Enlarge image

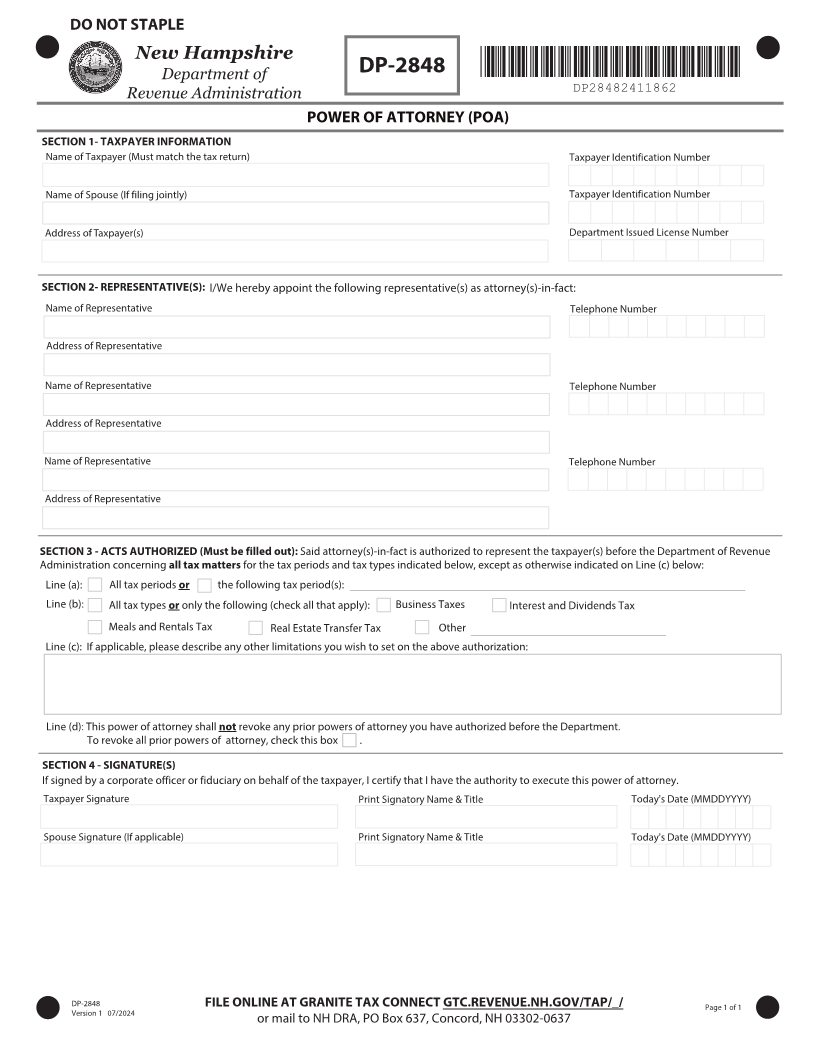

DO NOT STAPLE

New Hampshire

DP-2848

Department of *DP28482411862*

Revenue Administration DP28482411862

POWER OF ATTORNEY (POA)

SECTION 1- TAXPAYER INFORMATION

Name of Taxpayer (Must match the tax return) Taxpayer Identification Number

Name of Spouse (If filing jointly) Taxpayer Identification Number

Address of Taxpayer(s) Department Issued License Number

SECTION 2- REPRESENTATIVE(S): I/We hereby appoint the following representative(s) as attorney(s)-in-fact:

Name of Representative Telephone Number

Address of Representative

Name of Representative Telephone Number

Address of Representative

Name of Representative Telephone Number

Address of Representative

SECTION 3 - ACTS AUTHORIZED (Must be filled out): Said attorney(s)-in-fact is authorized to represent the taxpayer(s) before the Department of Revenue

Administration concerning all tax matters for the tax periods and tax types indicated below, except as otherwise indicated on Line (c) below:

Line (a): All tax periods or the following tax period(s):

Line (b): All tax types oronly the following (check all that apply): Business Taxes Interest and Dividends Tax

Meals and Rentals Tax Real Estate Transfer Tax Other

Line (c): If applicable, please describe any other limitations you wish to set on the above authorization:

Line (d): This power of attorney shall not revoke any prior powers of attorney you have authorized before the Department.

To revoke all prior powers of attorney, check this box .

SECTION 4 - SIGNATURE(S)

If signed by a corporate officer or fiduciary on behalf of the taxpayer, I certify that I have the authority to execute this power of attorney.

Taxpayer Signature Print Signatory Name & Title Today's Date (MMDDYYYY)

Spouse Signature (If applicable) Print Signatory Name & Title Today's Date (MMDDYYYY)

DP-2848 FILE ONLINE AT GRANITE TAX CONNECT (5$ 3&7&/6& /) (07 5"1 @ 1BHF PG

7FSTJPO

or mail to NH DRA, PO Box 637, Concord, NH 03302-0637