Enlarge image

1 1

2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 32 34 36 38 40 42 44 46 48 50 52 54 56 58 60 62 64 66 68 70 72 74 76 78 80 82 84 86

3 NEAR FINAL DRAFT 8/1/24 3

4 4

5 5

6 *244511* 6

7 7

8 8

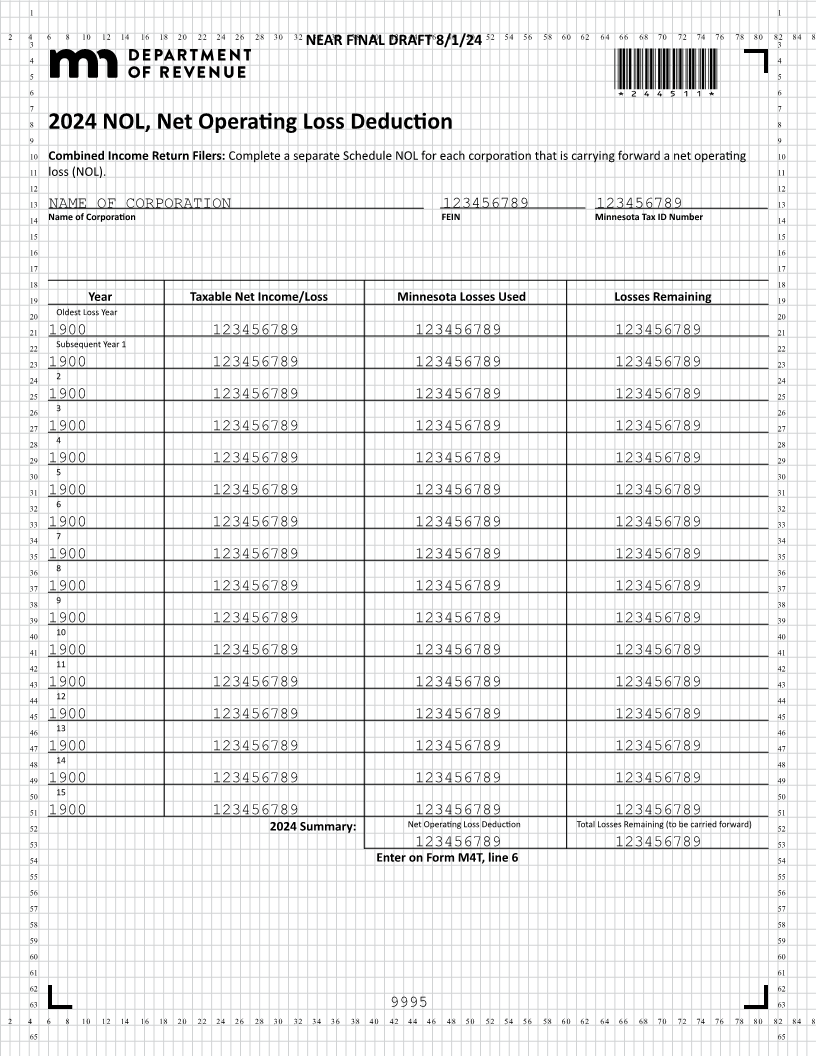

2024 NOL, Net Operating Loss Deduction

9 9

10 Combined Income Return Filers: Complete a separate Schedule NOL for each corporation that is carrying forward a net operating 10

11 loss (NOL). 11

12 12

13 NAME OF CORPORATION 123456789 123456789 13

14 Name of Corporation FEIN Minnesota Tax ID Number 14

15 15

16 16

17 17

18 18

19 Year Taxable Net Income/Loss Minnesota Losses Used Losses Remaining 19

20 Oldest Loss Year 20

21 1900 123456789 123456789 123456789 21

22 Subsequent Year 1 22

23 1900 123456789 123456789 123456789 23

24 2 24

25 1900 123456789 123456789 123456789 25

26 3 26

27 1900 123456789 123456789 123456789 27

28 4 28

29 1900 123456789 123456789 123456789 29

30 5 30

31 1900 123456789 123456789 123456789 31

32 6 32

33 1900 123456789 123456789 123456789 33

34 7 34

35 1900 123456789 123456789 123456789 35

36 8 36

37 1900 123456789 123456789 123456789 37

38 9 38

39 1900 123456789 123456789 123456789 39

40 10 40

41 1900 123456789 123456789 123456789 41

42 11 42

43 1900 123456789 123456789 123456789 43

44 12 44

45 1900 123456789 123456789 123456789 45

46 13 46

47 1900 123456789 123456789 123456789 47

48 14 48

49 1900 123456789 123456789 123456789 49

50 15 50

51 1900 123456789 123456789 123456789 51

52 2024 Summary: Net Operating Loss Deduction Total Losses Remaining (to be carried forward) 52

53 123456789 123456789 53

54 Enter on Form M4T, line 6 54

55 55

56 56

57 57

58 58

59 59

60 60

61 61

62 62

63 9995 63

2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 32 34 36 38 40 42 44 46 48 50 52 54 56 58 60 62 64 66 68 70 72 74 76 78 80 82 84 86

65 65