Enlarge image

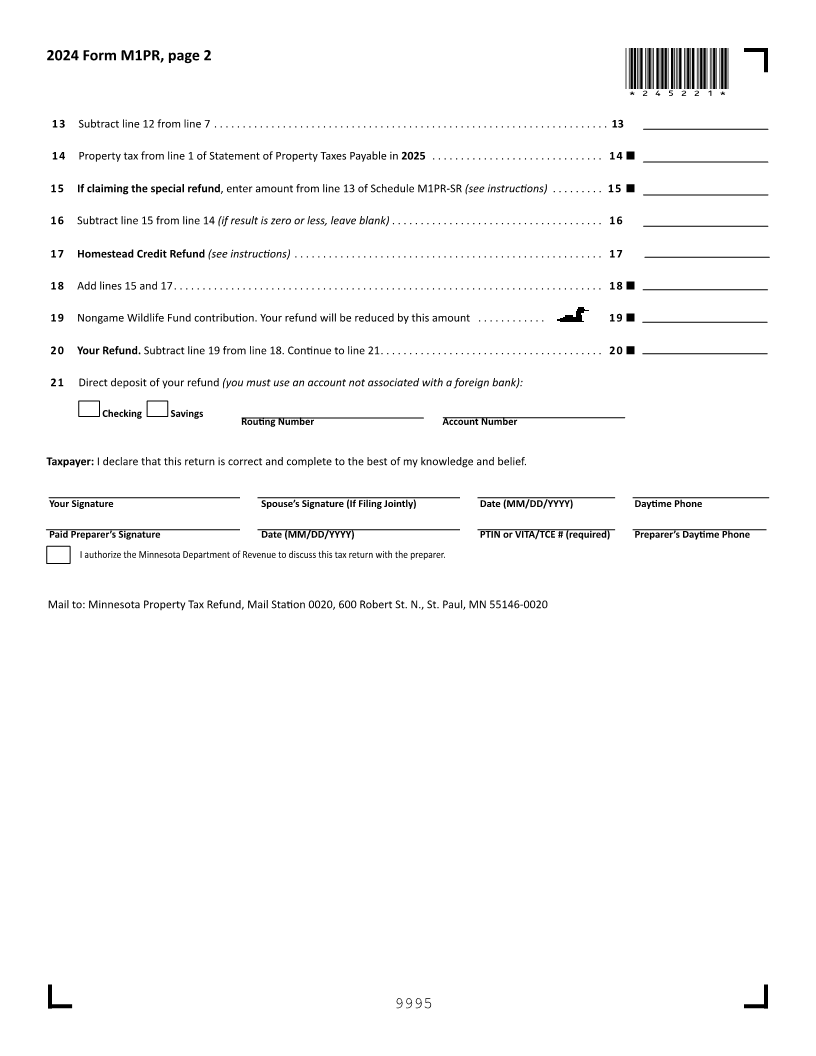

NEAR FINAL DRAFT 8/1/24

*245211*

2024 Form M1PR, Homestead Credit Refund

Your First Name and Initial Last Name Your Social Security Number Your Date of Birth (MM/DD/YYYY)

If a Joint Return, Spouse’s First Name and Initial Spouse’s Last Name Spouse’s Social Security Number Spouse’s Date of Birth

Check if Address is: New Foreign

Current Home Address

Check if Mobile Home Owner

City State ZIP Code

Property ID Number County where property is located

State Elections Campaign Fund: To grant $5 to this fund, enter the code for the party of your choice. It will help candidates for state offices pay campaign expenses.

This will not increase your tax or reduce your refund.

Political Party Code Numbers: Republican . . . . . . . . . . . . . . . . 11 Grassroots/Legalize Cannabis Legal14 Marijuana Now . . . . . . . 17

Your Code Spouse’s Code Democratic/Farmer-Labor . . . 12 Libertarian . . . . . . . . . . . . . . . . 16 General Campaign Fund . . . . . 99

1 Federal adjusted gross income Line (from did you not Form file if of 1 M1)Form instructions see M1, . . . . . . . . . 1

2 Nontaxable Social Security and/or Railroad Retirement Board benefits (see instructions) . . . . . . . . . . . . . . . . . . . 2

3Deduction contributionsfor to a qualified retirement plan on federal Schedule 1 (see instructions) . . . . . . . . . . 3

4 Total government assistance payments (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Co-occupant Income 13 of Worksheetline (from 5 - Co-occupant negative,If Income. enter as a negative) . . . . 5

6 Additional Nontaxable Income. Add the amounts on column B below (see instructions) .. ...... ...... ..... 6

A — Type of Income B — Income Amount

a1 b1

a2 b2

a3 b3

7 Add lines 1 through 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

Subtraction for 65 or older (born before January 2, 1960) or disabled:

8

If you (or your spouse if filing a joint return) are age 65 or older or are disabled, enter $5,050: . . . . . . . . . . . . . 8

Check the box if you or your spouse are: A) 65 or Older (B) Disabled

9 Dependent Subtraction: Enter your subtraction for dependents (use worksheet in instructions) . . . . . . . . . . . . 9

Number of dependents:

Names and Social Security numbers:

10 Retirement Account Subtraction (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Total other subtractions (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

Subtraction type

12 Add lines 8 through 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

9995