Enlarge image

New Hampshire

202

Department of *0010412411862*

Revenue Administration NH-1041 0010412411862

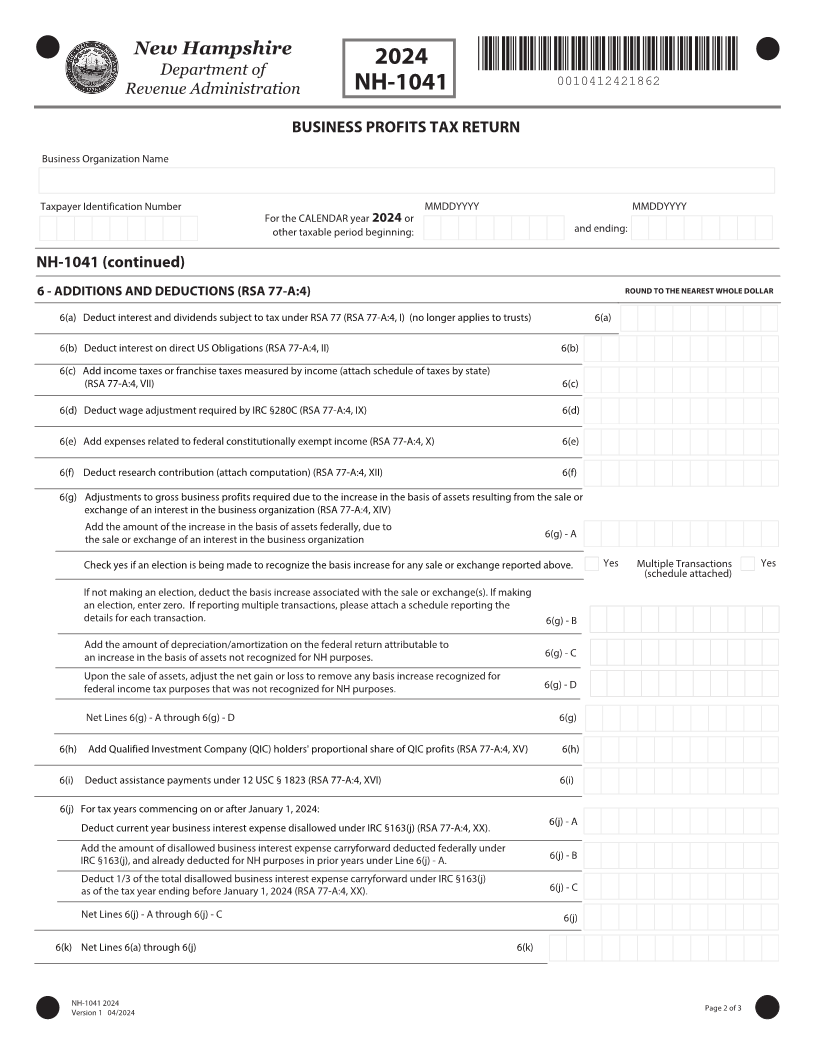

BUSINESS PROFITS TAX RETURN

Business Organization Name

Taxpayer Identification Number MMDDYYYY MMDDYYYY

For the CALENDAR year 202 or and ending:

other taxable period beginning:

1 GROSS BUSINESS PROFITS 306/% 50 5)& /&"3&45 8)0-& %0--"3

1(a) Interest income reported on Federal Form 1041, Line 1 1(a)

1(b) Total Dividends reported on Federal Form 1041, Line 2(a) 1(b)

1(c) Business income or (loss) reported on Federal Form 1041, Line 3 1(c)

1(d) Net Capital gain only reported on Federal Form 1041, Line 4 1(d)

1(e) Rents, and royalties reported on Federal Form 1041, Line 5 1(e)

1(f) Farm Income or (loss) reported on Federal Form 1041, Line 6 1(f)

1(g) Ordinary gain or (loss) reported on Federal Form 1041, Line 7 1(g)

1(h) Other income reported on Federal Form 1041, Line 8 1(h)

1(i) Other business expenses not reported above (attach schedule) 1(i)

1(j) Business profits from business activity of an association or trust (Combine Lines 1(a) through 1(h)

and from the result subtract Line 1(i)) 1(j)

INCREASE or DECREASE TO GROSS BUSINESS PROFITS TO RECONCILE WITH IRC

2(a) Add amount of IRC §179 expense taken on federal return in excess of the amount permitted pursuant

to RSA 77-A:3-b, IV, including carryover amounts deducted in this taxable period 2(a)

2(b) Add the amount of bonus depreciation taken on the federal return for assets placed in service this period

pursuant to RSA 77-A:3-b, I 2(b)

2(c) Add any other deductions or exclusions taken on the federal return that need to be eliminated or

adjusted pursuant to RSA 77-A:1, XX and 77-A:3-b, III. Complete and attach Schedule IV 2(c)

2(d) Deduct regular depreciation related to IRC §179 and bonus depreciation not allowed for this taxable

period or for prior taxable periods 2(d)

2(e) Deduct any other items included on the federal return that need to be eliminated or adjusted pursuant to

RSA 77-A:1, XX or RSA 77-A:4, XIX. Complete and attach Schedule IV 2(e)

2(f) Increase or Decrease the net gain or loss on the sale of assets used in the business that have a different

state basis from the tax basis reported on the federal return 2(f)

2(g) Net Lines 2(a) through 2(f) 2(g)

Subtotal Line 1(j) adjusted by Line 2(g) 3

Separate entity items of income or expense (attach schedule) 4

Gross Business Profits (combine Line 3 and Line 4) 5

NH-1041 202 Page 1 of 3

Version 1 0 /202