Enlarge image

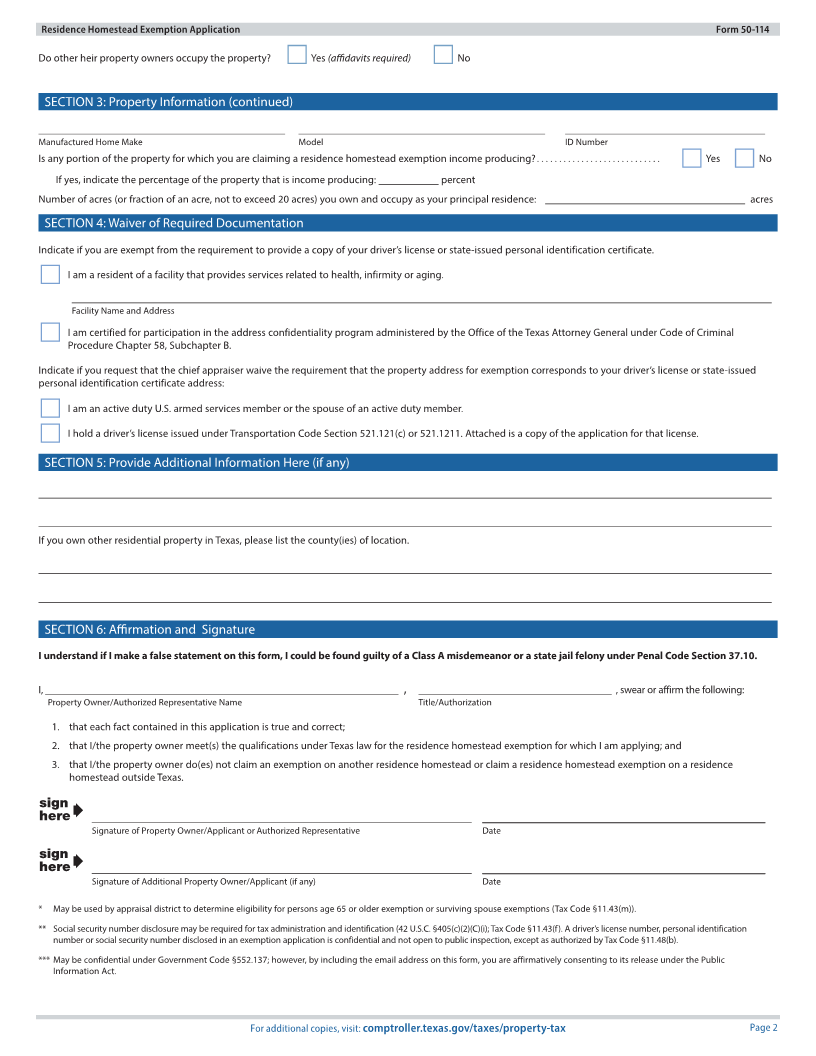

Form 50-114

Residence Homestead Exemption Application

_____________________________________________________________________________ _______________________________

Appraisal District’s Name Appraisal District Account Number (if known)

Are you filing a late application? Yes No Tax Year(s) for Application __________________________________________________________________

GENERAL INFORMATION: Property owners applying for a residence homestead exemption file this form and supporting documentation with the appraisal district in

each county in which the property is located (Tax Code sections 11.13, 11.131, 11.132, 11.133, 11.134 and 11.432). Do not file this form with the Texas Comptroller of

Public Accounts.

SECTION 1: Exemption(s) Requested (Select all that apply.)

Do you live in the property for which you are seeking this residence homestead exemption? Yes No

General Residence Homestead Exemption Disabled Person Person Age 65 or Older (or Surviving Spouse)

100 Percent Disabled Veteran (or Surviving Spouse) Is the disability a permanent total disability

as determined by the U.S. Department of Veterans Affairs under 38 C.F.R. Section 4.15? .............................................. Yes No

Surviving Spouse of an Armed Services Member Killed or Fatally Injured in the Line of Duty Surviving Spouse of a First Responder Killed in

the Line of Duty

Donated Residence of Partially Disabled Veteran (or Surviving Spouse) _________________________

Percent Disability Rating

Surviving Spouse: _____________________________________________________________________ ________________________

Name of Deceased Spouse Date of Death

Cooperative Housing: Do you have an exclusive right to occupy this

property because you own stock in a cooperative housing corporation? .................................................................... Yes No

If yes, state name of cooperative housing corporation: __________________________________________________________________

Were you receiving a residence homestead exemption on your previous residence? ........................................................ Yes No

Are you transferring an exemption from a previous residence? ............................................................................. Yes No

Are you transferring a tax limitation?....................................................................................................... Yes No

_____________________________________________________________________________ _______________________________

Previous Residence Address, City, State, Zip Code Previous County

SECTION 2: Property Owner/Applicant (Provide information for additional property owners in Section 5.)

Select One: Single Adult Married Couple Other (e.g., individual who owns the property with others)

___________________________________________ ________________________________ _______________________________

Name of Property Owner 1 Birth Date* (mm/dd/yyyy) Driver’s License, Personal ID Certificate

or Social Security Number**

________________________________ __________________________________________ _______________________________

Primary Phone Number (area code and number) Email Address*** Percent Ownership Interest

___________________________________________ ________________________________ _______________________________

Name of Property Owner 2 Birth Date* (mm/dd/yyyy) Driver’s License, Personal ID Certificate

(e.g., Spouse, Co-Owner/Individual) or Social Security Number**

________________________________ __________________________________________ _______________________________

Primary Phone Number (area code and number) Email Address*** Percent Ownership Interest

______________________________________________________________________________________________________________

Applicant Mailing Address (if different from the physical address)

SECTION 3: Property Information

____________________________________________ ________________________________________________________________

Date you acquired this property Date you began occupying this property as your principal residence

______________________________________________________________________________________________________________

Physical Address (i.e. street address, not P.O. Box), City, County, ZIP Code

______________________________________________________________________________________________________________

Legal Description (if known)

Is the applicant identified on deed or other recorded instrument?

Yes ___________________________________________________________________

Court record/filing number on recorded deed or other recorded instrument, if available

No If no, required documentation must be provided. (see Important Information)

Is the property for which this application is submitted an heir property? (see Important Information) Yes No

Form developed by: Texas Comptroller of Public Accounts, Property Tax Assistance Division For additional copies, visit: comptroller.texas.gov/taxes/property-tax

50-114 • Rev. 11-23/37