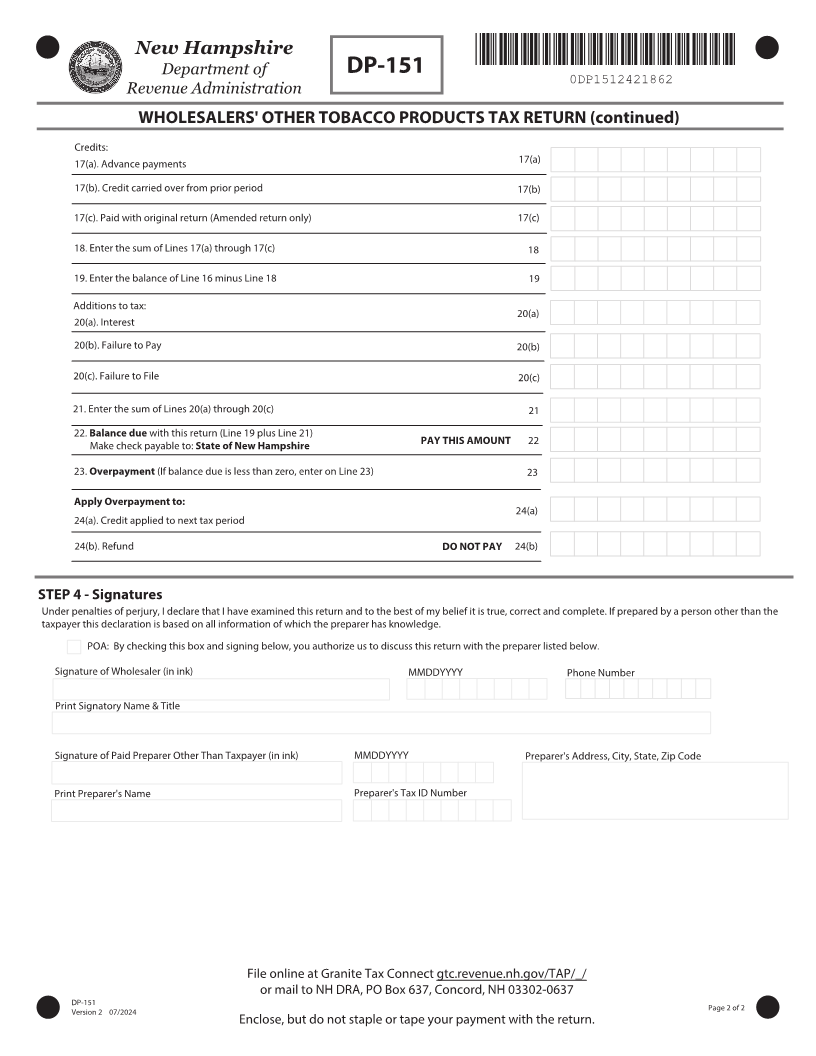

Department of DP-151 *0DP1512411862*

Revenue Administration 0DP1512411862

WHOLESALERS' OTHER TOBACCO PRODUCTS TAX RETURN

STEP 1 - PRINT OR TYPE Type of Return (check if applicable)

MMYYYY Amended Return Final Return

Tax Period

Tobacco Tax from returned product taken as a credit in this return

STEP 2 - PRINT OR TYPE

Wholesaler License Number

Number & Street Address (Mailing Address) Taxpayer Identification Number

Address (continued)

City / Town State Zip Code + 4 (or Canadian Postal Code)

STEP 3 - Calculate Your Balance Due or Overpayment Round to the nearest whole dollar

1. Smokeless Tobacco sold or distributed in New Hampshire 1

2. Loose Tobacco other than RYO sold or distributed in New Hampshire 2

3. Smokeless and Loose Tobacco (Line 1 plus Line 2) 3

4. Total Smokeless and Loose Tobacco Tax (Line 3 multiplied by applicable tax rate) 4

5.QSPQPSUJPOBM UBY SBUF Little cigars as defined in RSA 78:1, V (not stamped) (number sold multiplied by applicable 5

6. Total weight in ounces of RYO sold or distributed in New Hampshire 6

7. Total RYO Tax (see instructions) 7

8. Total wholesale sales price of all cigars not meeting the definition of a DJHBSFUUF PS MJUUMF 8

cigar (RSA 78:1, I & V)

9. Total wholesale sales price of all premium cigars (RSA 78:1, IX) sold or EJTUSJCVUF JO /FX )BNQTIJSF 9

10. Total wholesale sales price of all taxable cigars (Line 8 minus Line 9) 10

11. Calculate cigar tax (Line 10 multiplied by applicable tax rate) 11

12. Total volume in milliliters for closed system e-cigarettes FMFDUSPOJD DJHBSFUUFT BT EFGJOFE 12

in RSA 78:1, III-a)

13. Total closed system e-cigarette Tax (see instructions) 13

14. Total wholesale sales price of all open system e-cigarettes TFF JOTUSVDUJPOT 14

15. Total open system e-cigarette Tax (see instructions) 15

16. Total tax liability (Add lines 4, 5, 7, 11, 13, & 15) 16

DP-151 Page 1 of

7FSTJPO