Enlarge image

1 1

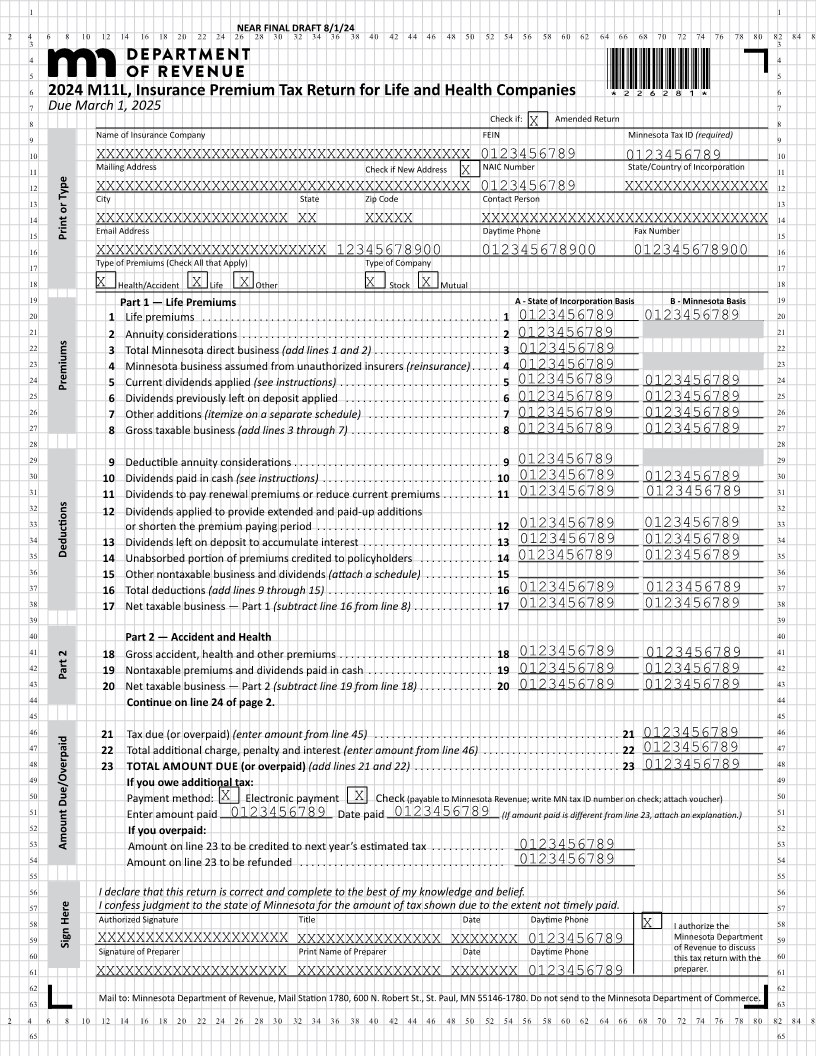

NEAR FINAL DRAFT 8/1/24

2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 32 34 36 38 40 42 44 46 48 50 52 54 56 58 60 62 64 66 68 70 72 74 76 78 80 82 84 86

3 3

4 4

5 5

*226281*

6 2024 M11L, Insurance Premium Tax Return for Life and Health Companies 6

7 Due March 1, 2025 7

8 Check if: Amended Return 8

9 Name of Insurance Company FEIN X Minnesota Tax ID (required) 9

10 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 0123456789 0123456789 10

11 Mailing Address Check if New Address NAIC Number State/Country of Incorporation 11

X

12 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 0123456789 XXXXXXXXXXXXXXX 12

13 City State Zip Code Contact Person 13

14 XXXXXXXXXXXXXXXXXXXX XX XXXXX XXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 14

15 Print or Type Email Address Daytime Phone Fax Number 15

16 XXXXXXXXXXXXXXXXXXXXXXXX 12345678900 012345678900 012345678900 16

17 Type of Premiums (Check All that Apply) Type of Company 17

18 X Health/Accident X Life X Other X Stock X Mutual 18

19 Part 1 — Life Premiums A - State of Incorporation Basis B - Minnesota Basis 19

20 1 Life premiums .. ...... ..... ...... ...... ...... ..... ..... ...... ..... 1 0123456789 0123456789 20

21 2 Annuity considerations ... ...... ..... ...... ...... ..... ...... ..... ... 2 0123456789 21

22 3 Total Minnesota direct business (add lines 1 and 2) ... ...... ..... ...... .. 3 0123456789 22

23 4 Minnesota business assumed from unauthorized insurers (reinsurance) ... .. 4 0123456789 23

24 Premiums 5 Current dividends applied (see instructions) ... ...... ..... ....... ..... .. 5 0123456789 0123456789 24

25 6 Dividends previously left on deposit applied .. ....... ...... ..... ..... .. 6 0123456789 0123456789 25

26 7 Other additions (itemize on a separate schedule) .. ...... ...... ...... ... 7 0123456789 0123456789 26

27 8 Gross taxable business (add lines 3 through 7) ... ...... ..... ....... ..... 8 0123456789 0123456789 27

28 28

29 9 Deductible annuity considerations ... ...... ...... ...... ..... ...... .... 9 0123456789 29

30 10 Dividends paid in cash (see instructions) ... ...... ..... ...... ...... .... 10 0123456789 0123456789 30

31 11 Dividends to pay renewal premiums or reduce current premiums ... ...... 11 0123456789 0123456789 31

32 12 Dividends applied to provide extended and paid-up additions 32

33 or shorten the premium paying period ... ...... ..... ....... ..... ..... 12 0123456789 0123456789 33

34 13 Dividends left on deposit to accumulate interest ... ...... ..... ...... ... 13 0123456789 0123456789 34

Deductions

35 14 Unabsorbed portion of premiums credited to policyholders .. ...... ..... 14 0123456789 0123456789 35

36 15 Other nontaxable business and dividends (attach a schedule) .. ....... ... 15 36

37 16 Total deductions (add lines 9 through 15) ... ...... ..... ....... ..... ... 16 0123456789 0123456789 37

38 17 Net taxable business Part— 1 (subtract line 16 from line 8) ... ...... ..... 17 0123456789 0123456789 38

39 39

40 Part 2 — Accident and Health 40

41 18 Gross accident, health and other premiums ... ...... ..... ....... ..... . 18 0123456789 0123456789 41

42 Part 2 19 Nontaxable andpremiums dividends paid in cash ... ...... ..... ....... . 19 0123456789 0123456789 42

43 20 Net taxable business Part— 2 (subtract line 19 from line 18) ... ...... .... 20 0123456789 0123456789 43

44 Continue on line 24 of page 2. 44

45 45

46 21 Tax due (or overpaid) (enter amount from line 45) .. ..... ...... ..... ....... ..... ...... ..... .. 21 0123456789 46

47 22 Total additional charge, penalty and interest (enter amount from line 46) .. ..... ..... ....... ..... 22 0123456789 47

48 23 TOTAL AMOUNT DUE (or overpaid) (add lines 21 and 22) ... ...... ..... ...... ...... ..... ..... 23 0123456789 48

49 If you owe additional tax: 49

50 Payment method: X Electronic payment X Check (payable to Minnesota Revenue; write MN tax ID number on check; attach voucher) 50

51 Enter amount paid 0123456789 Date paid 0123456789 (If amount paid is different from line 23, attach an explanation.) 51

52 If you overpaid: 52

53 Amount Due/Overpaid Amount on line 23 to be credited to next year’s estimated tax .... ...... ... 53

0123456789

54 Amount on line 23 to be refunded . ..... ...... ..... ...... ..... ...... .. 0123456789 54

55 55

56 I declare that this return is correct and complete to the best of my knowledge and belief. 56

57 I confess judgment to the state of Minnesota for the amount of tax shown due to the extent not timely paid. 57

58 Authorized Signature Title Date Daytime Phone X I authorize the 58

59 Sign Here XXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXX XXXXXXX 0123456789 Minnesota Department 59

60 Signature of Preparer Print Name of Preparer Date Daytime Phone of Revenue to discuss 60

this tax return with the

61 preparer. 61

XXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXX XXXXXXX 0123456789

62 62

63 Mail to: Minnesota Department of Revenue, Mail Station 1780, 600 N. Robert St., St. Paul, MN 55146-1780. Do not send to the Minnesota Department of Commerce. 63

2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 32 34 36 38 40 42 44 46 48 50 52 54 56 58 60 62 64 66 68 70 72 74 76 78 80 82 84 86

65 65