Enlarge image

NEAR FINAL DRAFT 8/1/24

*245511*

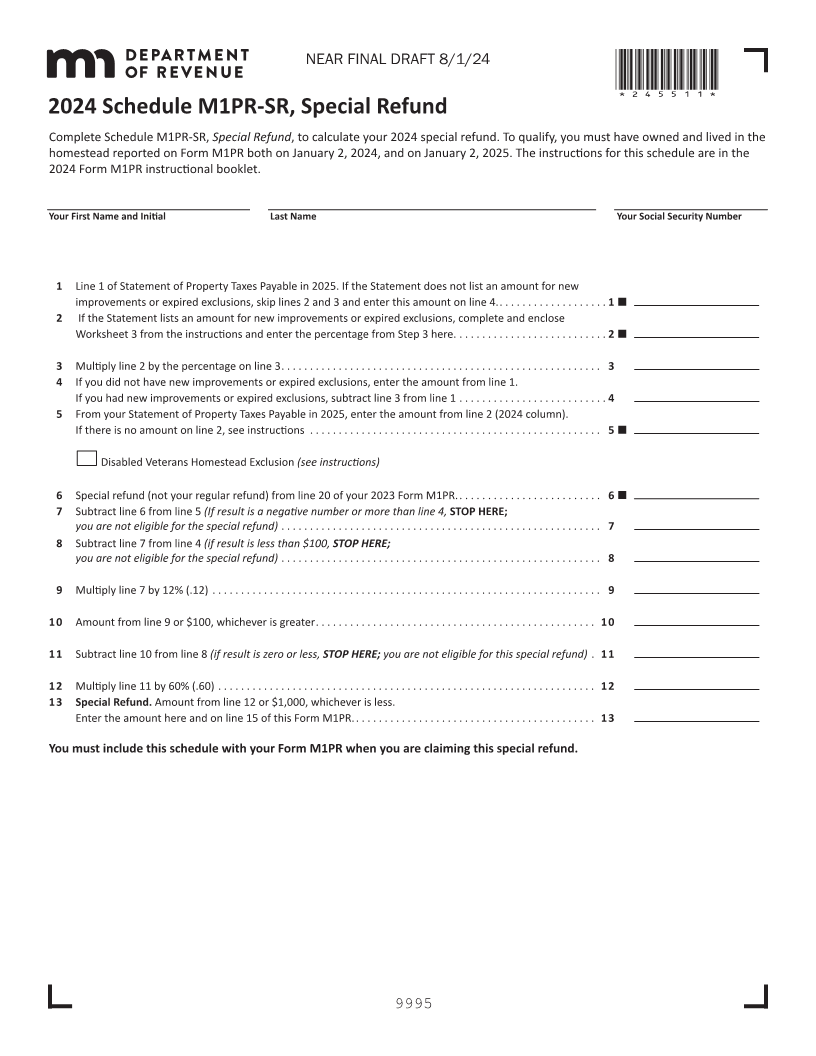

2024 Schedule M1PR-SR, Special Refund

Complete Schedule M1PR-SR, Special Refund, to calculate your 2024 special refund. To qualify, you must have owned and lived in the

homestead reported on Form M1PR both on January 2, 2024, and on January 2, 2025. The instructions for this schedule are in the

2024 Form M1PR instructional booklet.

Your First Name and Initial Last Name Your Social Security Number

1 Line 1 of Statement of Property Taxes Payable in 2025. If the Statement does not list an amount for new

improvements or expired exclusions, skip lines 2 and 3 and enter this amount on line 4.... ...... ..... ..... 1

2 If the Statement lists an amount for new improvements or expired exclusions, complete and enclose

Worksheet 3 from the instructions and enter the percentage from Step 3 here. . ...... ...... ...... ..... .. 2

3 Multiply line 2 by the percentage on line 3... ...... ..... ....... ..... ...... ..... ..... ...... ...... .. 3

4 If you did not have new improvements or expired exclusions, enter the amount from line 1.

If you had new improvements or expired exclusions, subtract line 3 from line 1 ..... ...... ...... ..... .... 4

5 From your Statement of Property Taxes Payable in 2025, enter the amount from line 2 (2024 column).

If there is no amount on line 2, see instructions . ...... ...... ...... ..... ..... ...... ...... ...... .... 5

Disabled Veterans Homestead Exclusion (see instructions)

6 Special refund (not your regular refund) from line 20 of your 2023 Form M1PR. ... ...... ..... ....... .... 6

7 Subtract line 6 from line 5 (If result is a negative number or more than line 4, STOP HERE;

you are not eligible for the special refund) .... ...... ..... ...... ..... ....... ..... ..... ...... ...... . 7

8 Subtract line 7 from line 4 (if result is less than $100, STOP HERE;

you are not eligible for the special refund) .... ...... ..... ...... ..... ....... ..... ..... ...... ...... . 8

9 Multiply line 7 by 12% (.12) .. ....... ..... ..... ...... ..... ...... ...... ...... ..... ...... ..... .... 9

10 Amount from line 9 or $100, whichever is greater... ...... ..... ....... ..... ...... ..... ..... ...... . 10

11 Subtract line 10 from line 8 (if result is zero or less, STOP HERE; you are not eligible for this special refund) . 11

12 Multiply line 11 by 60% (.60) .... ..... ..... ...... ...... ...... ..... ...... ..... ...... ...... ...... 12

13 Special Refund. Amount from line 12 or $1,000, whichever is less.

Enter the amount here and on line 15 of this Form M1PR. ... ...... ..... ....... ..... ...... ..... ..... 13

You must include this schedule with your Form M1PR when you are claiming this special refund.

9995