Enlarge image

New Hampshire

202

Department of *0010402411862*

Revenue Administration NH-1040 0010402411862

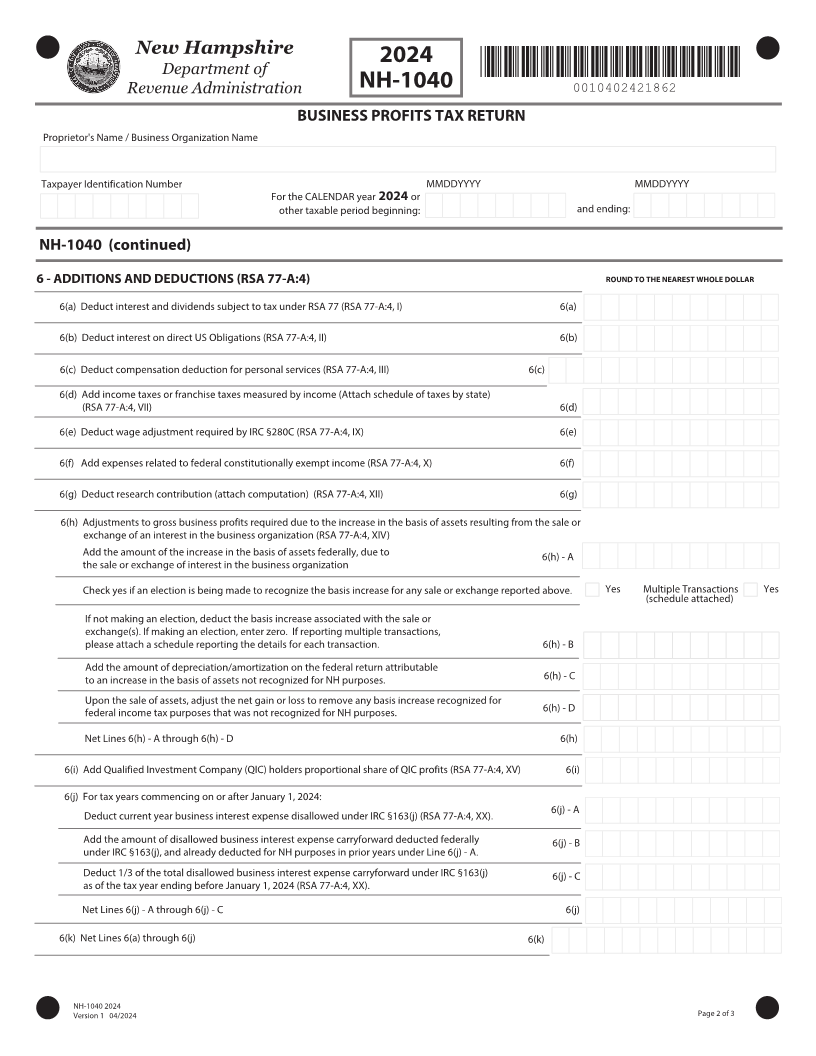

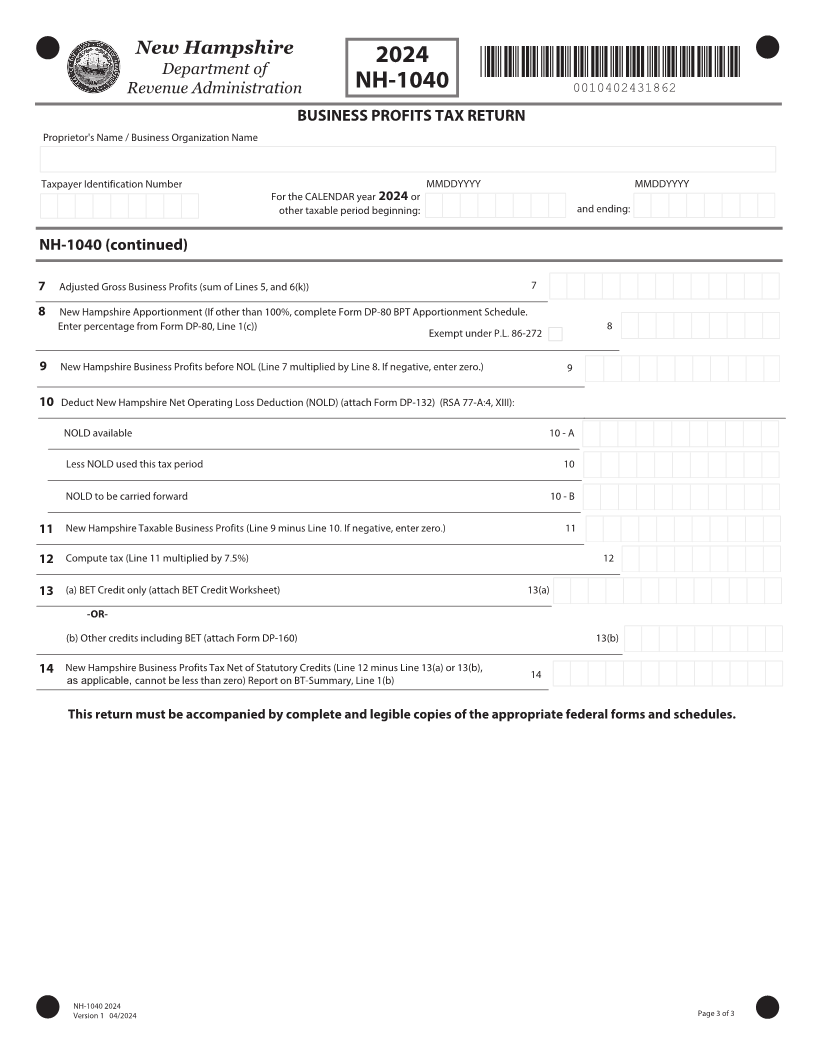

BUSINESS PROFITS TAX RETURN

Proprietor's Name / Business Organization Name

Taxpayer Identification Number MMDDYYYY MMDDYYYY

For the CALENDAR year 202 or

other taxable period beginning: and ending:

1 GROSS BUSINESS PROFITS Each business organization must file a separate return. 306/% 50 5)& /&"3&45 8)0-& %0--"3

1(a) Net profit or loss reported on proprietor Federal Schedule C, Line 31 1(a)

1(b) Net rental profit or loss reported on Federal Schedule E, Line 21 1(b)

1(c) Net farm rental profit or loss reported on Federal Form 4835, Line 32 1(c)

1(d) Net farm profit or loss reported on Federal Schedule F, Line 34 1(d)

1(e) Net gain or loss from the sale of business assets reported on Federal Form 4797, Lines 2(g), 3, 5, 10(g), 14,

16 and 30 1(e)

1(f) Net gain or loss from sale of investment assets used in business activity reported on Federal

Schedule D, Lines 1(h), 2(h), 3(h), 8(h), 9(h) and 10(h) 1(f)

1(g) Installment sale gains from the sale of business assets recognized during the period on

Federal Form 6252, Line 24 1(g)

1(h) Other net business income (attach schedule) attributable to this business organization as adjusted

accordingly from Federal Form 1040, Schedule B 1(h)

1(i) 0UIFS CVTJOFTT JODPNF BUUSJCVUBCMF UP UIJT CVTJOFTT PSHBOJ[BUJPO JODMVEFE PO 'FEFSBM 'PSN

4DIFEVMF MJOF BOE BEKVTUFE BDDPSEJOHMZ 1(i)

1(j) Subtotal Lines 1(a) through 1(i) 1(j)

2 INCREASE or DECREASE TO GROSS BUSINESS PROFITS TO RECONCILE WITH IRC

2(a) Add amount of IRC §179 expense taken on federal return in excess of the amount permitted pursuant

to RSA 77-A:3-b, IV, including carryover amounts deducted in this taxable period 2(a)

2(b) Add the amount of bonus depreciation taken on the federal return for assets placed in service this

period pursuant to RSA 77-A:3-b, I. 2(b)

2(c) Add any other deductions or exclusions taken on the federal return that need to be eliminated or

adjusted pursuant to RSA 77-A:1, XX, and 77-A:3-b, III. Complete and attach Schedule IV 2(c)

2(d) Deduct regular depreciation related to IRC §179 and bonus depreciation not allowed for this taxable

period or for prior taxable periods 2(d)

2(e) Deduct any other items included on the federal return that need to be eliminated or adjusted

pursuant to RSA 77-A:1, XX or RSA 77-A:4, XIX. Complete and attach Schedule IV 2(e)

2(f) Increase or Decrease the net gain or loss on the sale of assets used in the business that have a

different state basis from the tax basis reported on the federal return 2(f)

2(g) Net Lines 2(a) through 2(f) 2(g)

Subtotal Line 1(j) adjusted by Line 2(g) 3

Separate entity items of income or expense (attach schedule) 4

Gross Business Profits (combine Line 3 and Line 4) 5

NH-1040 202 Page 1 of 3

Version 1 0 /202