Enlarge image

1 1

2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 32 34 36 38 40 42 44 46 48 50 52 54 56 58 60 62 64 66 68 70 72 74 76 78 80 82 84 86

3 NEAR FINAL DRAFT 8/1/24 3

4 4

5 5

6 6

7 YEAR 7

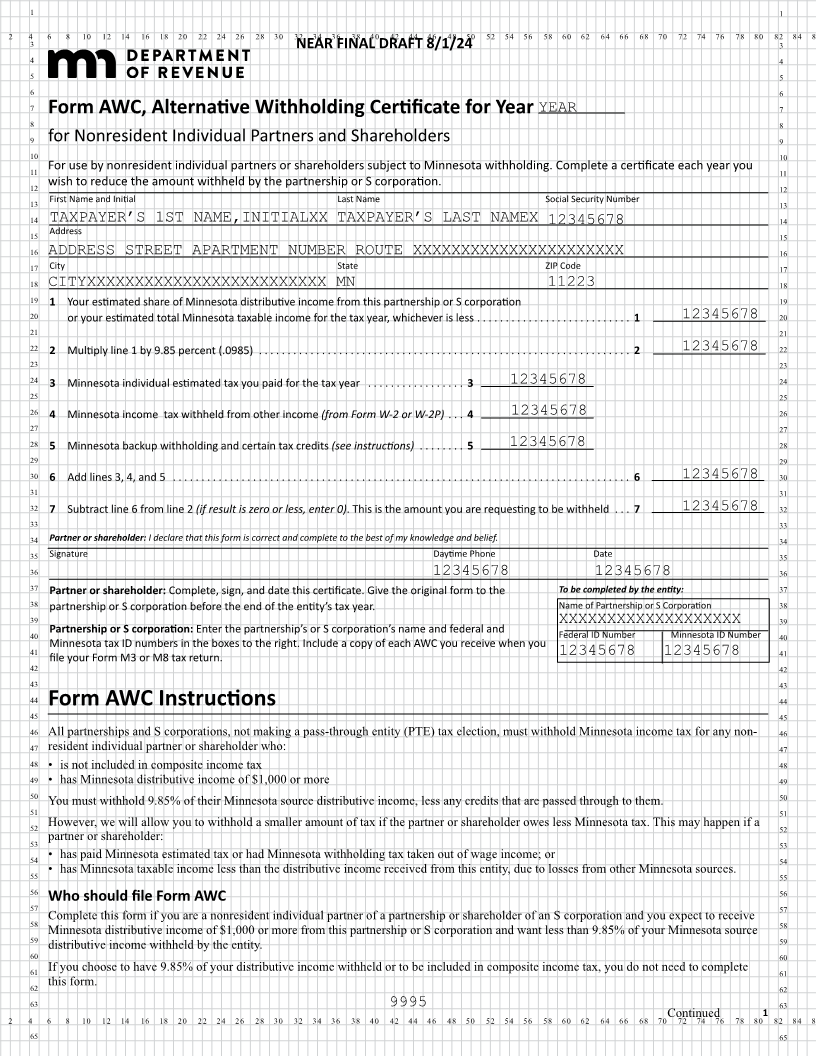

Form AWC, Alternative Withholding Certificate for Year

8 8

9 for Nonresident Individual Partners and Shareholders 9

10 10

11 For use by nonresident individual partners or shareholders subject to Minnesota withholding. Complete a certificate each year you 11

12 wish to reduce the amount withheld by the partnership or S corporation. 12

13 First Name and Initial Last Name Social Security Number 13

14 TAXPAYER’S 1ST NAME,INITIALXX TAXPAYER’S LAST NAMEX 12345678 14

15 Address 15

16 ADDRESS STREET APARTMENT NUMBER ROUTE XXXXXXXXXXXXXXXXXXXXXX 16

17 City State ZIP Code 17

18 CITYXXXXXXXXXXXXXXXXXXXXXXXXX MN 11223 18

19 1 Your estimated share of Minnesota distributive income from this partnership or S corporation 19

20 or your estimated total Minnesota taxable income for the tax year, whichever is less . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 12345678 20

21 21

22 2 Multiply line 1 by 9.85 percent (.0985) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 12345678 22

23 23

24 3 Minnesota individual estimated tax you paid for the tax year . . . . . . . . . . . . . . . . . 3 12345678 24

25 25

26 4 Minnesota income tax withheld from other income (from Form W-2 or W-2P) . . . 4 12345678 26

27 27

28 5 Minnesota backup withholding and certain tax credits (see instructions) . . . . . . . . 5 12345678 28

29 29

30 6 Add lines 3, 4, and 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 12345678 30

31 31

32 7 Subtract line 6 from line 2 (if result is zero or less, enter 0). This is the amount you are requesting to be withheld . . . 7 12345678 32

33 33

34 Partner or shareholder: I declare that this form is correct and complete to the best of my knowledge and belief. 34

35 Signature Daytime Phone Date 35

36 12345678 12345678 36

37 Partner or shareholder: Complete, sign, and date this certificate. Give the original form to the To be completed by the entity: 37

38 partnership or S corporation before the end of the entity’s tax year. Name of Partnership or S Corporation 38

39 XXXXXXXXXXXXXXXXXXX 39

40 Partnership or S corporation: Enter the partnership’s or S corporation’s name and federal and Federal ID Number Minnesota ID Number 40

Minnesota tax ID numbers in the boxes to the right. Include a copy of each AWC you receive when you

41 12345678 12345678 41

file your Form M3 or M8 tax return.

42 42

43 43

44 44

Form AWC Instructions

45 45

46 All partnerships and S corporations, not making a pass-through entity (PTE) tax election, must withhold Minnesota income tax for any non- 46

47 resident individual partner or shareholder who: 47

48 • is not included in composite income tax 48

49 • has Minnesota distributive income of $1,000 or more 49

50 50

You must withhold 9.85% of their Minnesota source distributive income, less any credits that are passed through to them.

51 51

52 However, we will allow you to withhold a smaller amount of tax if the partner or shareholder owes less Minnesota tax. This may happen if a 52

53 partner or shareholder: 53

54 • has paid Minnesota estimated tax or had Minnesota withholding tax taken out of wage income; or 54

55 • has Minnesota taxable income less than the distributive income received from this entity, due to losses from other Minnesota sources. 55

56 56

Who should file Form AWC

57 57

58 Complete this form if you are a nonresident individual partner of a partnership or shareholder of an S corporation and you expect to receive 58

Minnesota distributive income of $1,000 or more from this partnership or S corporation and want less than 9.85% of your Minnesota source

59 59

distributive income withheld by the entity.

60 60

61 If you choose to have 9.85% of your distributive income withheld or to be included in composite income tax, you do not need to complete 61

62 this form. 62

63 9995 63

2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 32 34 36 38 40 42 44 46 48 50 52 54 56 58 60 62 64 66 68 70 Continued72 74 76 78 80 1 82 84 86

65 65