Enlarge image

1 1

2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 32 34 36 38 40 42 44 46 48 50 52 54 56 58 60 62 64 66 68 70 72 74 76 78 80 82 84 86

3 3

4 NEAR FINAL DRAFT 8/1/24 4

5 5

6 *241321* 6

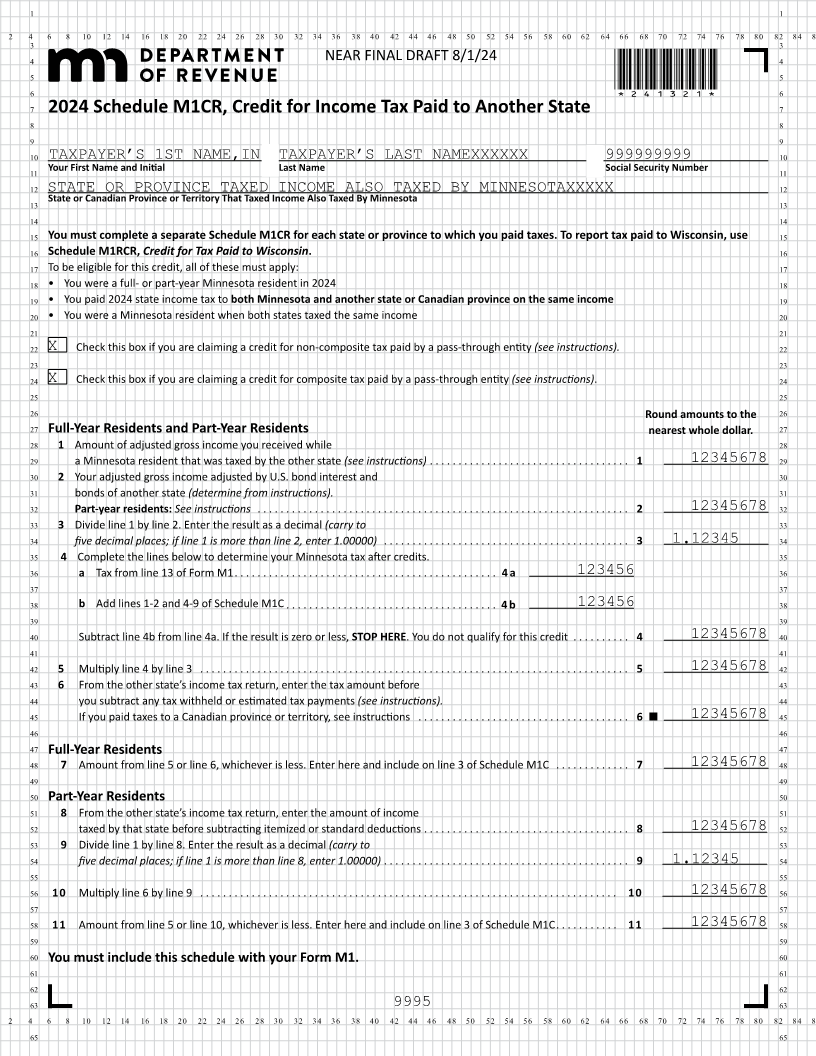

7 2024 Schedule M1CR, Credit for Income Tax Paid to Another State 7

8 8

9 9

10 TAXPAYER’S 1ST NAME,IN TAXPAYER’S LAST NAMEXXXXXX 999999999 10

11 Your First Name and Initial Last Name Social Security Number 11

12 STATE OR PROVINCE TAXED INCOME ALSO TAXED BY MINNESOTAXXXXX 12

13 State or Canadian Province or Territory That Taxed Income Also Taxed By Minnesota 13

14 14

15 You must complete a separate Schedule M1CR for each state or province to which you paid taxes. To report tax paid to Wisconsin, use 15

16 Schedule M1RCR, Credit for Tax Paid to Wisconsin. 16

17 To be eligible for this credit, all of these must apply: 17

18 • You were a full- or part-year Minnesota resident in 2024 18

19 • You paid 2024 state income tax to both Minnesota and another state or Canadian province on the same income 19

20 • You were a Minnesota resident when both states taxed the same income 20

21 21

22 X Check this box if you are claiming a credit for non-composite tax paid by a pass-through entity (see instructions). 22

23 23

24 X Check this box if you are claiming a credit for composite tax paid by a pass-through entity (see instructions) . 24

25 25

26 Round amounts to the 26

27 Full-Year Residents and Part-Year Residents nearest whole dollar. 27

28 1 Amount of adjusted gross income you received while 28

29 a Minnesota resident that was taxed by the other state (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 12345678 29

30 2 Your adjusted gross income adjusted by U .S . bond interest and 30

31 bonds of another state (determine from instructions). 31

32 Part-year residents: See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 12345678 32

33 3 Divide line 1 by line 2 . Enter the result as a decimal (carry to 33

34 five decimal places; if line 1 is more than line 2, enter 1.00000) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .3. . 1.12345. 34

35 4 Complete the lines below to determine your Minnesota tax after credits. 35

36 a Tax from line 13 of Form M1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4a 123456 36

37 37

38 b Add lines 1-2 and 4-9 of Schedule M1C . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4b 123456 38

39 39

40 Subtract line 4b from line 4a . If the result is zero or less, STOP HERE . You do not qualify for this credit . . . . . . . . . . 4 12345678 40

41 41

42 5 Multiply line 4 by line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 12345678 42

43 6 From the other state’s income tax return, enter the tax amount before 43

44 you subtract any tax withheld or estimated tax payments (see instructions). 44

45 If you paid taxes to a Canadian province or territory, see instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 12345678 45

46 46

47 Full-Year Residents 47

48 7 Amount from line 5 or line 6, whichever is less . Enter here and include on line 3 of Schedule M1C . . . . . . . . . . . . . 7 12345678 48

49 49

50 Part-Year Residents 50

51 8 From the other state’s income tax return, enter the amount of income 51

52 taxed by that state before subtracting itemized or standard deductions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8 12345678 52

53 9 Divide line 1 by line 8 . Enter the result as a decimal (carry to 53

54 five decimal places; if line 1 is more than line 8, enter 1.00000) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .9. . 1.12345. 54

55 55

56 10 Multiply line 6 by line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10 12345678 56

57 57

58 11 Amount from line 5 or line 10, whichever is less . Enter here and include on line 3 of Schedule M1C . . . . . . . . . . . 11 12345678 58

59 59

60 You must include this schedule with your Form M1. 60

61 61

62 62

63 9995 63

2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 32 34 36 38 40 42 44 46 48 50 52 54 56 58 60 62 64 66 68 70 72 74 76 78 80 82 84 86

65 65