Enlarge image

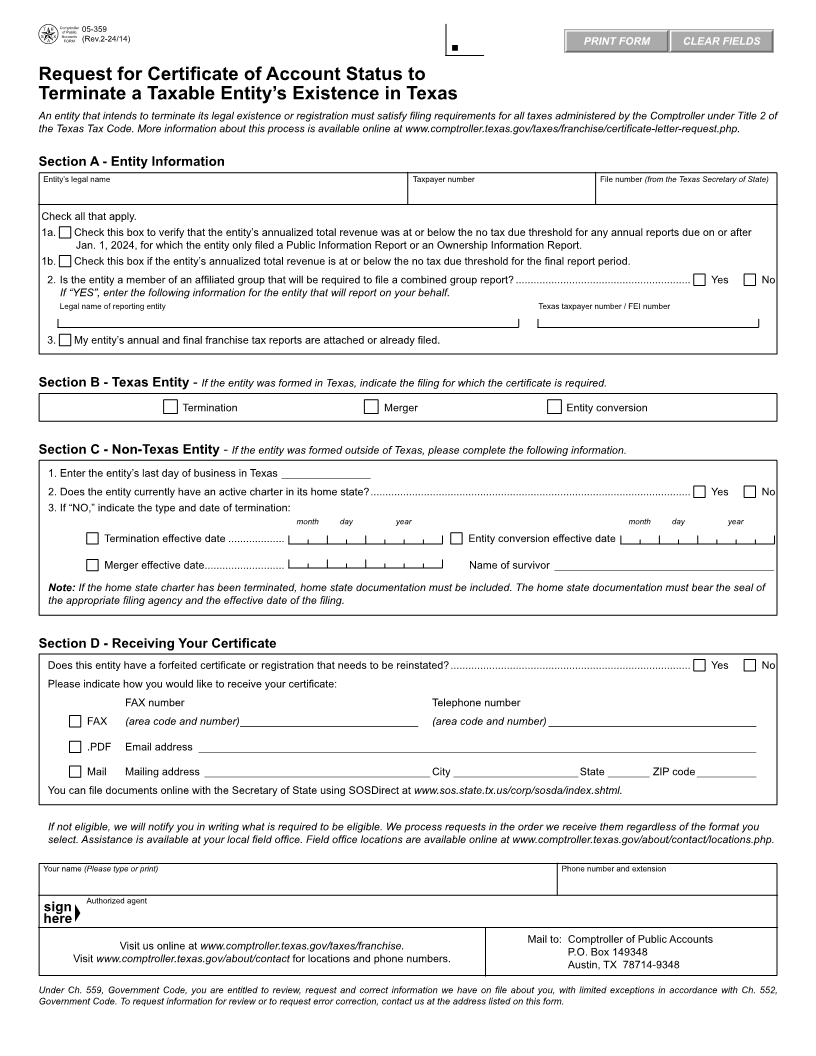

05-359

(Rev.2-24/14) PRINT FORM CLEAR FIELDS

Request for Certificate of Account Status to

Terminate a Taxable Entity’s Existence in Texas

An entity that intends to terminate its legal existence or registration must satisfy filing requirements for all taxes administered by the Comptroller under Title 2 of

the Texas Tax Code. More information about this process is available online at www.comptroller.texas.gov/taxes/franchise/certificate-letter-request.php.

Section A - Entity Information

Entity’s legal name Taxpayer number File number (from the Texas Secretary of State)

Check all that apply.

1a. Check this box to verify that the entity’s annualized total revenue was at or below the no tax due threshold for any annual reports due on or after

Jan. 1, 2024, for which the entity only filed a Public Information Report or an Ownership Information Report.

1b. Check this box if the entity’s annualized total revenue is at or below the no tax due threshold for the final report period.

2. Is the entity a member of an affiliated group that will be required to file a combined group report? ........................................................... Yes No

If “YES”, enter the following information for the entity that will report on your behalf.

Legal name of reporting entity Texas taxpayer number / FEI number

3. My entity’s annual and final franchise tax reports are attached or already filed.

Section B - Texas Entity - If the entity was formed in Texas, indicate the filing for which the certificate is required.

Termination Merger Entity conversion

Section C - Non-Texas Entity - If the entity was formed outside of Texas, please complete the following information.

1. Enter the entity’s last day of business in Texas _______________

2. Does the entity currently have an active charter in its home state? ............................................................................................................ Yes No

3. If “NO,” indicate the type and date of termination:

month day year month day year

Termination effective date ................... Entity conversion effective date

Merger effective date ........................... Name of survivor _____________________________________

Note: If the home state charter has been terminated, home state documentation must be included. The home state documentation must bear the seal of

the appropriate filing agency and the effective date of the filing.

Section D - Receiving Your Certificate

Does this entity have a forfeited certificate or registration that needs to be reinstated? ................................................................................. Yes No

Please indicate how you would like to receive your certificate:

FAX number Telephone number

FAX (area code and number) ______________________________ (area code and number) ___________________________________

.PDF Email address ______________________________________________________________________________________________

Mail Mailing address ______________________________________ City _____________________State _______ ZIP code __________

You can file documents online with the Secretary of State using SOSDirect at www.sos.state.tx.us/corp/sosda/index.shtml.

If not eligible, we will notify you in writing what is required to be eligible. We process requests in the order we receive them regardless of the format you

select. Assistance is available at your local field office. Field office locations are available online at www.comptroller.texas.gov/about/contact/locations.php.

Your name (Please type or print) Phone number and extension

Authorized agent

Visit us online at www.comptroller.texas.gov/taxes/franchise. Mail to: Comptroller of Public Accounts

Visit www.comptroller.texas.gov/about/contact for locations and phone numbers. P.O. Box 149348

Austin, TX 78714-9348

Under Ch. 559, Government Code, you are entitled to review, request and correct information we have on file about you, with limited exceptions in accordance with Ch. 552,

Government Code. To request information for review or to request error correction, contact us at the address listed on this form.