Enlarge image

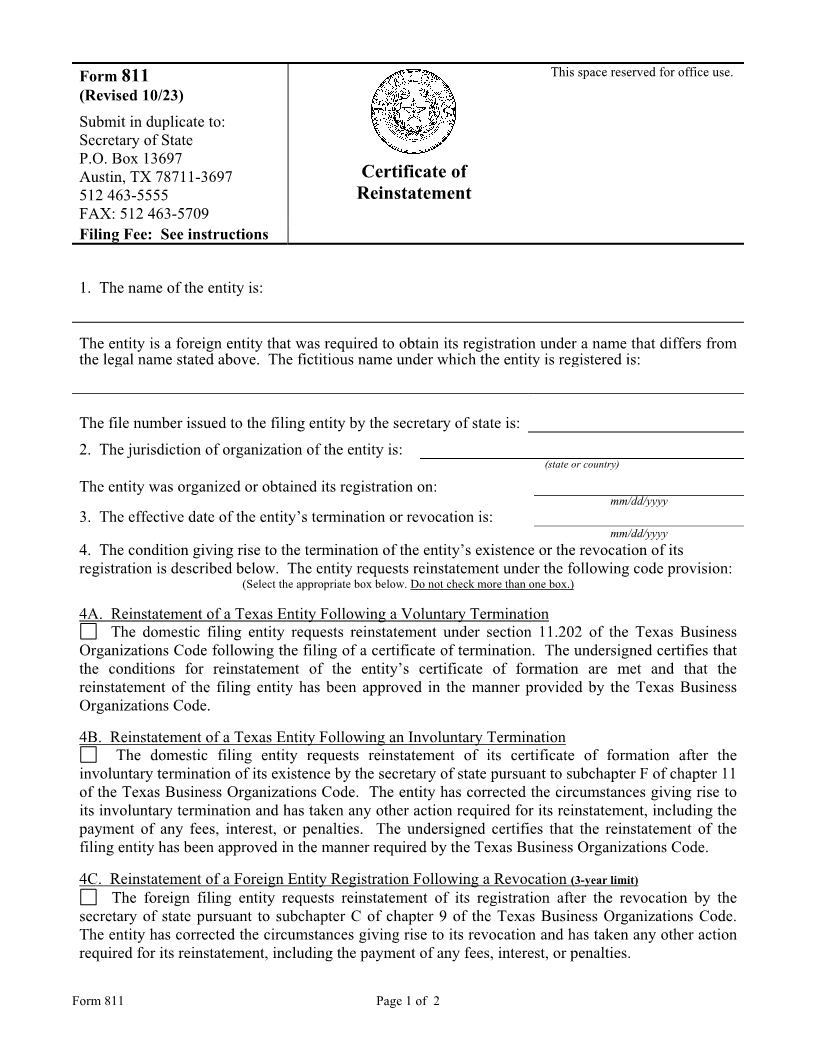

Form 811—General Information

(Certificate of Reinstatement)

The attached form is designed to meet minimal statutory filing requirements pursuant to the relevant

code provisions. This form and the information provided are not substitutes for the advice and services of an

attorney and tax specialist.

Commentary

This form may be used to reinstate: (1) the existence of a domestic filing entity that has been voluntarily

terminated; (2) the existence of a domestic filing entity that has been involuntarily terminated by action

of the secretary of state; or (3) the registration of a foreign filing entity whose registration has been

revoked by action of the secretary of state.

Do Not Use This Form If:

The entity’s existence or registration was forfeited under the Tax Code. See Form 801.

The entity is a professional association that was terminated or revoked for failure to timely file

an annual statement. See Form 814.

The entity was terminated or revoked by court order.

Time Frames for Reinstatement

Voluntarily Terminated Domestic Entity: Certificate of reinstatement may be filed at any time so

long as the entity would otherwise have continued to exist. (See part 4A of the form.)

Involuntarily Terminated Domestic Entity: Certificate of reinstatement may be filed at any time so

long as the entity would otherwise have continued to exist. However, the entity is considered to

have continued in existence without interruption from the date of termination only if the entity is

rd

reinstated before the third (3 ) anniversary of the date of involuntary termination. (See part 4B.)

Revoked Foreign Entity Registration: Certificate of reinstatement must be filed no later than the

rd

third (3 ) anniversary of the effective date of the revocation. (See part 4C.)

Instructions for Form

Item 1—Entity Name and File Number: Set forth the legal name of the entity and the secretary of

state file number. For a foreign filing entity that was registered to transact business in Texas under a

different name, also set forth the fictitious name under which the entity obtained its registration.

Item 2—Jurisdictional Information: To ensure that the correct entity is reinstated, the jurisdiction

of organization and the entity’s date of organization or registration in Texas should be provided.

Item 3—Date of Termination or Revocation: Provide the effective date of the termination or

revocation. In the case of a terminated domestic entity that has delayed the effectiveness of the

filing of its certificate of termination, provide the effective date as stated on the certificate.

Item 4—Conditions for Reinstatement: Select the grounds or conditions for reinstatement. Do not

check more than one box. If unsure, verify the reason for inactive status by contacting the secretary

of state at (512) 463-5555, 7-1-1 for relay services, CorpInfo@sos.texas.gov, or online through

SOSDirect. (Visit https://www.sos.state.tx.us/corp/sosda/index.shtml for SOSDirect information.)

4A. Reinstatement of a Texas Entity Following Voluntary Termination: Sections 11.201 and 11.202

of the Texas Business Organizations Code (BOC) permit reinstatement if the owners, members,

governing persons, or other persons specified by the BOC approve the reinstatement in the manner

provided by the title of the BOC governing the entity and:

Form 811 General Information – Do not submit.