Enlarge image

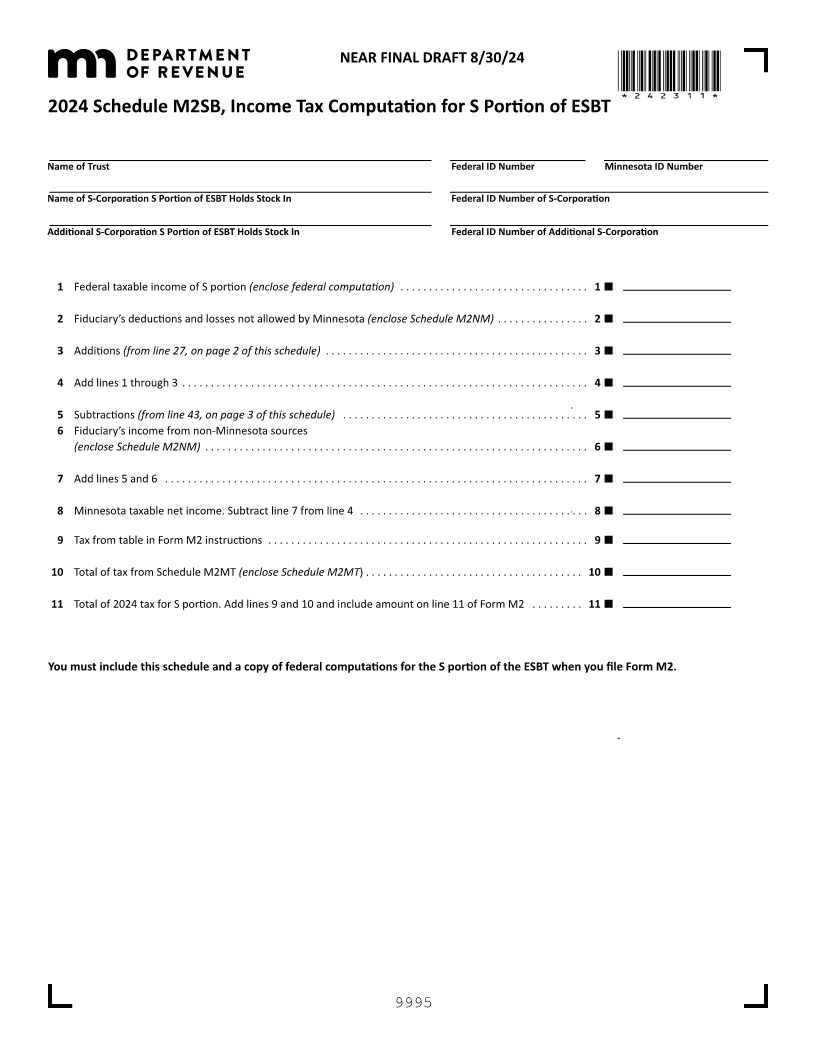

NEAR FINAL DRAFT 8/30/24

*242311*

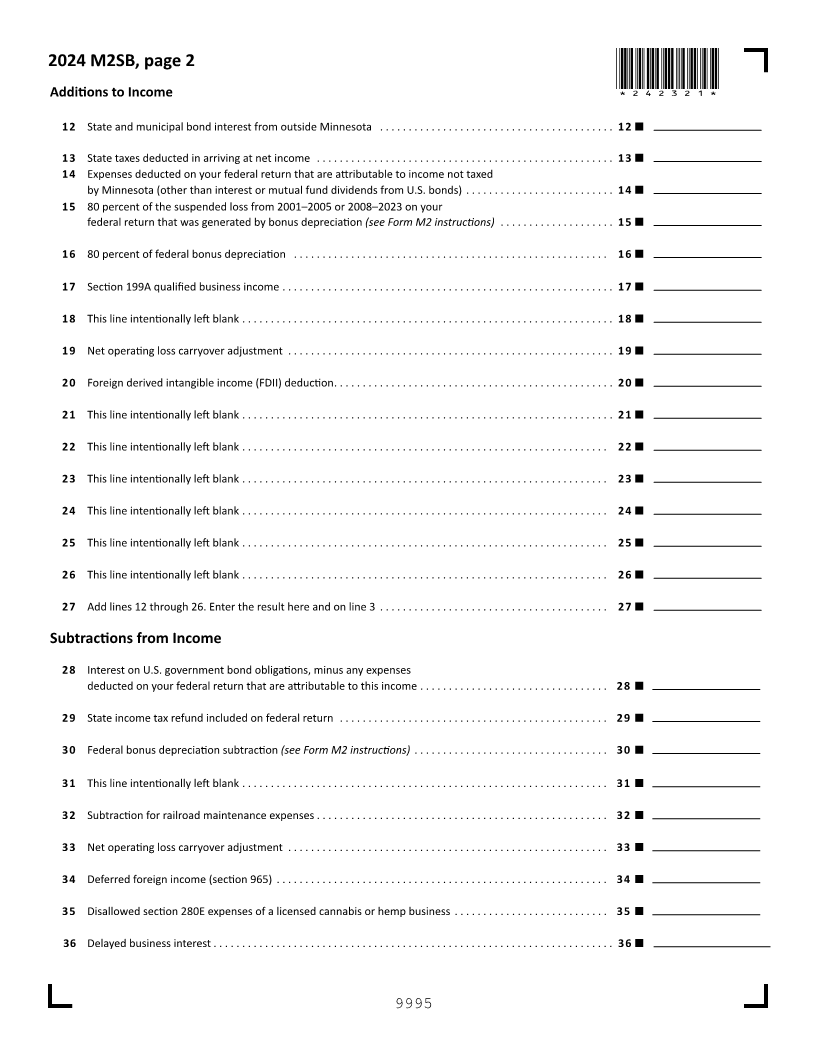

2024 Schedule M2SB, Income Tax Computation for S Portion of ESBT

Name of Trust Federal ID Number Minnesota ID Number

Name of S-Corporation S Portion of ESBT Holds Stock In Federal ID Number of S-Corporation

Additional S-Corporation S Portion of ESBT Holds Stock In Federal ID Number of Additional S-Corporation

1 Federal taxable income of S portion (enclose federal computation) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Fiduciary’s deductions and losses not allowed by Minnesota (enclose Schedule M2NM) . . . . . . . . . . . . . . . . 2

3 Additions (from line 27, on page 2 of this schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Add lines 1 through 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .4. . . .

5 Subtractions (from line 43, on page 3 of this schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Fiduciary’s income from non-Minnesota sources

Schedule M2NM) (enclose . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .6. . . .

7 Add lines 5 and 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7. . . .

8 Minnesota taxable net income. Subtract line 7 from line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Tax tablefrom M2 in instructions Form . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9. . . .

10 Total of tax from Schedule M2MT (enclose Schedule M2MT) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Total of 2024 tax for S portion. Add lines 9 and 10 and include amount on line 11 of Form M2 . . . . . . . . . 11

You must include this schedule and a copy of federal computations for the S portion of the ESBT when you file Form M2.

9995