Enlarge image

1 1

2 4 6 8 10 12 14 16 18 20 22 24 26 28 30FINALNEAR 8/1/24DRAFT 32 34 36 38 40 42 44 46 48 50 52 54 56 58 60 62 64 66 68 70 72 74 76 78 80 82 84 86

3 3

4 4

5 5

6 *247101* 6

7 7

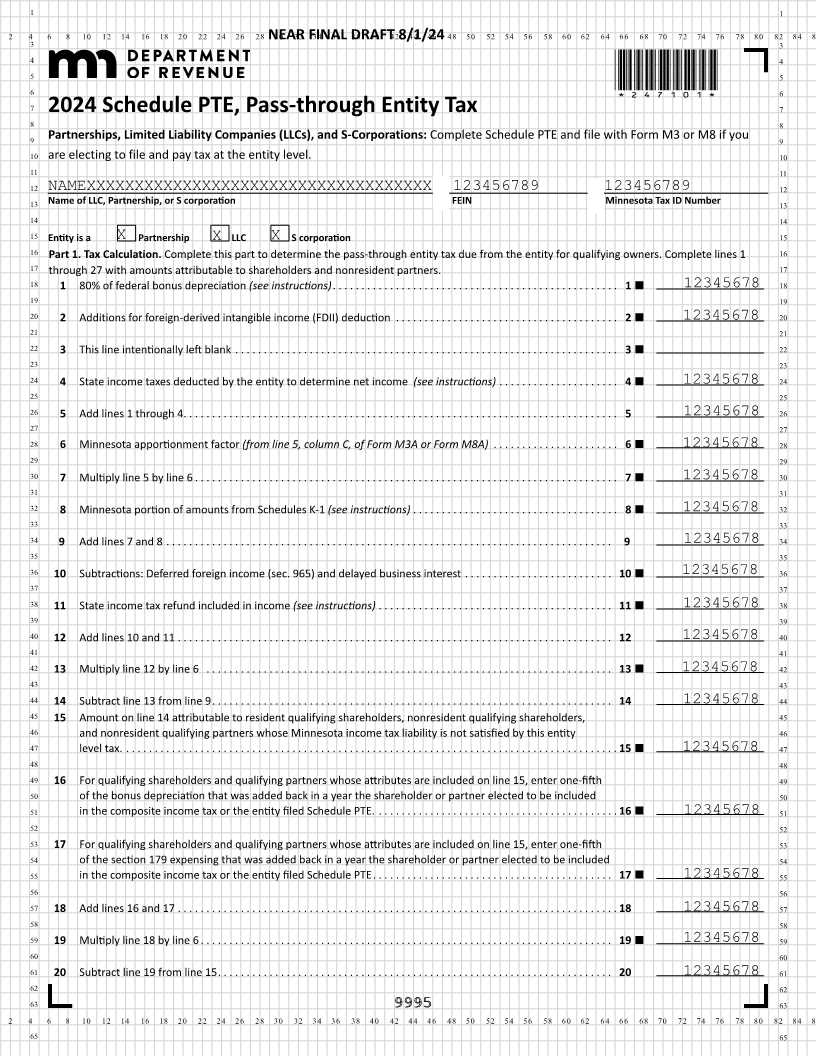

2024 Schedule PTE, Pass-through Entity Tax

8 8

9 Partnerships, Limited Liability Companies (LLCs), and S-Corporations: Complete Schedule PTE and file with Form M3 or M8 if you 9

10 are electing to file and pay tax at the entity level. 10

11 11

12 NAMEXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 123456789 123456789 12

13 Name of LLC, Partnership, or S corporation FEIN Minnesota Tax ID Number 13

14 14

15 Entity is a X Partnership X LLC X S corporation 15

16 Part 1. Tax Calculation. Complete this part to determine the pass-through entity tax due from the entity for qualifying owners. Complete lines 1 16

17 through 27 with amounts attributable to shareholders and nonresident partners. 17

18 1 80% of federal bonus depreciation (see instructions) ... ...... ..... ....... ..... ...... ..... ..... ...... .. 1 12345678 18

19 19

20 2 Additions for foreign-derived intangible income (FDII) deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 12345678 20

21 21

22 3 This line intentionally left blank . ..... ...... ...... ..... ..... ...... ...... ..... ...... ...... ..... ..... 3 22

23 23

24 4 State income taxes deducted by the entity to determine net income (see instructions) .... ...... ....... .... 4 12345678 24

25 25

26 5 Add lines 1 through 4... ...... ..... ...... ...... ..... ...... ..... ...... ...... ..... ...... ...... ..... 5 12345678 26

27 27

28 6 Minnesota apportionment factor (from line 5, column C, of Form M3A or Form M8A) .. ..... ....... ..... ... 6 12345678 28

29 29

30 7 Multiply line 5 by line 6 ... ...... ...... ...... ..... ...... ..... ...... ..... ...... ...... ...... ..... ... 7 12345678 30

31 31

32 8 Minnesota portion of amounts from Schedules K-1 (see instructions) ..... ...... ...... ...... ..... ...... .. 8 12345678 32

33 33

34 9 Add lines 7 and 8 . ...... ...... ...... .... ...... ...... ...... ..... ...... ..... ...... ...... ...... ... 9 12345678 34

35 35

36 10 Subtractions: Deferred foreign income (sec. 965) and delayed business interest . ...... ..... ...... ..... ... 10 12345678 36

37 37

38 11 State income tax refund included in income (see instructions) ...... ...... ..... ...... ..... ...... ...... . 11 12345678 38

39 39

40 12 Add lines 10 and 11 ... ...... ..... ...... ..... ...... ...... ...... ..... ...... ..... ...... ...... ..... 12 12345678 40

41 41

42 13 Multiply line 12 by line 6 ..... ..... ...... ...... ..... ....... ..... ..... ...... ..... ...... ...... .... 13 12345678 42

43 43

44 14 Subtract line 13 from line 9 ... ...... ..... ....... ..... ..... ...... ..... ...... ...... ...... ..... ..... 14 12345678 44

45 15 Amount on line 14 attributable to resident qualifying shareholders, nonresident qualifying shareholders, 45

46 and nonresident qualifying partners whose Minnesota income tax liability is not satisfied by this entity 46

47 level tax. ... ...... ..... ....... ..... ...... ..... ...... ..... ...... ...... ...... ..... ...... ..... .... 15 12345678 47

48 48

49 16 For qualifying shareholders and qualifying partners whose attributes are included on line 15, enter one-fifth 49

50 of the bonus depreciation that was added back in a year the shareholder or partner elected to be included 50

51 in the composite income tax or the entity filed Schedule PTE. ... ...... ..... ...... ...... ..... ...... ..... 16 12345678 51

52 52

53 17 For qualifying shareholders and qualifying partners whose attributes are included on line 15, enter one-fifth 53

54 of the section 179 expensing that was added back in a year the shareholder or partner elected to be included 54

55 in the composite income tax or the entity filed Schedule PTE ... ...... ..... ....... ..... ...... ..... ..... 17 12345678 55

56 56

57 18 Add lines 16 and 17 ... ...... ..... ...... ..... ...... ...... ...... ..... ...... ..... ...... ...... ..... . 18 12345678 57

58 58

59 19 Multiply line 18 by line 6 ... ...... ..... ....... ..... ...... ..... ..... ...... ...... ...... ..... ...... . 19 12345678 59

60 60

61 20 Subtract line 19 from line 15 ... ...... ..... ....... ..... ...... ..... ...... ..... ...... ...... ...... ... 20 12345678 61

62 62

63 99959995 63

2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 32 34 36 38 40 42 44 46 48 50 52 54 56 58 60 62 64 66 68 70 72 74 76 78 80 82 84 86

65 65