Enlarge image

New Hampshire 202

Department of *SCHD042411862*

Revenue Administration Schedule IV

SCHD042411862

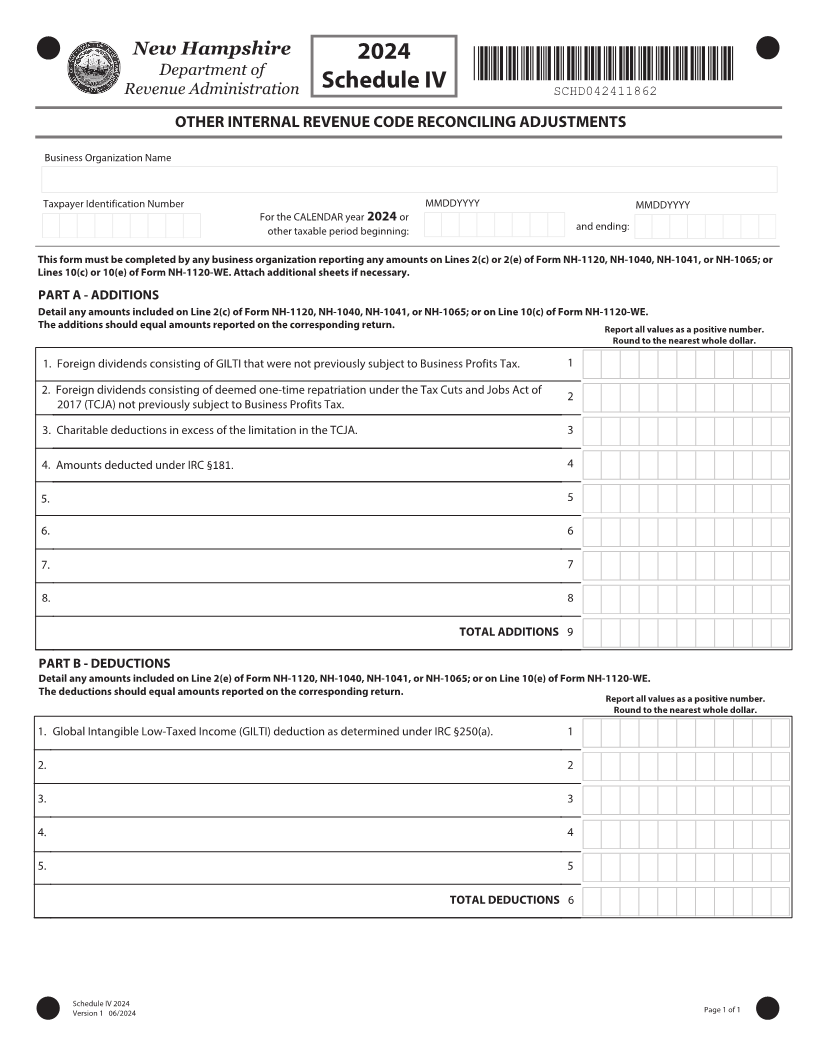

OTHER INTERNAL REVENUE CODE RECONCILING ADJUSTMENTS

Business Organization Name

Taxpayer Identification Number MMDDYYYY MMDDYYYY

For the CALENDAR year 202 or

other taxable period beginning: and ending:

This form must be completed by any business organization reporting any amounts on Lines 2(c) or 2(e) of Form NH-1120 /) /) PS /) PS ;

Lines 10(c) or 10(e) of Form NH-1120-WE Attach additional sheets if necessary.

PART A - A%%*5*0/4

Detail any amounts included on -JOF D PG Form NH-1120, /) /) PS /) PS PO -JOF D PG 'PSN NH-1120-WE.

The additions should equal amounts reported on the corresponding return. 3FQPSU BMM WBMVFT BT B QPTJUJWF OVNCFS

3PVOE UP UIF OFBSFTU XIPMF EPMMBS

'PSFJHO EJWJEFOET DPOTJTUJOH PG (*-5* UIBU XFSF OPU QSFWJPVTMZ TVCKFDU UP #VTJOFTT 1SPGJUT 5BY . 1

'PSFJHO EJWJEFOET DPOTJTUJOH PG EFFNFE POF UJNF SFQBUSJBUJPO VOEFS UIF 5BY $VUT BOE +PCT "DU PG. 2

5$+" OPU QSFWJPVTMZ TVCKFDU UP #VTJOFTT 1SPGJUT 5BY

. Charitable deductions in excess of the limitation in the TCJA 3

. Amounts deducted under IRC §181͘ 4

. 5

6. 6

7. 7

8. 8

505"- "%%*5*0/4 9

PART B - D&%6$5*0/4

%FUBJM BOZ BNPVOUT JODMVEFE PO -JOF F PG 'PSN /) /) /) PS /) PS PO -JOF F PG 'PSN /) 8&

The deductions should equal amounts reported on the corresponding return.

3FQPSU BMM WBMVFT BT B QPTJUJWF OVNCFS

3PVOE UP UIF OFBSFTU XIPMF EPMMBS

1. Global Intangible Low-Taxed Income (GILTI) deduction as determined under IRC § 250(a) 1

2. 2

3. 3

4. 4

5. 5

505"- %&%6$5*0/4 6

SDIFEVMF IV 202 Page 1 of 1

Version 1 0 /202