Enlarge image

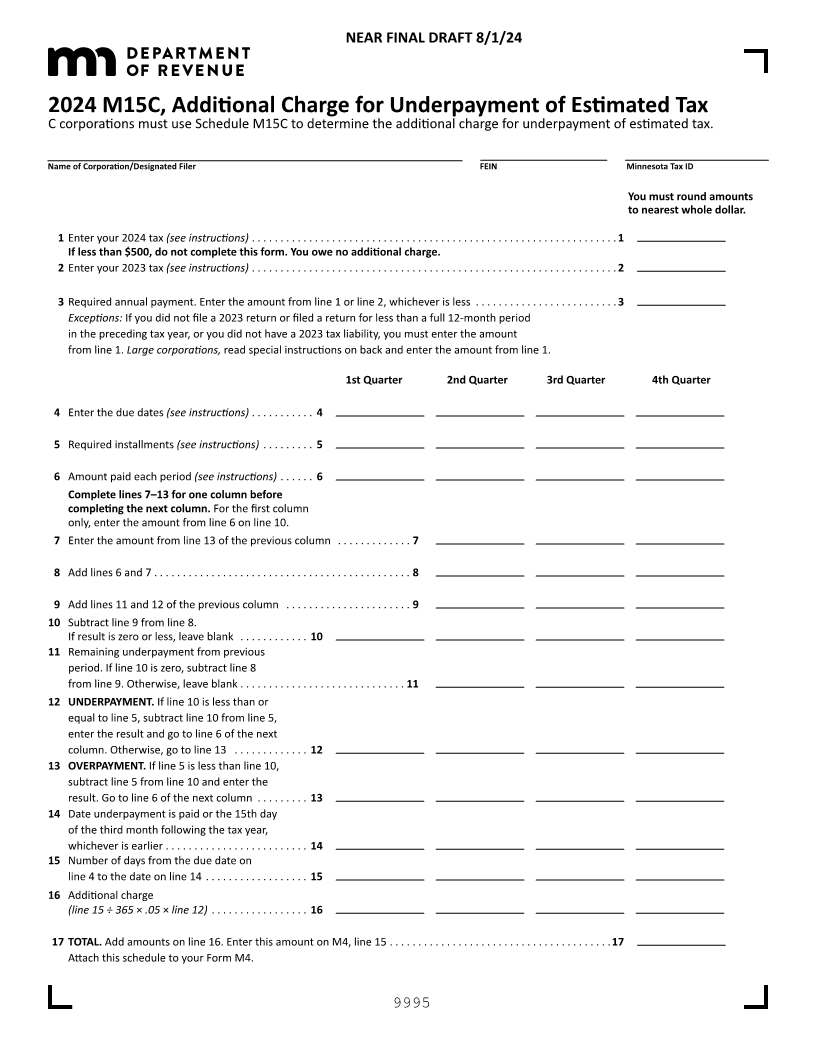

NEAR FINAL DRAFT 8/1/24

2024 M15C, Additional Charge for Underpayment of Estimated Tax

C corporations must use Schedule M15C to determine the additional charge for underpayment of estimated tax.

Name of Corporation/Designated Filer FEIN Minnesota Tax ID

You must round amounts

to nearest whole dollar.

1 Enter your 2024 tax (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

If less than $500, do not complete this form. You owe no additional charge.

2 Enter your 2023 tax (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Required annual payment . Enter the amount from line 1 or line 2, whichever is less . . . . . . . . . . . . . . . . . . . . . . . . . 3

Exceptions: If you did not file a 2023 return or filed a return for less than a full 12-month period

in the preceding tax year, or you did not have a 2023 tax liability, you must enter the amount

from line 1 . Large corporations, read special instructions on back and enter the amount from line 1.

1st Quarter 2nd Quarter 3rd Quarter 4th Quarter

4 Enter the due dates (see instructions) . . . . . . . . . . . 4

5 Required installments (see instructions) . . . . . . . . . 5

6 Amount paid each period (see instructions) . . . . . . 6

Complete lines 7–13 for one column before

completing the next column. For the first column

only, enter the amount from line 6 on line 10 .

7 Enter the amount from line 13 of the previous column . . . . . . . . . . . . . 7

8 Add lines 6 and 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Add lines 11 and 12 of the previous column . . . . . . . . . . . . . . . . . . . . . . 9

10 Subtract line 9 from line 8 .

If result is zero or less, leave blank . . . . . . . . . . . . 10

11 Remaining underpayment from previous

period . If line 10 is zero, subtract line 8

from line 9. Otherwise, leave blank . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 UNDERPAYMENT. If line 10 is less than or

equal to line 5, subtract line 10 from line 5,

enter the result and go to line 6 of the next

column . Otherwise, go to line 13 . . . . . . . . . . . . . 12

13 OVERPAYMENT. If line 5 is less than line 10,

subtract line 5 from line 10 and enter the

result . Go to line 6 of the next column . . . . . . . . . 13

14 Date underpayment is paid or the 15th day

of the third month following the tax year,

whichever is earlier . . . . . . . . . . . . . . . . . . . . . . . . . 14

15Number of days from the due date on

line 4 to the date on line 14 . . . . . . . . . . . . . . . . . . 15

16 Additional charge

(line 15 ÷ 365 .05 × × line 12) . . . . . . . . . . . . . . . .16 .

17 TOTAL. Add amounts on line 16 . Enter this amount on M4, line 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .17

Attach this schedule to your Form M4.

9995