Enlarge image

1 1

2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 32 34 36 38 40 42 44 46 48 50 52 54 56 58 60 62 64 66 68 70 72 74 76 78 80 82 84 86

3 3

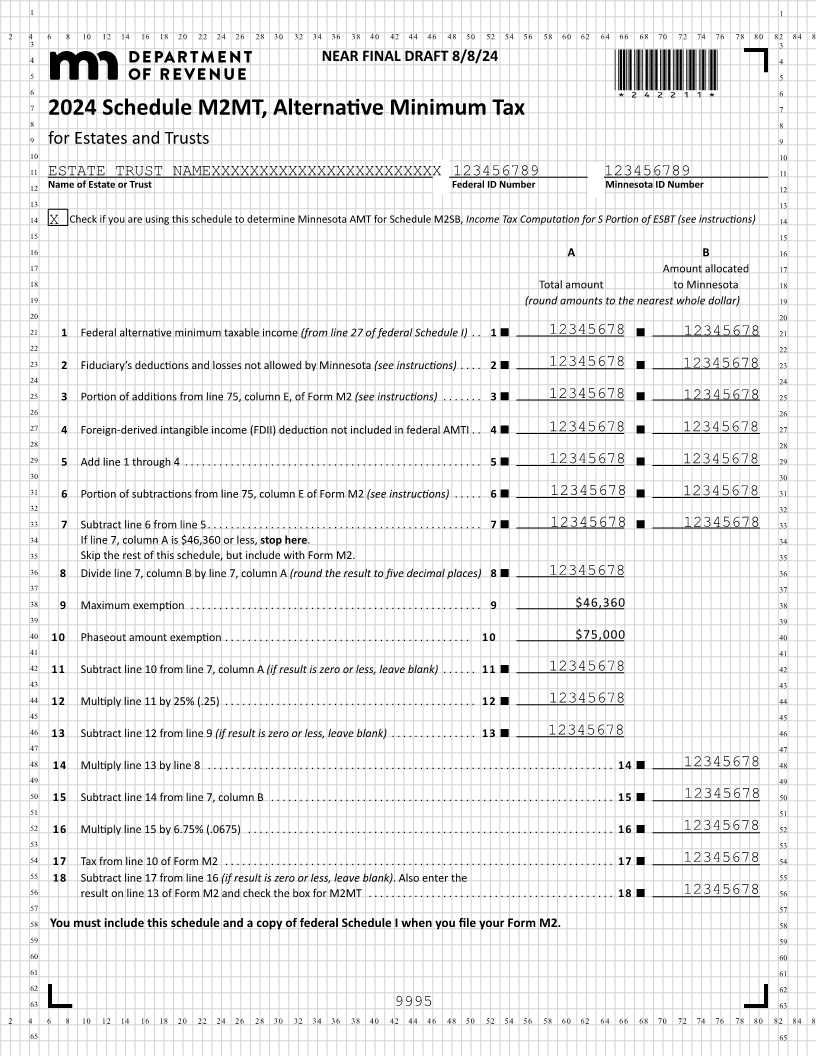

4 NEAR FINAL DRAFT 8/8/24 4

5 5

6 *242211* 6

7 7

8 2024 Schedule M2MT, Alternative Minimum Tax 8

9 for Estates and Trusts 9

10 10

11 ESTATE TRUST NAMEXXXXXXXXXXXXXXXXXXXXXXXX 123456789 123456789 11

12 Name of Estate or Trust Federal ID Number Minnesota ID Number 12

13 13

14 Check if you are using this schedule to determine Minnesota AMT for Schedule M2SB, Income Tax Computation for S Portion of ESBT (see instructions) 14

X

15 15

16 A B 16

17 Amount allocated 17

18 Total amount to Minnesota 18

19 (round amounts to the nearest whole dollar) 19

20 20

21 1 Federal alternative minimum taxable income (from line 27 of federal Schedule I) . . 1 12345678 12345678 21

22 22

23 2 Fiduciary’s deductions and losses not allowed by Minnesota (see instructions) . . . . 2 12345678 12345678 23

24 24

25 3 Portion of additions from line 75, column E, of Form M2 (see instructions) . . . . . . . 3 12345678 12345678 25

26 26

27 4 Foreign-derived intangible income (FDII) deduction not included in federal AMTI . . 4 12345678 12345678 27

28 28

29 5 Add line 1 through 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 12345678 12345678 29

30 30

31 6 Portion of subtractions from line 75, column E of Form M2 (see instructions) . . . . . 6 12345678 12345678 31

32 32

33 7 Subtract line 6 from line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 12345678 12345678 33

34 If line 7, column A is $46,360 or less, stop here . 34

35 Skip the rest of this schedule, but include with Form M2. 35

36 8 Divide line 7, column B by line 7, column A (round the result to five decimal places) 8 12345678 36

37 37

38 9 Maximum exemption . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9 $46,360 38

39 39

40 10 Phaseout amount exemption . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10 $75,000 40

41 41

42 11 Subtract line 10 from line 7, column A (if result is zero or less, leave blank) . . . . . . 11 12345678 42

43 43

44 12 Multiply line 11 by 25% (.25) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12 12345678 44

45 45

46 13 Subtract line 12 from line 9 (if result is zero or less, leave blank) . . . . . . . . . . . . . . . 13 12345678 46

47 47

48 14 Multiply line 13 by line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14 12345678 48

49 49

50 15 Subtract line 14 from line 7, column B . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15 12345678 50

51 51

52 16 Multiply line 15 by 6.75% (.0675) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16 12345678 52

53 53

54 17 Tax from line 10 of Form M2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17 12345678 54

55 18 Subtract line 17 from line 16 (if result is zero or less, leave blank) . Also enter the 55

56 result on line 13 of Form M2 and check the box for M2MT . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18 12345678 56

57 57

58 You must include this schedule and a copy of federal Schedule I when you file your Form M2. 58

59 59

60 60

61 61

62 62

63 9995 63

2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 32 34 36 38 40 42 44 46 48 50 52 54 56 58 60 62 64 66 68 70 72 74 76 78 80 82 84 86

65 65