Enlarge image

1 1

2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 32 34 36 38 40 42 44 46 48 50 52 54 56 58 60 62 64 66 68 70 72 74 76 78 80 82 84 86

3 3

4 NEAR FINAL DRAFT 8/1/24 4

5 5

6 *241811*6

7 7

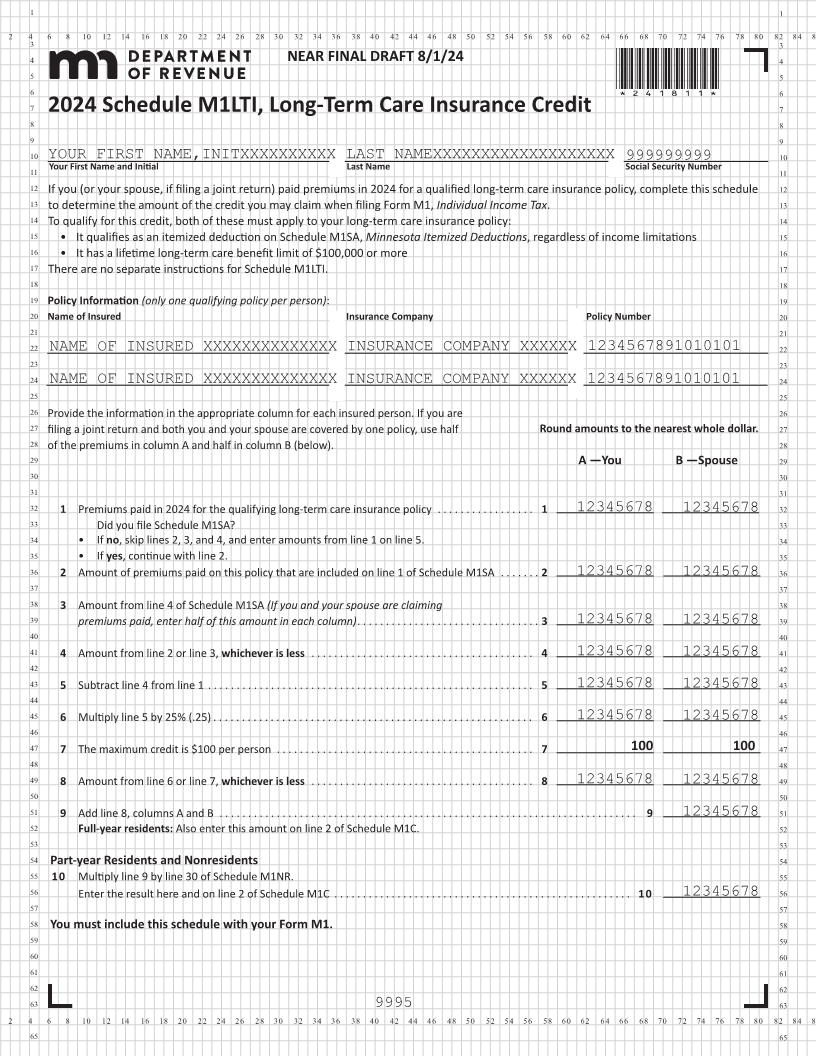

2024 Schedule M1LTI, Long-Term Care Insurance Credit

8 8

9 9

10 YOUR FIRST NAME,INITXXXXXXXXXX LAST NAMEXXXXXXXXXXXXXXXXXXX 999999999 10

11 Your First Name and Initial Last Name Social Security Number 11

12 If you (or your spouse, if filing a joint return) paid premiums in 2024 for a qualified long-term care insurance policy, complete this schedule 12

13 to determine the amount of the credit you may claim when filing Form M1, Individual Income Tax . 13

14 To qualify for this credit, both of these must apply to your long-term care insurance policy: 14

15 • It qualifies as an itemized deduction on Schedule M1SA, Minnesota Itemized Deductions, regardless of income limitations 15

16 • It has a lifetime long-term care benefit limit of $100,000 or more 16

17 There are no separate instructions for Schedule M1LTI. 17

18 18

19 Policy Information (only one qualifying policy per person): 19

20 Name of Insured Insurance Company Policy Number 20

21 21

22 NAME OF INSURED XXXXXXXXXXXXXX INSURANCE COMPANY XXXXXX 1234567891010101 22

23 23

24 NAME OF INSURED XXXXXXXXXXXXXX INSURANCE COMPANY XXXXXX 1234567891010101 24

25 25

26 Provide the information in the appropriate column for each insured person. If you are 26

27 filing a joint return and both you and your spouse are covered by one policy, use half Round amounts to the nearest whole dollar. 27

28 of the premiums in column A and half in column B (below). 28

29 A —You B —Spouse 29

30 30

31 31

32 1 Premiums paid in 2024 for the qualifying long-term care insurance policy . . . . . . . . . . . . . . . . . 1 12345678 12345678 32

33 Did you file Schedule M1SA? 33

34 • If no, skip lines 2, 3, and 4, and enter amounts from line 1 on line 5. 34

35 • If yes, continue with line 2. 35

36 2 Amount of premiums paid on this policy that are included on line 1 of Schedule M1SA . . . . . . . 2 12345678 12345678 36

37 37

38 3 Amount from line 4 of Schedule M1SA (If you and your spouse are claiming 38

39 premiums paid, enter half of this amount in each column) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 12345678 12345678 39

40 40

41 4 Amount from line 2 or line 3, whichever is less . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 12345678 12345678 41

42 42

43 5 Subtract line 4 from line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 12345678 12345678 43

44 44

45 6 Multiply line 5 by 25% (.25) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 12345678 12345678 45

46 46

47 7maximum The credit per person is $100 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7. . 100 100 47

48 48

49 8 Amount from line 6 or line 7, whichever is less . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8 12345678 12345678 49

50 50

51 9 Add line 8, columns A and B . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9 12345678 51

52 Full-year residents: Also enter this amount on line 2 of Schedule M1C. 52

53 53

54 Part-year Residents and Nonresidents 54

55 10 Multiply line 9 by line 30 of Schedule M1NR. 55

56 Enter the result here and on line 2 of Schedule M1C . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10 12345678 56

57 57

58 You must include this schedule with your Form M1. 58

59 59

60 60

61 61

62 62

63 9995 63

2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 32 34 36 38 40 42 44 46 48 50 52 54 56 58 60 62 64 66 68 70 72 74 76 78 80 82 84 86

65 65