Enlarge image

NEAR FINAL DRAFT 8/1/24

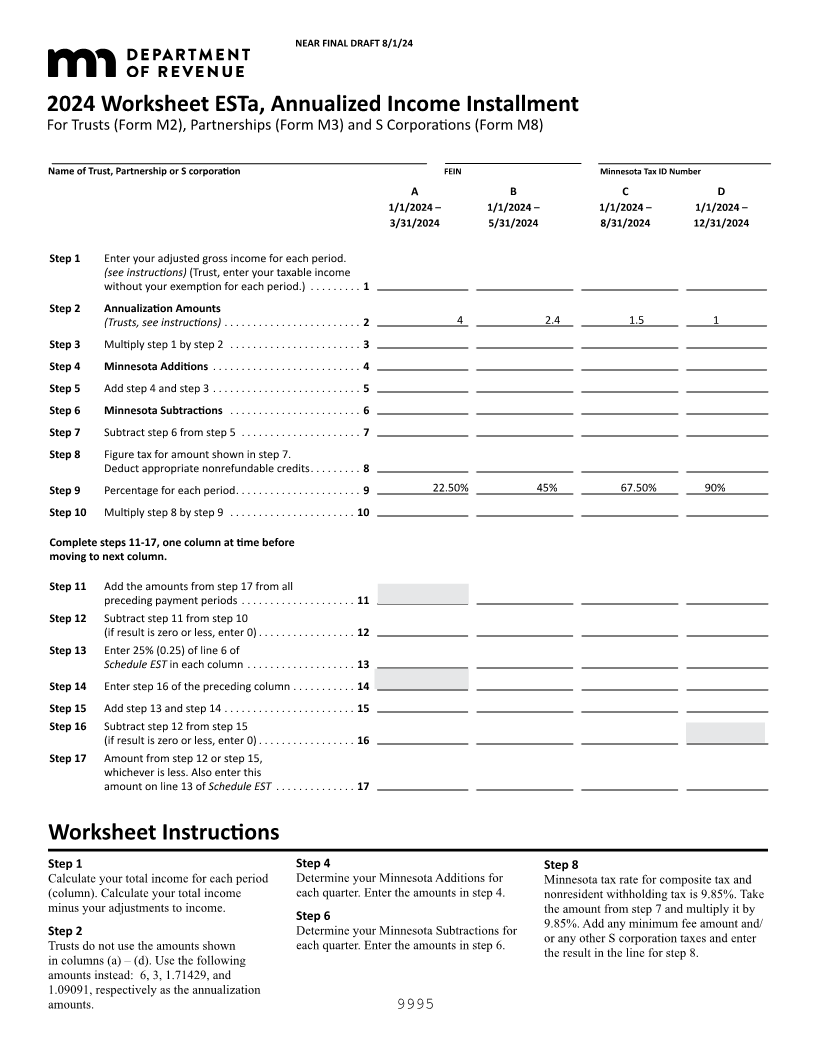

2024 Form EST, Additional Charge for Underpayment of Estimated Tax

For Trusts (Form M2), Partnerships (Form M3) and S Corporations (Form M8)

Name of Trust, Partnership or S corporation FEIN Minnesota Tax ID Number

Required Annual Payment

1 Minnesota tax for 2024 (from line 26 of Form M2; line 13 of Form M3; or line 14 of Form M8) . . . . . . . . . . . . . . . . . 1

2 Minnesota withholding and credits for 2024 (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Subtract line 2 from line 1 (if result is less than $500, stop here; you do not owe an additional charge) . . . . . . . . . . . . 3

4 Multiply line 1 by 90% (0.90) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Minnesota income tax for 2023 (from line 25 of Form M2, line 13 of Form M3 or line 14 of Form M8) .

If you did not file a 2023 return or filed a 2023 return for less than a full 12-month period, skip line 5

and enter the amount from line 4 on line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Required annual payment. Enter amount from line 4 or line 5, whichever is less . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

• If line 6 is less than or equal to line 2, stop here; you do not owe an additional charge.

• If line 6 is more than line 2, continue with line 7 or line 13, depending on which method you use.

Optional Short Method (see instructions to determine which method to use)

7 Estimated tax payments you made for 2024 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Add line 2 and line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Total underpayment for the year. Subtract line 8 from line 6

(if result is zero or less, stop here; you do not owe an additional charge) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10 Multiply line 9 by 2% (0.02) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 • If the amount on line 9 will be paid on or after the regular due date for filing your return, enter 0.

• If the amount was paid before the regular due date, use the following computation and

enter the result on line 11: amount 9 line on number daysof paid before the regular due dateX X .000137 . . . . . . . . . . . . . . . . . . . . . . . .11.

12 Additional Charge. Subtract line 11 from line 10.

Enter result here and on line 37 of Form M2, line 20 of Form M3 or line 23 of Form M8 . . . . . . . . . . . . . . . . . . . . . . 12

A B C D

Regular Method April 15, 2024 June 17, 2024 Sept. 16, 2024 Jan. 15, 2025

13 Enter 25% (0.25) of line 6 in each column . . . . . . . . . . . . . . . . . . . . . 13

14 Credits. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15 Overpayment. If line 14 is more than line 13, subtract line 13

from line 14. Enter the result here and add it

to line 14 in the next column . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

16 Underpayment. If line 14 is less than line 13,

subtract line 14 from line 13.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

17 Enter the date of payment or the regular due date for

filing your return, whichever is earlier (see instructions) . . . . . . . . . . 17

18 Number of days between the payment due date

and the date on line 17 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

19 Divide line 18 by 365. The result is a decimal . . . . . . . . . . . . . . . . . . 19 . . . .

20 Multiply line 19 by 5% (0.05). Enter as a decimal . . . . . . . . . . . . . . . 20 . . . .

21 Multiply line 20 by line 16 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

22 Additional Charge. Add line 21, columns A-D.

Enter result here and on line 37 of Form M2, line 20 of Form M3 or line 23 of Form M8 . . . . . . . . . . . . . . . . . . . . . . 22

You must include this schedule with your Form M2, M3 or M8.

9995