Enlarge image

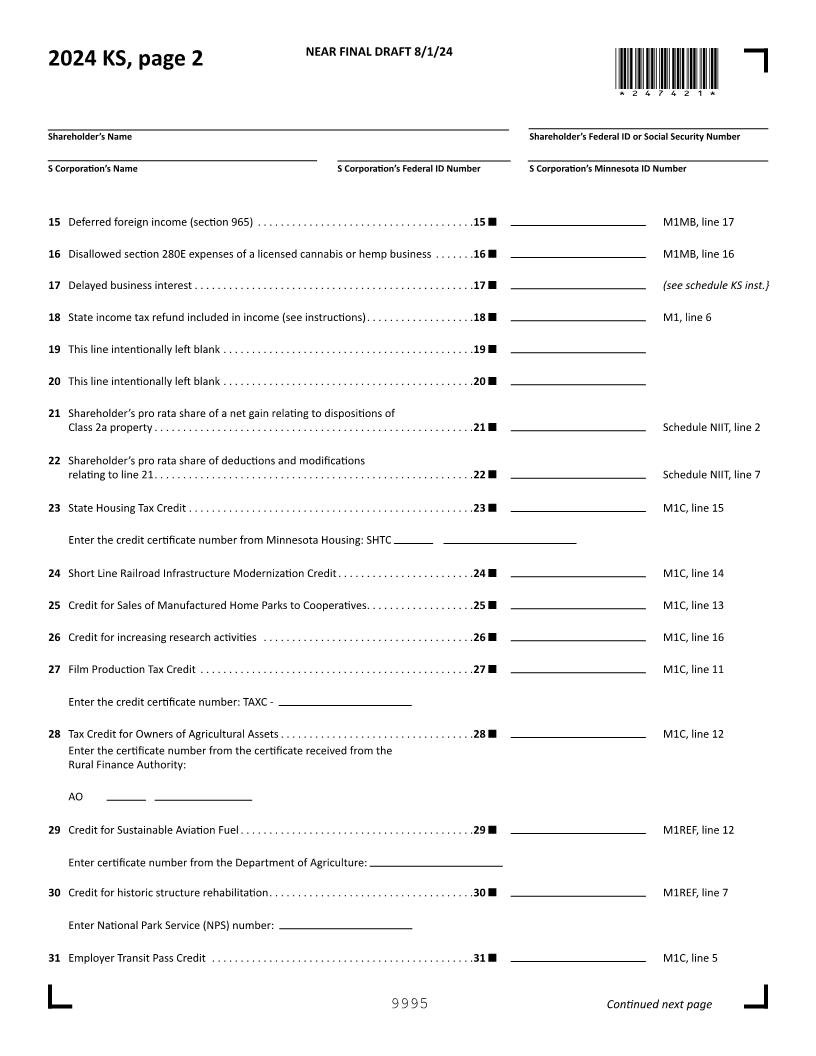

NEAR FINAL DRAFT 8/1/24

*247411*

2024 KS, Shareholder’s Share of Income,

Credits and Modifications

S corporation: Complete and provide Schedule KS to each nonresident shareholder and Minnesota shareholder who has

adjustments to income or credits, or all shareholders if the S corporation is electing PTE tax.

Tax year beginning (MM/DD/YYYY) / / and ending (MM/DD/YYYY) / / Amended KS:

Shareholder’s Federal ID or Social Security Number S Corporation’s Federal ID Number S Corporation’s Minnesota Tax ID

Shareholder’s Name S Corporation’s Name

Mailing Address Mailing Address

City State ZIP Code City State ZIP Code

Entity of Shareholder Individual Estate Shareholder’s percentage of

(place an X in one box): Trust Exempt Organization stock ownership for tax year:

Calculate lines 1–38 the same for all resident and nonresident shareholders. Calculate lines 39-53 for all nonresident shareholder’s, and resident shareholders if the

s-corporation elected PTE tax. Round amounts to the nearest whole dollar. Form M1 filers,

include on:

Modifications to Federal Taxable Income

1 Interest income from non-Minnesota state and municipal bonds . . . . . . . . . . . . . . . . . 1 M1M, line 1

2 State taxes deducted in arriving at s corporation’s net income . . . . . . . . . . . . . . . . . . . 2 M1MB, line 2

3 Expenses deducted that are attributable to income not taxed by Minnesota

(other than interest or mutual fund dividends from U .S . bonds) . . . . . . . . . . . . . . . . . . 3 M1M, line 3

4 100% of shareholder’s pro rata share of federal bonus depreciation . . . . . . . . . . . . . . 4 M1MB, see line 1 inst .

5 Foreign-derived intangible income (FDII) deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 M1MB, line 3

6 This line intentionally left blank . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .6

7a Shareholder’s pro rata gross profit from installment sales of pass-through

businesses (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .7a M1AR, line 1

7b Shareholder’s pro rata installment sale income from pass-through

businesses (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7b M1AR, line 3

8 This line intentionally left blank . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .8

9 This line intentionally left blank . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .9

10 This line intentionally left blank . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .10

11 This line intentionally left blank . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .11

12 This line intentionally left blank . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .12

13 This line intentionally left blank . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .13

14 Interest from U.S. government bond obligations, minus any expenses

deducted on the federal return that are attributable to this income . . . . . . . . . . . . . .14 M1M, line 14

9995 Continued next page