Enlarge image

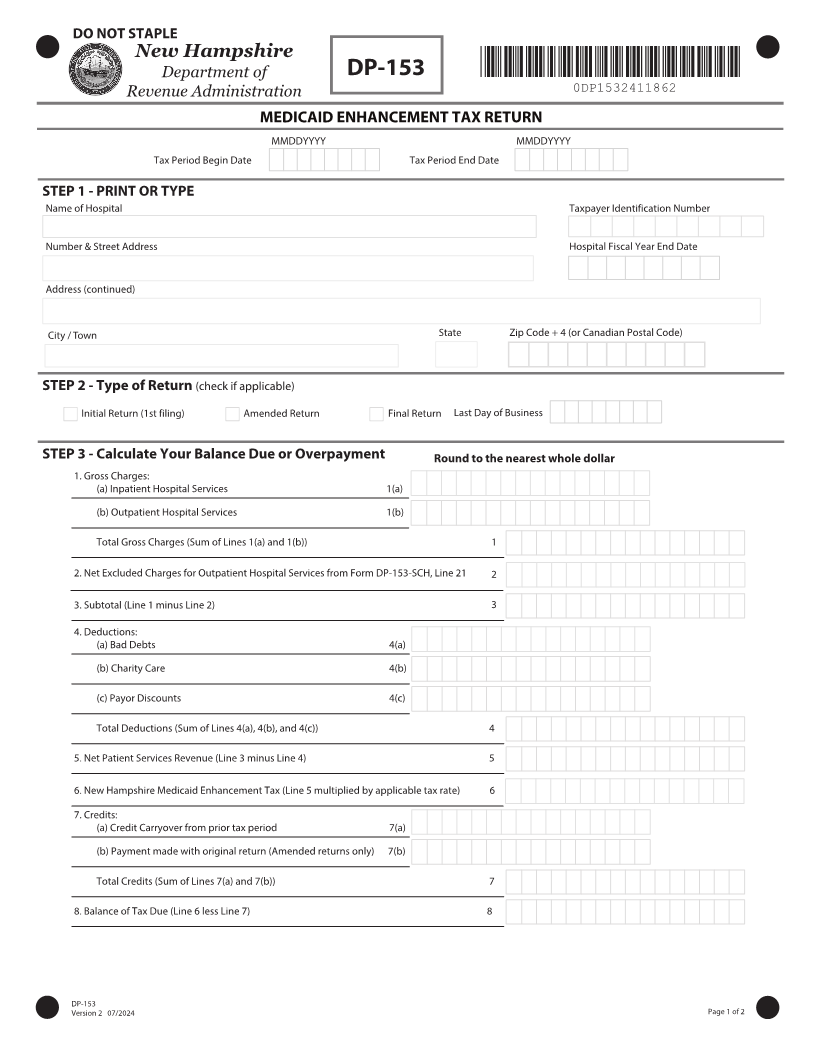

DO NOT STAPLE

New Hampshire

Department of DP-153 *0DP1532411862*

Revenue Administration 0DP1532411862

M&%*$"*% &/)"/$&.&/5 5"9 3&563/

MMDDYYYY MMDDYYYY

Tax Period Begin Date Tax Period End Date

STEP 1 - PRINT OR TYPE

Name of Hospital Taxpayer Identification Number

Number & Street Address Hospital Fiscal Year End Date

Address (continued)

City / Town State Zip Code + 4 (or Canadian Postal Code)

STEP 2 - Type of Return (check if applicable)

Initial Return (1st filing) Amended Return Final Return Last Day of Business

STEP 3 - Calculate Your Balance Due or Overpayment Round to the nearest whole dollar

1. Gross Charges:

(a) Inpatient Hospital Services 1(a)

(b) Outpatient Hospital Services 1(b)

Total Gross Charges (Sum of Lines 1(a) and 1(b)) 1

2. Net Excluded Charges for Outpatient Hospital Services from 'PSN %1 4$) -JOF 2

3. Subtotal (Line 1 minus Line 2) 3

4. Deductions:

(a) Bad Debts 4(a)

(b) Charity Care 4(b)

(c) Payor Discounts 4(c)

Total Deductions (Sum of Lines 4(a), 4(b), and 4(c)) 4

5. Net Patient Services Revenue (Line 3 minus Line 4) 5

6. New Hampshire Medicaid Enhancement Tax (Line 5 multiplied by applicable tax rate) 6

7. Credits:

(a) Credit Carryover from prior tax period 7(a)

(b) Payment made with original return (Amended returns only) 7(b)

Total Credits (Sum of Lines 7(a) and 7(b)) 7

8. Balance of Tax Due (Line 6 less Line 7) 8

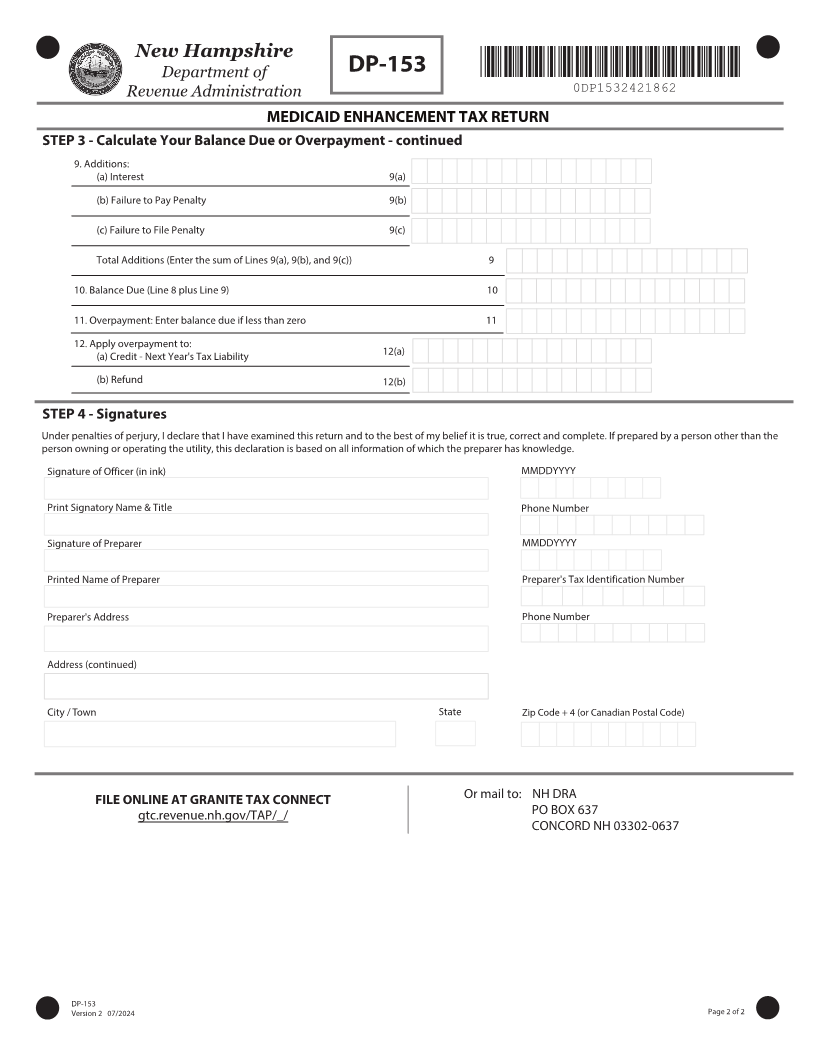

DP-153

7FSTJPO 1BHF PG