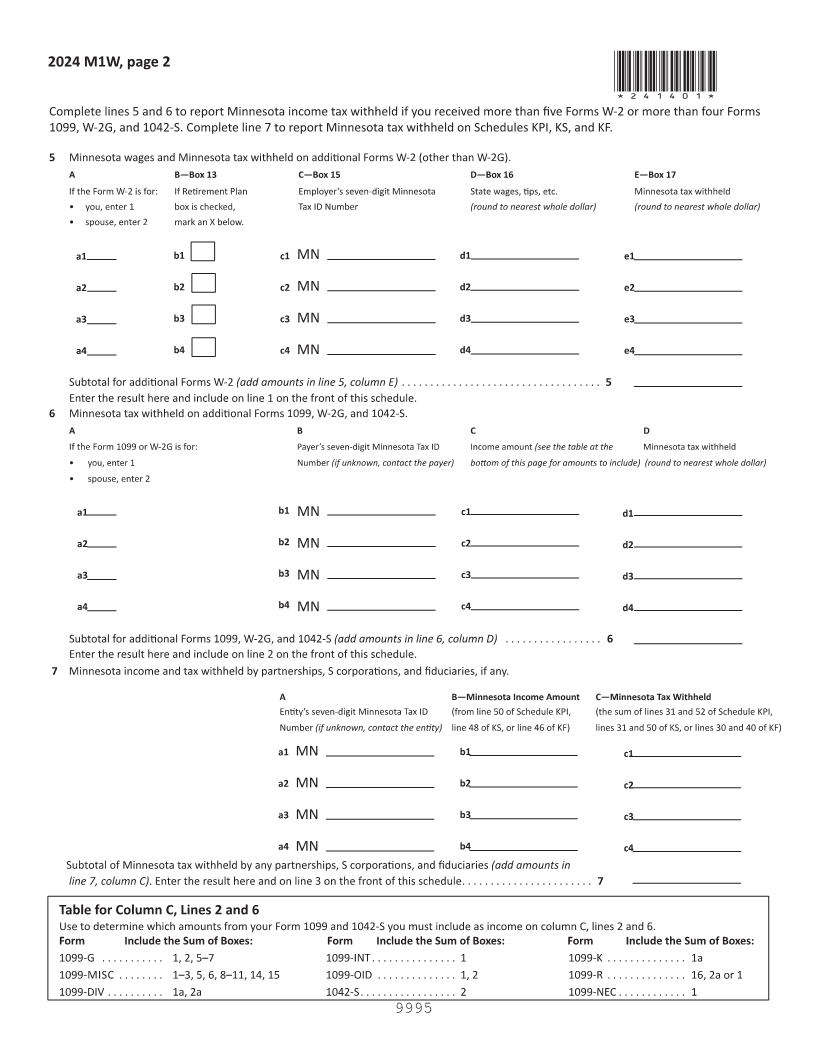

Enlarge image

NEAR FINAL DRAFT 8/1/24

*241311*

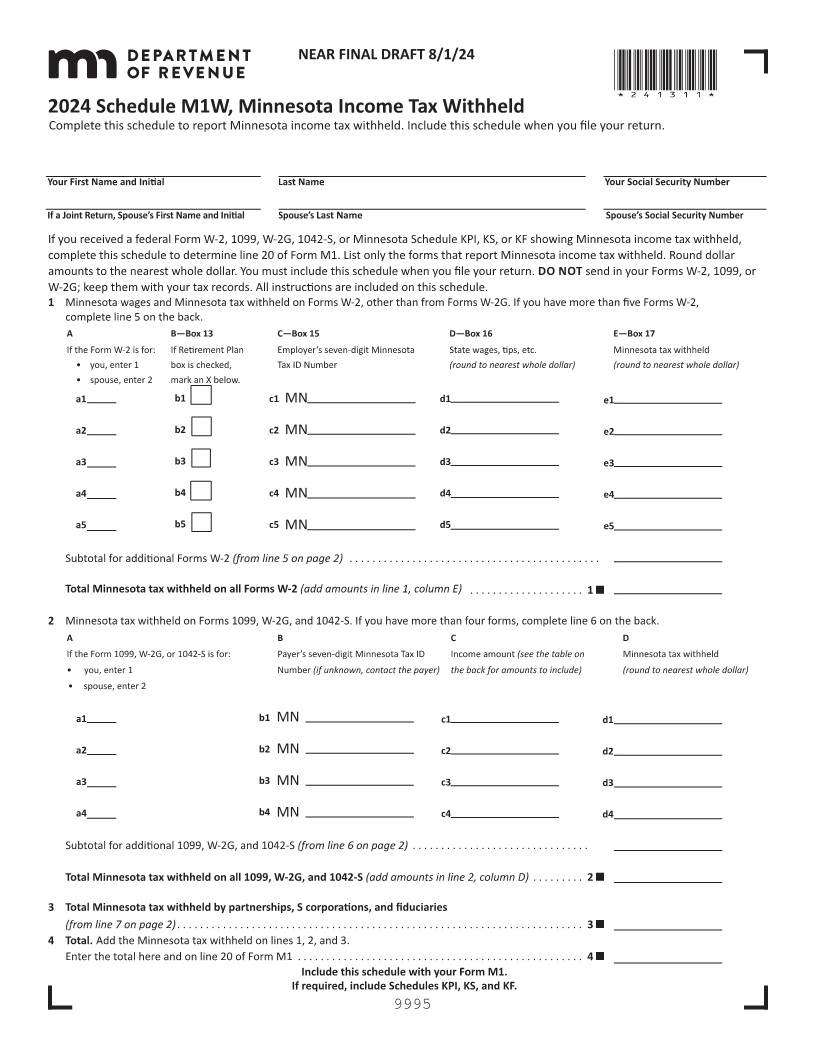

2024 Schedule M1W, Minnesota Income Tax Withheld

Complete this schedule to report Minnesota income tax withheld. Include this schedule when you file your return.

Your First Name and Initial Last Name Your Social Security Number

If a Joint Return, Spouse’s First Name and Initial Spouse’s Last Name Spouse’s Social Security Number

If you received a federal Form W-2, 1099, W-2G, 1042-S, or Minnesota Schedule KPI, KS, or KF showing Minnesota income tax withheld,

complete this schedule to determine line 20 of Form M1. List only the forms that report Minnesota income tax withheld. Round dollar

amounts to the nearest whole dollar. You must include this schedule when you file your return. DO NOT send in your Forms W-2, 1099, or

W-2G; keep them with your tax records. All instructions are included on this schedule.

1 Minnesota wages and Minnesota tax withheld on Forms W-2, other than from Forms W-2G. If you have more than five Forms W-2,

complete line 5 on the back.

A B—Box 13 C—Box 15 D—Box 16 E—Box 17

If the Form W-2 is for: If Retirement Plan Employer’s seven-digit Minnesota State wages, tips, etc. Minnesota tax withheld

• you, enter 1 box is checked, Tax ID Number (round to nearest whole dollar) (round to nearest whole dollar)

• spouse, enter 2 mark an X below.

a1 b1 c1 MN d1 e1

a2 b2 c2 MN d2 e2

a3 b3 c3 MN d3 e3

a4 b4 c4 MN d4 e4

a5 b5 c5 MN d5 e5

Subtotal for additional Forms W-2 (from line 5 on page 2) .... ...... ..... ...... ...... ..... ...... ..... .

Total Minnesota tax withheld on all Forms W-2 (add amounts in line 1, column E) .... ...... ...... .... 1

2 Minnesota tax withheld on Forms 1099, W-2G, and 1042-S. If you have more than four forms, complete line 6 on the back.

A B C D

If the Form 1099, W-2G, or 1042-S is for: Payer’s seven-digit Minnesota Tax ID Income amount (see the table on Minnesota tax withheld

• you, enter 1 Number (if unknown, contact the payer) the back for amounts to include) (round to nearest whole dollar)

• spouse, enter 2

a1 b1 MN c1 d1

a2 b2 MN c2 d2

a3 b3 MN c3 d3

a4 b4 MN c4 d4

Subtotal for additional 1099, W-2G, and 1042-S (from line 6 on page 2) ... ...... ..... ....... ..... .....

Total Minnesota tax withheld on all 1099, W-2G, and 1042-S (add amounts in line 2, column D) ... ...... 2

3 Total Minnesota tax withheld by partnerships, S corporations, and fiduciaries

(from line 7 on page 2) ... ...... ..... ....... ..... ...... ..... ..... ...... ...... ...... ..... ...... 3

4 Total. Add the Minnesota tax withheld on lines 1, 2, and 3.

Enter the total here and on line 20 of Form M1 ... ...... ..... ....... ..... ...... ..... ..... ...... .. 4

Include this schedule with your Form M1.

If required, include Schedules KPI, KS, and KF.

9995