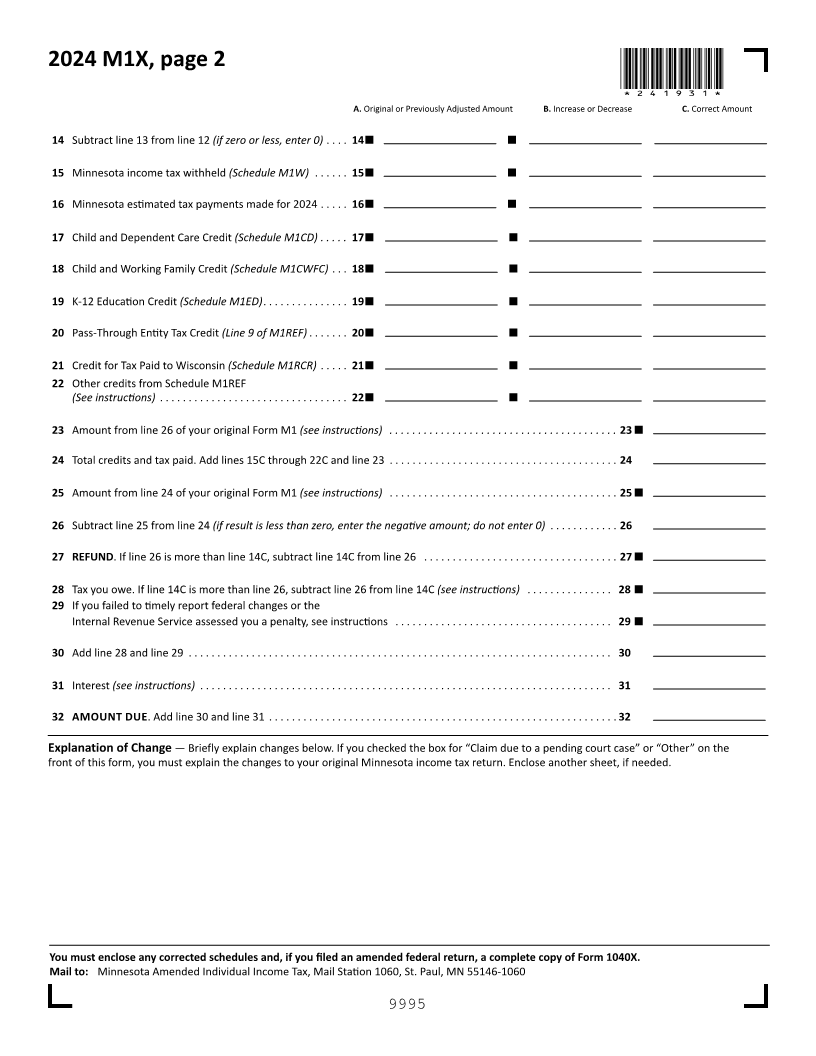

Enlarge image

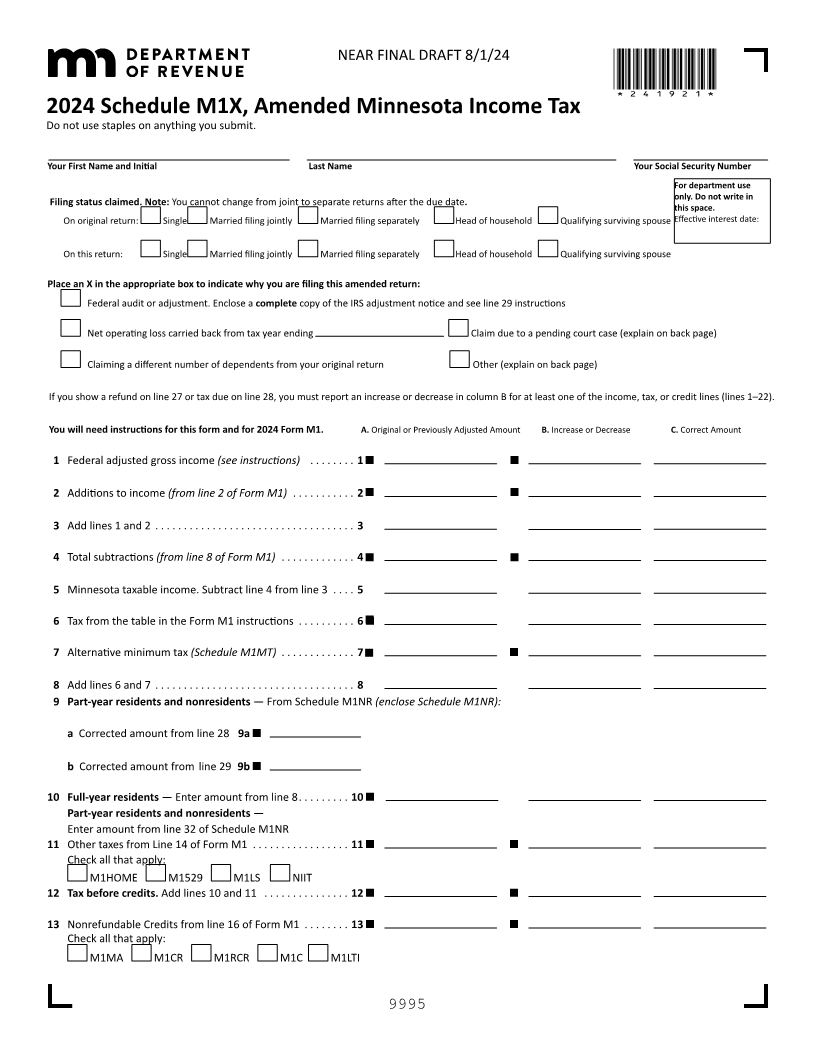

NEAR FINAL DRAFT 8/1/24

*241921*

2024 Schedule M1X, Amended Minnesota Income Tax

Do not use staples on anything you submit .

Your First Name and Initial Last Name Your Social Security Number

For department use

Filing status claimed. Note:You cannot change jointfrom to separate returns after the due date . only. Do not write in

this space.

On original return: Single Married filing jointly Married filing separately Head of household Qualifying surviving spouse Effective interest date:

On this return: Single Married filing jointly Married filing separately Head of household Qualifying surviving spouse

Place an X in the appropriate box to indicate why you are filing this amended return:

Federal audit or adjustment . Enclose a complete copy of the IRS adjustment notice and see line 29 instructions

Net operating loss carried back from tax year ending Claim due to a pending court case (explain on back page)

Claiming a different number of dependents from your original return Other (explain on back page)

If you show a refund on line 27 or tax due on line 28, you must report an increase or decrease in column B for at least one of the income, tax, or credit lines (lines 1–22) .

You will need instructions for this form and for 2024 Form M1. A. Original or Previously Adjusted Amount B. Increase or Decrease C. Correct Amount

1 Federal adjusted gross income (see instructions) . . . . . . . . 1

2 Additions to income (from line 2 of Form M1) . . . . . . . . . . . 2

3 Add lines 1 and 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Total subtractions (from line 8 of Form M1) . . . . . . . . . . . . . 4

5 Minnesota taxable income . Subtract line 4 from line 3 . . . . 5

6 Tax from the table in the Form M1 instructions . . . . . . . . . . 6

7Alternative minimum tax M1MT)(Schedule . . . . . . . . . . . . 7.

8 Add lines 6 and 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Part-year residents and nonresidents — From Schedule M1NRM1NR):(enclose Schedule

a Corrected amount from line 28 9a

b Corrected amount from line 29 9b

10 Full-year residents — Enter amount from line 8 . . . . . . . . .10

Part-year residents and nonresidents —

Enter amount from line 32 of Schedule M1NR

11 Other taxes from Line 14 of Form M1 . . . . . . . . . . . . . . . . . 11

Check all that apply:

M1HOME M1529 M1LS NIIT

12 Tax before credits. Add lines 10 and 11 . . . . . . . . . . . . . . . 12

13 Nonrefundable Credits from line 16 of Form M1 . . . . . . . . 13

Check all that apply:

M1MA M1CR M1RCR M1C M1LTI

9995