Enlarge image

1 1

2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 32 34 36 38 40 42 44 46 48 50 52 54 56 58 60 62 64 66 68 70 72 74 76 78 80 82 84 86

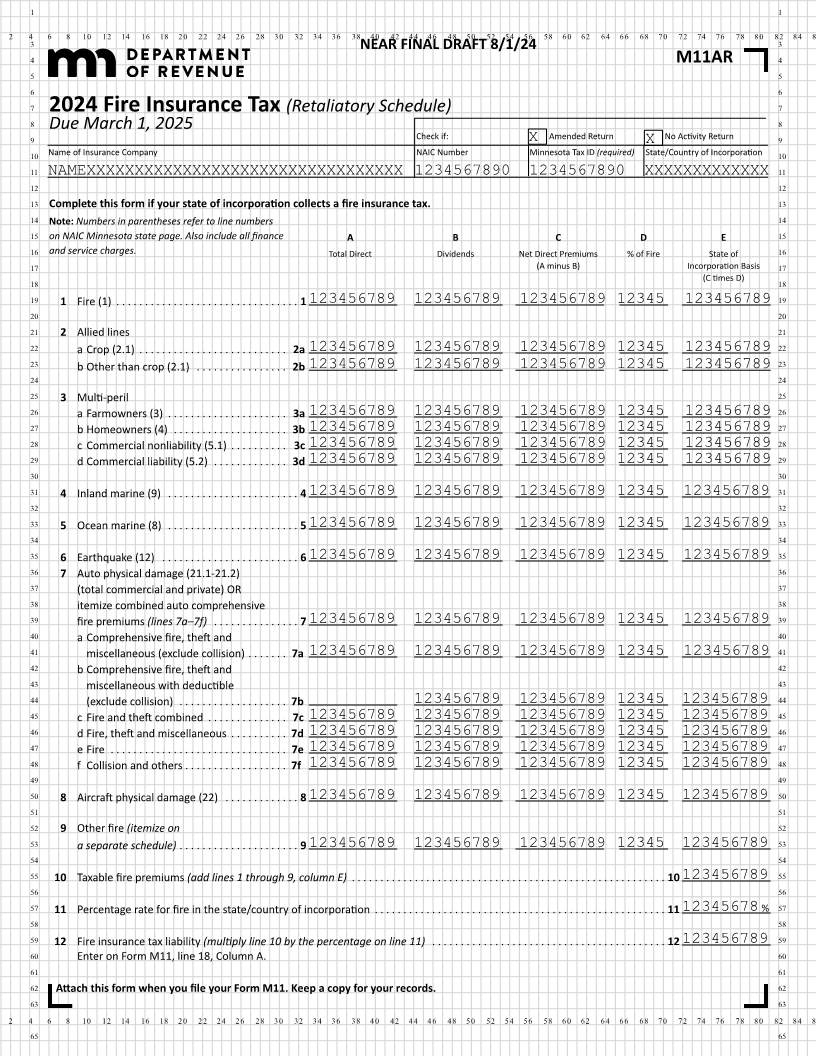

3 NEAR FINAL DRAFT 8/1/24 3

4 M11AR 4

5 5

6 6

7 2024 Fire Insurance Tax (Retaliatory Schedule) 7

8 Due March 1, 2025 8

9 Check if: Amended Return No Activity Return 9

X

10 Name of Insurance Company NAIC Number Minnesota Tax ID (required) State/CountryX Incorporationof 10

11 NAMEXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 1234567890 1234567890 XXXXXXXXXXXXX 11

12 12

13 Complete this form if your state of incorporation collects a fire insurance tax. 13

14 Note: Numbers in parentheses refer to line numbers 14

15 on NAIC Minnesota state page. Also include all finance A B C D E 15

16 and service charges. Total Direct Dividends Net Direct Premiums % of Fire State of 16

17 (A minus B) Incorporation Basis 17

18 (C times D) 18

19 1 Fire (1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.123456789 123456789 123456789 12345 123456789 19

20 20

21 2 Allied lines 21

22 a Crop (2 .1) . . . . . . . . . . . . . . . . . . . . . . . . .2a. 123456789 123456789 123456789 12345 123456789 22

23 b Other than crop (2 .1) . . . . . . . . . . . . . . . . 2b 123456789 123456789 123456789 12345 123456789 23

24 24

25 3 Multi-peril 25

26 a Farmowners (3) . . . . . . . . . . . . . . . . . . . . . 3a 123456789 123456789 123456789 12345 123456789 26

27 b Homeowners (4) . . . . . . . . . . . . . . . . . . . . 3b 123456789 123456789 123456789 12345 123456789 27

28 c Commercial nonliability (5 .1) . . . . . . . . . . 3c123456789 123456789 123456789 12345 123456789 28

29 d Commercial liability (5 .2) . . . . . . . . . . . . . 3d 123456789 123456789 123456789 12345 123456789 29

30 30

31 4 Inland marine (9) . . . . . . . . . . . . . . . . . . . . . . . 4 123456789 123456789 123456789 12345 123456789 31

32 32

33 5 Ocean marine (8) . . . . . . . . . . . . . . . . . . . . . . . 5 123456789 123456789 123456789 12345 123456789 33

34 34

35 6 Earthquake (12) . . . . . . . . . . . . . . . . . . . . . . . . 6 123456789 123456789 123456789 12345 123456789 35

36 7 Auto physical damage (21.1-21.2) 36

37 (total commercial and private) OR 37

38 itemize combined auto comprehensive 38

39 fire premiums (lines 7a–7f) . . . . . . . . . . . . . . 7.123456789 123456789 123456789 12345 123456789 39

40 a Comprehensive fire, theft and 40

41 miscellaneous (exclude collision) . . . . . . . 7a 123456789 123456789 123456789 12345 123456789 41

42 b Comprehensive fire, theft and 42

43 miscellaneous with deductible 43

44 (exclude collision) . . . . . . . . . . . . . . . . . . . 7b 123456789 123456789 12345 123456789 44

45 Fire c and theft combined . . . . . . . . . . . . . . 7c 123456789 123456789 123456789 12345 123456789 45

46 Fire, d theft and miscellaneous . . . . . . . . . . 7d 123456789 123456789 123456789 12345 123456789 46

47 e Fire . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .7e. 123456789 123456789 123456789 12345 123456789 47

48 f Collision and others . . . . . . . . . . . . . . . . . . 7f 123456789 123456789 123456789 12345 123456789 48

49 49

50 8Aircraft physical damage (22) . . . . . . . . . . . . 8.123456789 123456789 123456789 12345 123456789 50

51 51

52 9 Other fire (itemize on 52

53 a separate schedule) . . . . . . . . . . . . . . . . . . . . 9.123456789 123456789 123456789 12345 123456789 53

54 54

55 10 Taxable fire premiums (add lines 1 through 9, column E) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10 123456789 55

56 56

57 11 Percentage rate for fire in the state/country of incorporation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11 12345678 % 57

58 58

59 12 Fire insurance tax liability (multiply line 10 by the percentage on line 11) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12 123456789 59

60 Enter on Form M11, line 18, Column A. 60

61 61

62 Attach this form when you file your Form M11. Keep a copy for your records. 62

63 63

2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 32 34 36 38 40 42 44 46 48 50 52 54 56 58 60 62 64 66 68 70 72 74 76 78 80 82 84 86

65 65