Enlarge image

1 1

2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 32 34 36 38 40 42 44 46 48 50 52 54 56 58 60 62 64 66 68 70 72 74 76 78 80 82 84 86

3 NEAR FINAL DRAFT 8/1/24 3

4 4

5 5

6 6

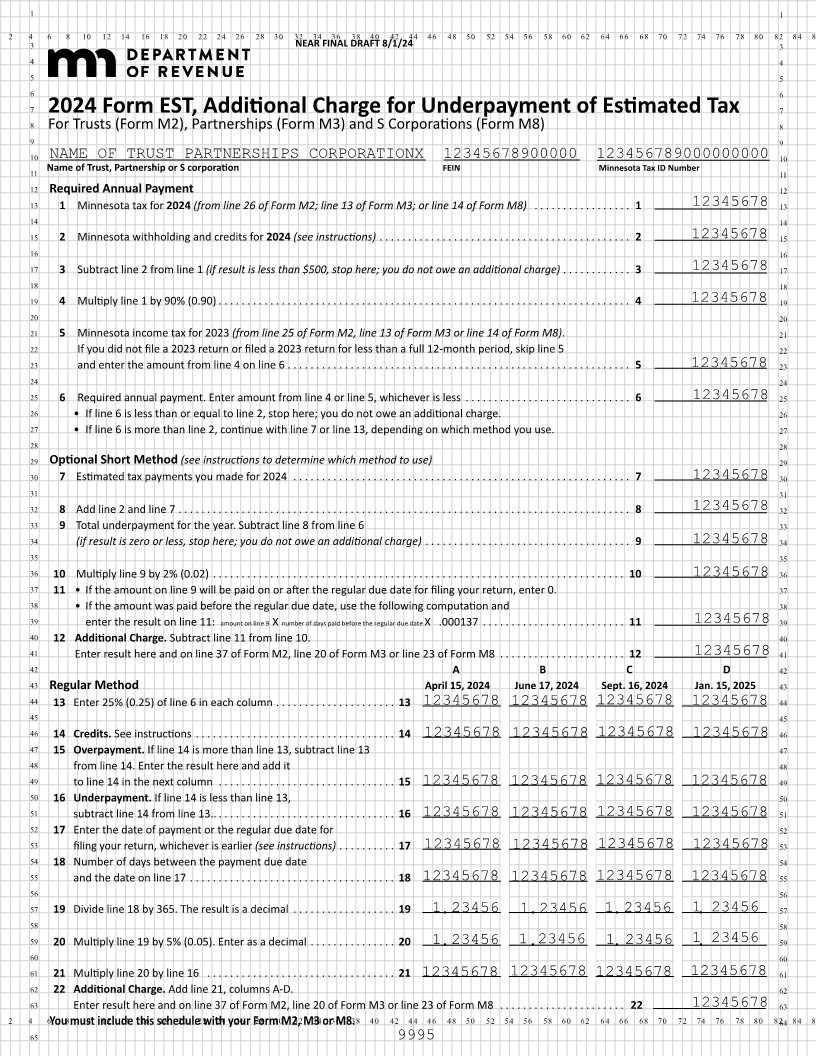

7 2024 Form EST, Additional Charge for Underpayment of Estimated Tax 7

8 For Trusts (Form M2), Partnerships (Form M3) and S Corporations (Form M8) 8

9 9

10 NAME OF TRUST PARTNERSHIPS CORPORATIONX 12345678900000 123456789000000000 10

11 Name of Trust, Partnership or S corporation FEIN Minnesota Tax ID Number 11

12 Required Annual Payment 12

13 1 Minnesota tax for 2024 (from line 26 of Form M2; line 13 of Form M3; or line 14 of Form M8) . . . . . . . . . . . . . . . . . 1 12345678 13

14 14

15 2 Minnesota withholding and credits for 2024 (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 12345678 15

16 16

17 3 Subtract line 2 from line 1 (if result is less than $500, stop here; you do not owe an additional charge) . . . . . . . . . . . . 3 12345678 17

18 18

19 4 Multiply line 1 by 90% (0.90) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 12345678 19

20 20

21 5 Minnesota income tax for 2023 (from line 25 of Form M2, line 13 of Form M3 or line 14 of Form M8) . 21

22 If you did not file a 2023 return or filed a 2023 return for less than a full 12-month period, skip line 5 22

23 and enter the amount from line 4 on line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 12345678 23

24 24

25 6 Required annual payment. Enter amount from line 4 or line 5, whichever is less . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 12345678 25

26 • If line 6 is less than or equal to line 2, stop here; you do not owe an additional charge. 26

27 • If line 6 is more than line 2, continue with line 7 or line 13, depending on which method you use. 27

28 28

29 Optional Short Method (see instructions to determine which method to use) 29

30 7 Estimated tax payments you made for 2024 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 12345678 30

31 31

32 8 Add line 2 and line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8 12345678 32

33 9 Total underpayment for the year. Subtract line 8 from line 6 33

34 (if result is zero or less, stop here; you do not owe an additional charge) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9 12345678 34

35 35

36 10 Multiply line 9 by 2% (0.02) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10 12345678 36

37 11 • If the amount on line 9 will be paid on or after the regular due date for filing your return, enter 0. 37

38 • If the amount was paid before the regular due date, use the following computation and 38

39 enter the result on line 11: amount on line 9 number of days paid before the regular due dateX .000137 X . . . . . . . . . . . . . . . . . . . . . . . .11. 1234567839

40 12 Additional Charge. Subtract line 11 from line 10. 40

41 Enter result here and on line 37 of Form M2, line 20 of Form M3 or line 23 of Form M8 . . . . . . . . . . . . . . . . . . . . . . 12 12345678 41

42 A B C D 42

43 Regular Method April 15, 2024 June 17, 2024 Sept. 16, 2024 Jan. 15, 2025 43

44 13 Enter 25% (0.25) of line 6 in each column . . . . . . . . . . . . . . . . . . . . . 13 12345678 12345678 12345678 12345678 44

45 45

46 14 Credits. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14 12345678 12345678 12345678 12345678 46

47 15 Overpayment. If line 14 is more than line 13, subtract line 13 47

48 from line 14. Enter the result here and add it 48

49 to line 14 in the next column . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15 12345678 12345678 12345678 12345678 49

50 16 Underpayment. If line 14 is less than line 13, 50

51 subtract line 14 from line 13.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16 12345678 12345678 12345678 12345678 51

52 17 Enter the date of payment or the regular due date for 52

53 filing your return, whichever is earlier (see instructions) . . . . . . . . . . 17 12345678 12345678 12345678 12345678 53

54 18 Number of days between the payment due date 54

55 and the date on line 17 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18 12345678 12345678 12345678 12345678 55

56 56

57 1918 byline Divide 365. resultThe ais decimal . . . . . . . . . . . . . . . . . 19. 1. 23456 1. 23456 1. 23456 1. 23456 57

58 58

59 20Multiply 19line by 5% (0.05). Enter as a decimal . . . . . . . . . . . . . . 20. .1 23456 1.23456 1. 23456 1. 23456 59

60 60

61 21 Multiply line 20 by line 16 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21 12345678 12345678 12345678 12345678 61

62 22 Additional Charge. Add line 21, columns A-D. 62

63 Enter result here and on line 37 of Form M2, line 20 of Form M3 or line 23 of Form M8 . . . . . . . . . . . . . . . . . . . . . . 22 12345678 63

2 4 6mustYou include this8 schedule with10 12 M3 M8.or your Form M2, 14 16 18 20 22 24 26 28 30 32 34 36 38 40 42 44 46 48 50 52 54 56 58 60 62 64 66 68 70 72 74 76 78 80 8264 84 86

65 9995