Enlarge image

*244611*

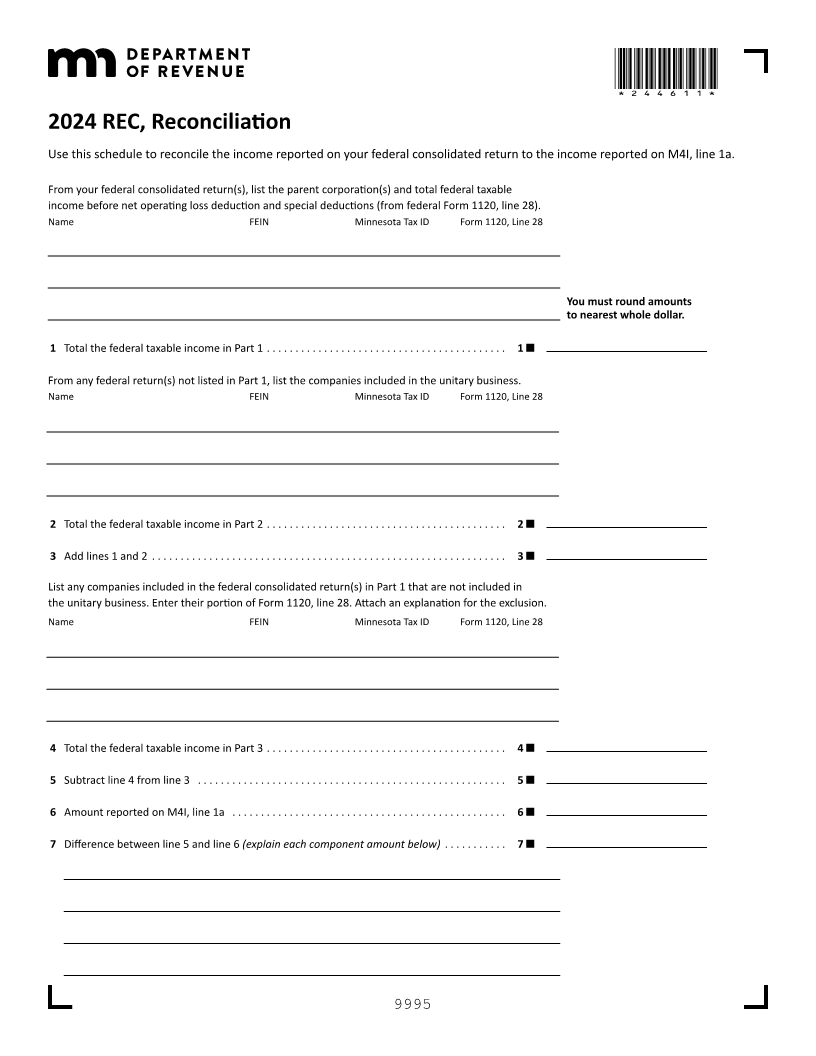

2024 REC, Reconciliation

Use this schedule to reconcile the income reported on your federal consolidated return to the income reported on M4I, line 1a.

From your federal consolidated return(s), list the parent corporation(s) and total federal taxable

income before net operating loss deduction and special deductions (from federal Form 1120, line 28).

Name FEIN Minnesota Tax ID Form 1120, Line 28

You must round amounts

to nearest whole dollar.

1 Total the federal taxable income in Part 1 ... ...... ..... ....... ..... ...... ..... ..... 1

From any federal return(s) not listed in Part 1, list the companies included in the unitary business.

Name FEIN Minnesota Tax ID Form 1120, Line 28

2 Total the federal taxable income in Part 2 ... ...... ..... ....... ..... ...... ..... ..... 2

3 Add lines and 1 2 ... ...... ..... ....... ..... ...... ..... ..... ...... ...... ...... .. 3

List any companies included in the federal consolidated return(s) in Part that 1 are not included in

the unitary business. Enter their portion of Form 1120, line 28. Attach an explanation for the exclusion.

Name FEIN Minnesota Tax ID Form 1120, Line 28

4 Total the federal taxable income in Part 3 ... ...... ..... ....... ..... ...... ..... ..... 4

5 Subtract line from 4 line 3 .... ...... ...... ..... ....... ..... ..... ...... ..... ..... 5

6 Amount reported on M4I, line 1a ...... ..... ...... ...... ..... ...... ..... ...... ... 6

7 Difference between line and 5 line 6 (explain each component amount below) ... ...... .. 7

9995