Enlarge image

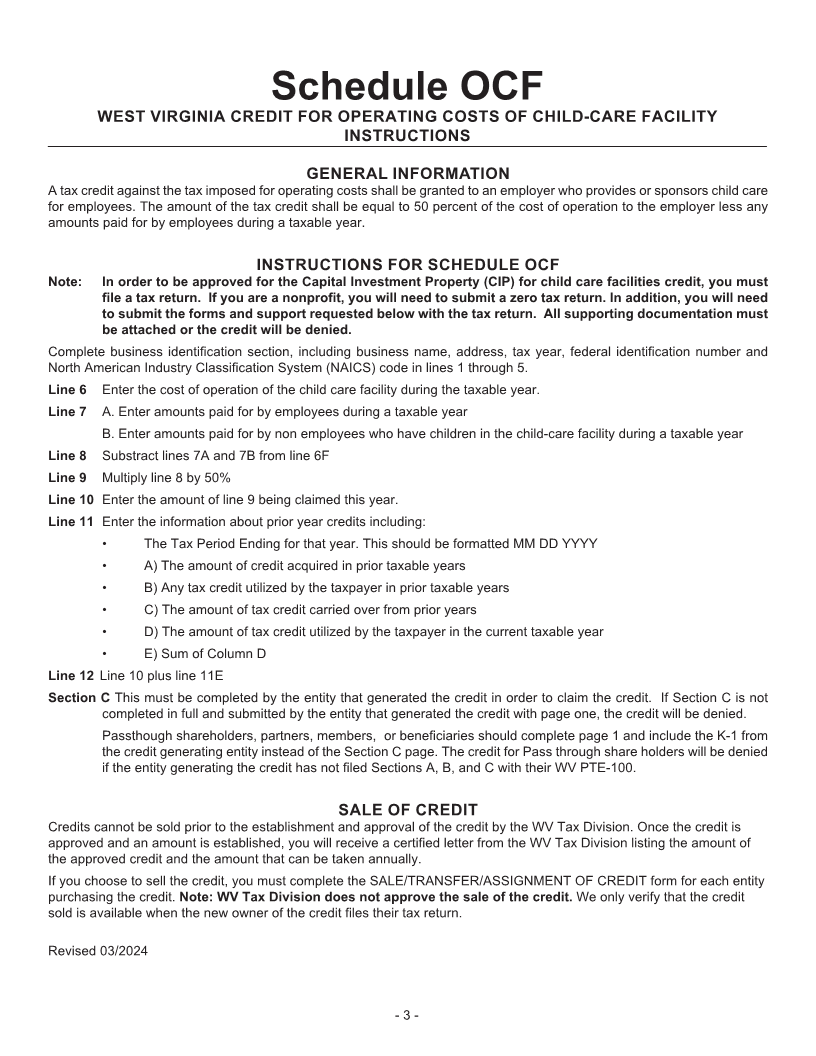

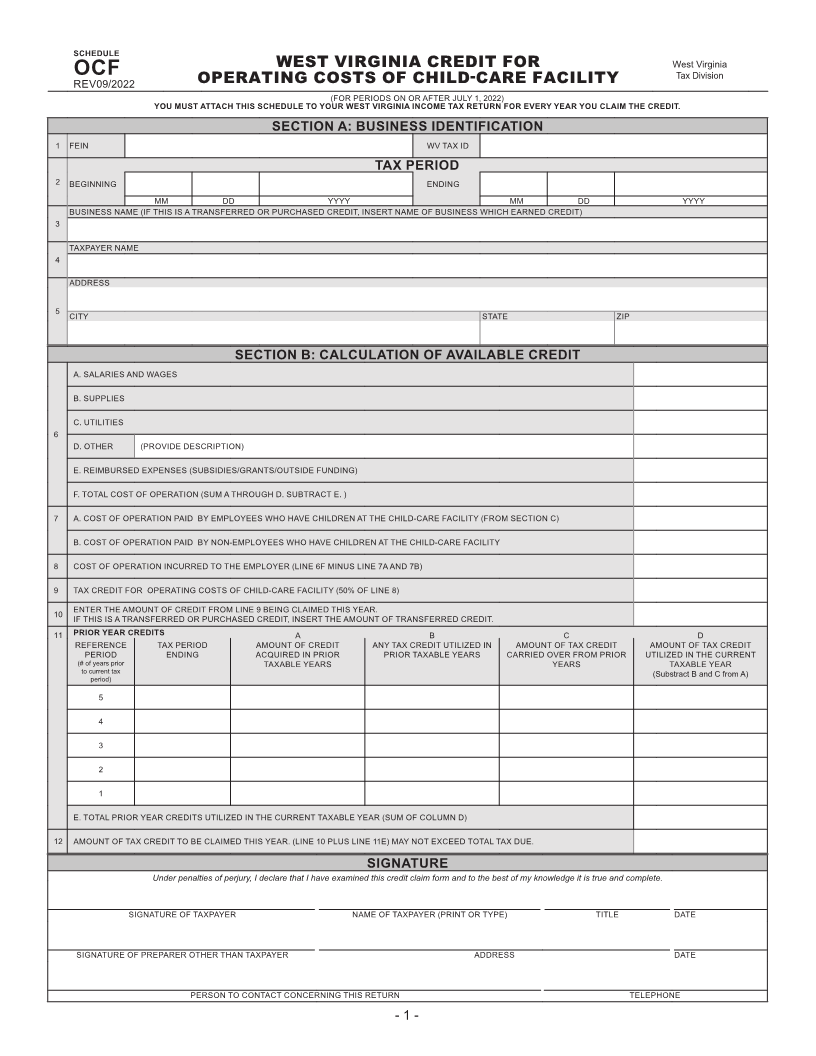

SCHEDULE

WEST VIRGINIA CREDIT FOR West Virginia

OCF OPERATING COSTS OF CHILD-CARE FACILITY Tax Division

REV09/2022

(FOR PERIODS ON OR AFTER JULY 1, 2022)

YOU MUST ATTACH THIS SCHEDULE TO YOUR WEST VIRGINIA INCOME TAX RETURN FOR EVERY YEAR YOU CLAIM THE CREDIT.

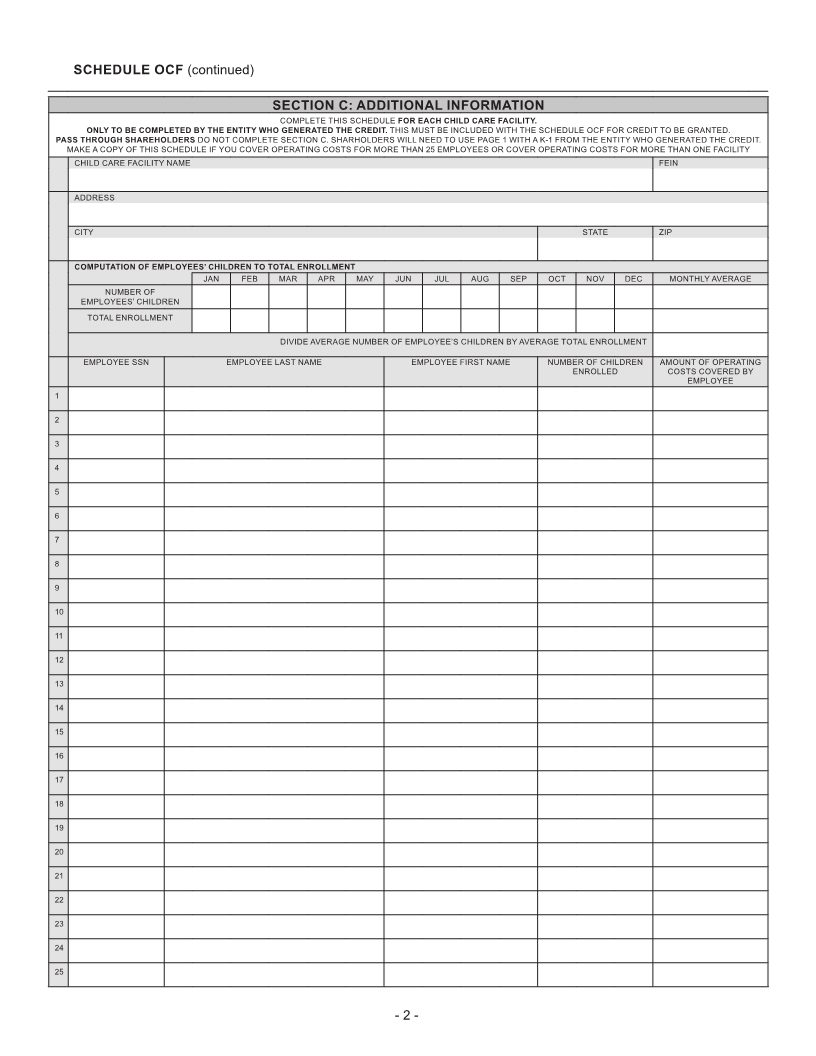

SECTION A: BUSINESS IDENTIFICATION

1 FEIN WV TAX ID

TAX PERIOD

2 BEGINNING ENDING

MM DD YYYY MM DD YYYY

BUSINESS NAME (IF THIS IS A TRANSFERRED OR PURCHASED CREDIT, INSERT NAME OF BUSINESS WHICH EARNED CREDIT)

3

TAXPAYER NAME

4

ADDRESS

5 CITY STATE ZIP

SECTION B: CALCULATION OF AVAILABLE CREDIT

A. SALARIES AND WAGES

B. SUPPLIES

C. UTILITIES

6

D. OTHER (PROVIDE DESCRIPTION)

E. REIMBURSED EXPENSES (SUBSIDIES/GRANTS/OUTSIDE FUNDING)

F. TOTAL COST OF OPERATION (SUM A THROUGH D. SUBTRACT E. )

7 A. COST OF OPERATION PAID BY EMPLOYEES WHO HAVE CHILDREN AT THE CHILD-CARE FACILITY (FROM SECTION C)

B. COST OF OPERATION PAID BY NON-EMPLOYEES WHO HAVE CHILDREN AT THE CHILD-CARE FACILITY

8 COST OF OPERATION INCURRED TO THE EMPLOYER (LINE 6F MINUS LINE 7A AND 7B)

9 TAX CREDIT FOR OPERATING COSTS OF CHILD-CARE FACILITY (50% OF LINE 8)

10 ENTER THE AMOUNT OF CREDIT FROM LINE 9 BEING CLAIMED THIS YEAR.

IF THIS IS A TRANSFERRED OR PURCHASED CREDIT, INSERT THE AMOUNT OF TRANSFERRED CREDIT.

11 PRIOR YEAR CREDITS A B C D

REFERENCE TAX PERIOD AMOUNT OF CREDIT ANY TAX CREDIT UTILIZED IN AMOUNT OF TAX CREDIT AMOUNT OF TAX CREDIT

PERIOD ENDING ACQUIRED IN PRIOR PRIOR TAXABLE YEARS CARRIED OVER FROM PRIOR UTILIZED IN THE CURRENT

(# of years prior TAXABLE YEARS YEARS TAXABLE YEAR

to current tax (Substract B and C from A)

period)

5

4

3

2

1

E. TOTAL PRIOR YEAR CREDITS UTILIZED IN THE CURRENT TAXABLE YEAR (SUM OF COLUMN D)

12 AMOUNT OF TAX CREDIT TO BE CLAIMED THIS YEAR. (LINE 10 PLUS LINE 11E) MAY NOT EXCEED TOTAL TAX DUE.

SIGNATURE

Under penalties of perjury, I declare that I have examined this credit claim form and to the best of my knowledge it is true and complete.

SIGNATURE OF TAXPAYER NAME OF TAXPAYER (PRINT OR TYPE) TITLE DATE

SIGNATURE OF PREPARER OTHER THAN TAXPAYER ADDRESS DATE

PERSON TO CONTACT CONCERNING THIS RETURN TELEPHONE

- 1 -