Enlarge image

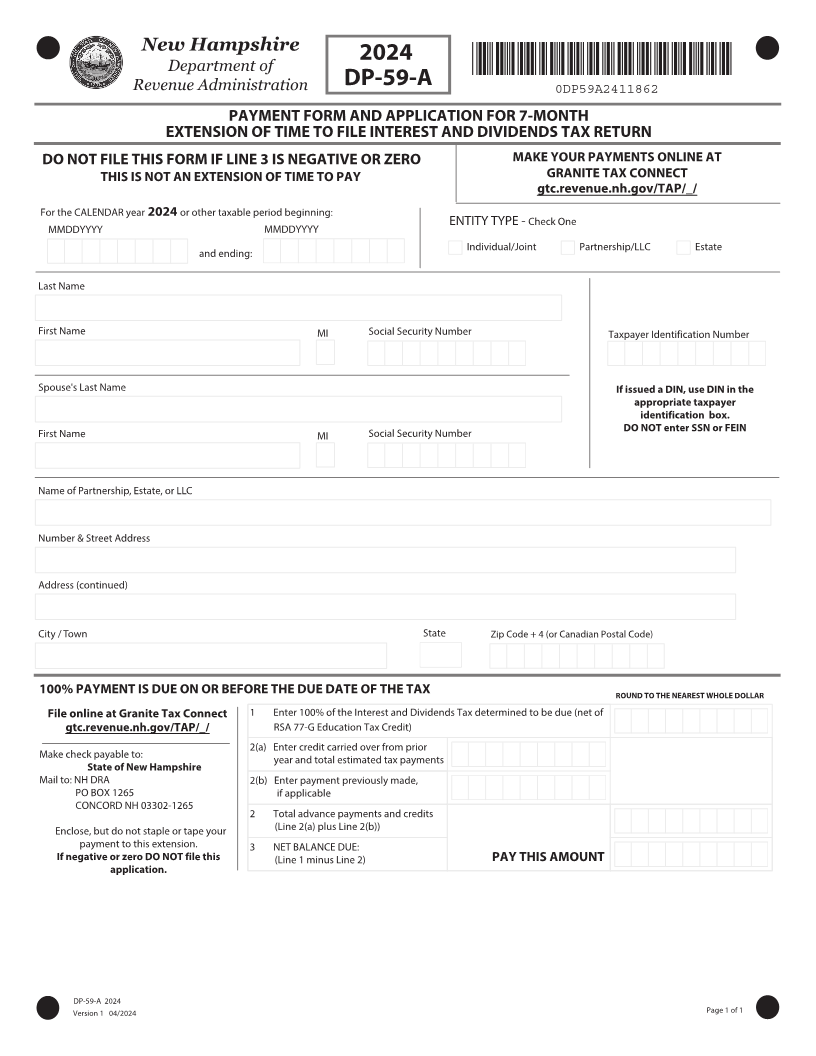

New Hampshire

202

Department of *0DP59A2411862*

Revenue Administration DP-59-A 0DP59A2411862

PAYMENT FORM AND APPLICATION FOR 7-MONTH

EXTENSION OF TIME TO FILE INTEREST AND DIVIDENDS TAX RETURN

DO NOT FILE THIS FORM IF LINE 3 IS NEGATIVE OR ZERO MAKE YOUR PAYMENTS ONLINE AT

THIS IS NOT AN EXTENSION OF TIME TO PAY GRANITE TAX CONNECT

HUD SFWFOVF OI HPW 5"1 @

For the CALENDAR year 202 or other taxable period beginning:

ENTITY TYPE - Check One

MMDDYYYY MMDDYYYY

Individual/Joint Partnership/LLC Estate

and ending:

Last Name

First Name MI Social Security Number Taxpayer Identification Number

Spouse's Last Name If issued a DIN, use DIN in the

appropriate taxpayer

identification box.

First Name MI Social Security Number DO NOT enter SSN or FEIN

Name of Partnership, Estate, or LLC

Number & Street Address

Address (continued)

City / Town State Zip Code + 4 (or Canadian Postal Code)

100% PAYMENT IS DUE ON OR BEFORE THE DUE DATE OF THE TAX 306/% 50 5)& /&"3&45 8)0-& %0--"3

File online at Granite Tax Connect 1 Enter 100% of the Interest and Dividends Tax determined to be due (net of

HUD SFWFOVF OI HPW 5"1 @ RSA 77-G Education Tax Credit)

2(a) Enter credit carried over from prior

Make check payable to: year and total estimated tax payments

State of New Hampshire

Mail to: NH DRA 2(b) Enter payment previously made,

PO BOX 1265 if applicable

CONCORD NH 03302-1265

2 Total advance payments and credits

Enclose, but do not staple or tape your (Line 2(a) plus Line 2(b))

payment to this extension. 3 NET BALANCE DUE:

If negative or zero DO NOT file this (Line 1 minus Line 2) 1": 5)*4 ".06/5

application.

DP-59-A 202

Version 1 /202 Page 1 of