Enlarge image

01-797-1

(Rev.9-23/35)

Worksheet for Completing the Sales and Use Tax Return Form 01-117

For the period of Jan. 1, 2023 through Dec. 31, 2023

• NOTE: Do not send this worksheet with your return. Keep this for your records.

• This worksheet is for taxpayers who report YEARLY, qualify to file the short form and have experienced a local sales tax RATE CHANGE

during the calendar year.

• Make additional copies of this form as necessary.

General Information

Use the instructions on this worksheet to complete Items 2, 4 and 5 on the return. CLEAR FIELDS

Use the instructions for your Texas Sales and Use Tax Return, Form 01-117, for all remaining items.

• Enter zero “0” in Item 3 on the return.

@ Old Total Rate @ New Total Rate

1. Taxable sales(Whole dollars only) ..................................... 1a. ___________________.00 1b. ___________________.00

2. Taxable purchases(Whole dollars only) ............................. + 2a. ___________________.00 2b. ___________________.00

3. Total amounts subject to tax(Item 1 plus Item 2) ............... = 3a. ___________________.00 3b. ___________________.00

4. Tax rate (See other side of worksheet) ............................... x 4a. ___________________ 4b. ___________________

5. Tax due(Multiply Item 3 by Item 4) ..................................... = 5a. ___________________. 5b. ___________________.

6. Total Tax Due (Item 5a plus Item 5b)

(Enter this amount here and in Item 5 on your return.) ............................................ 6. ___________________.

7. Enter the tax rate preprinted in Item 5 your return ............................................................ 7. ___________________

8. Amount subject to tax for 2023 (Divide Item 6 by Item 7)

(Enter this amount here and in Items 2 and 4 on your return.) ............................... 8. ___________________

For assistance, contact us at www.comptroller.texas.gov or call 800-252-5555.

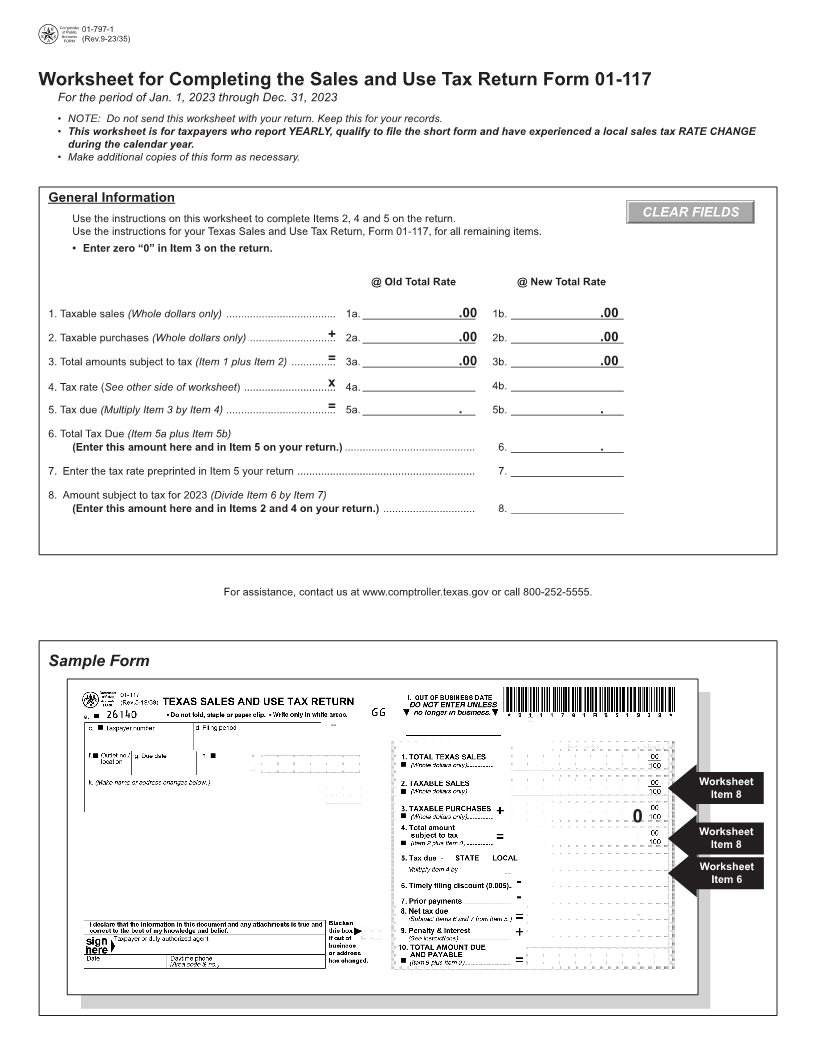

Sample Form

Worksheet

Item 8

0

Worksheet

Item 8

Worksheet

Item 6