Enlarge image

NEAR FINAL DRAFT 8/1/24

*242411*

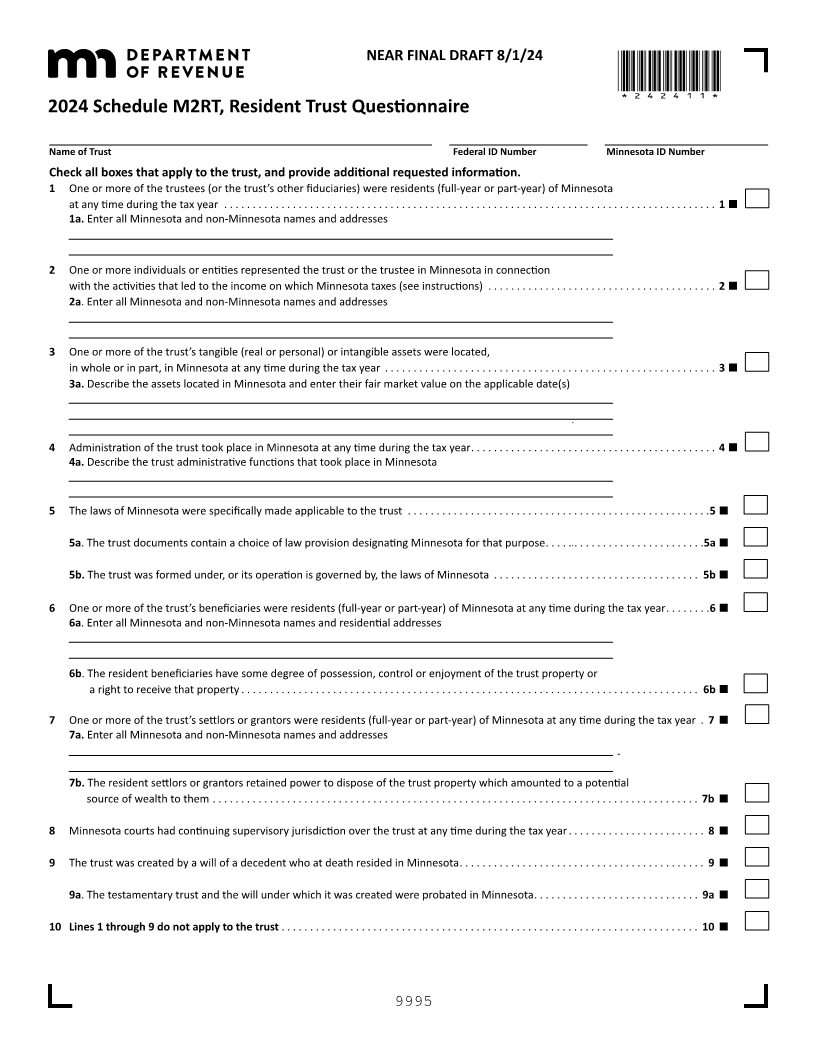

2024 Schedule M2RT, Resident Trust Questionnaire

Name of Trust Federal ID Number Minnesota ID Number

Check all boxes that apply to the trust, and provide additional requested information.

1 One or more of the trustees (or the trust’s other fiduciaries) were residents (full-year or part-year) of Minnesota

at any time during the tax year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

1a. Enter all Minnesota and non-Minnesota names and addresses

2 One or more individuals or entities represented the trust or the trustee in Minnesota in connection

with the activities that led to the income on which Minnesota taxes (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

2a. Enter all Minnesota and non-Minnesota names and addresses

3 One or more of the trust’s tangible (real or personal) or intangible assets were located,

in whole or in part, in Minnesota at any time during the tax year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

3a. Describe the assets located in Minnesota and enter their fair market value on the applicable date(s)

4 Administration of the trust took place in Minnesota at any time during the tax year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

4a. Describe the trust administrative functions that took place in Minnesota

5 The laws of Minnesota were specifically made applicable to the trust . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

5aThe. trust containdocuments a choice of law provision designating Minnesota for that purpose . . . . . . . . . . . . . . . . . . . . . . . . . . . .5a

5b.The wastrust under, formed or operationits governed is theby, laws Minnesotaof . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5b

6 One or more of the trust’s beneficiaries were residents (full-year or part-year) of Minnesota at any time during the tax year . . . . . . . . 6

6a. Enter all Minnesota and non-Minnesota names and residential addresses

6b. The resident beneficiaries have some degree of possession, control or enjoyment of the trust property or

a right to receive that property . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6b

7 One or more of the trust’s settlors or grantors were residents (full-year or part-year) of Minnesota at any time during the tax year . 7

7a. Enter all Minnesota and non-Minnesota names and addresses

7b. The resident settlors or grantors retained power to dispose of the trust property which amounted to a potential

source of wealth to them . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7b

8 Minnesota courts had continuing supervisory jurisdiction over the trust at any time during the tax year . . . . . . . . . . . . . . . . . . . . . . . . 8

9 The trust was created by a will of a decedent who at death resided in Minnesota . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

9a. The testamentary trust and the will under which it was created were probated in Minnesota . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9a

10 Lines 1 through 9 do not apply to the trust . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

9995