Enlarge image

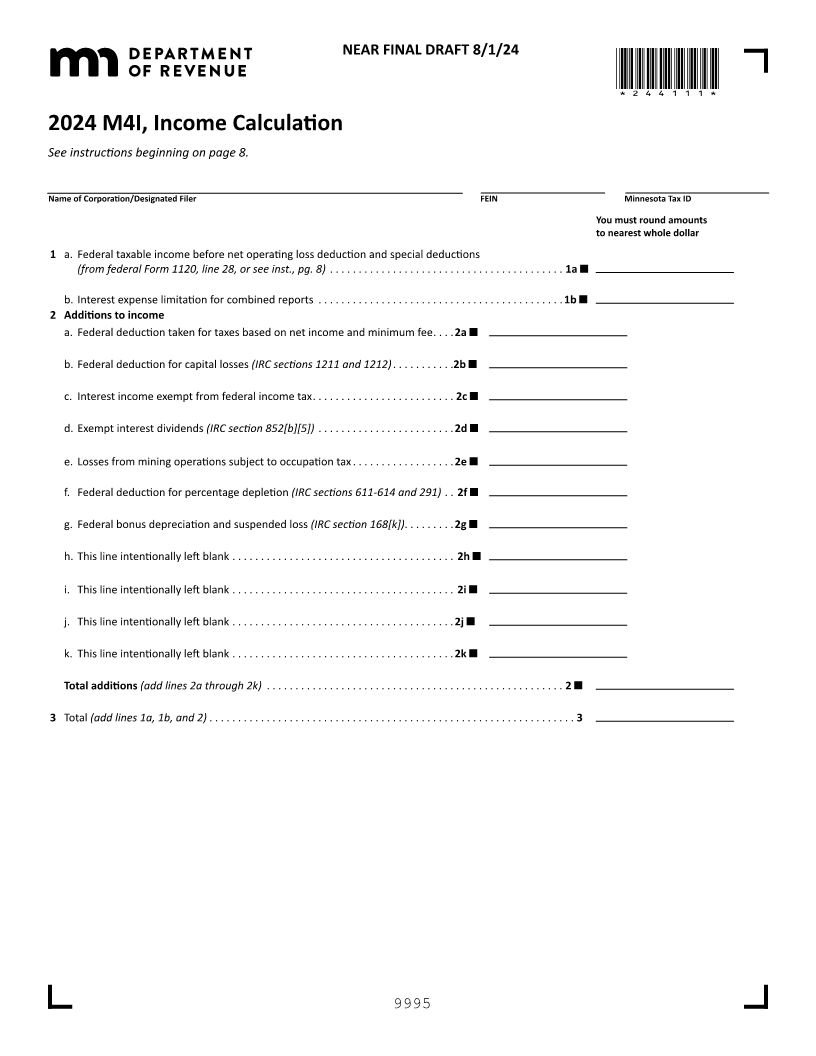

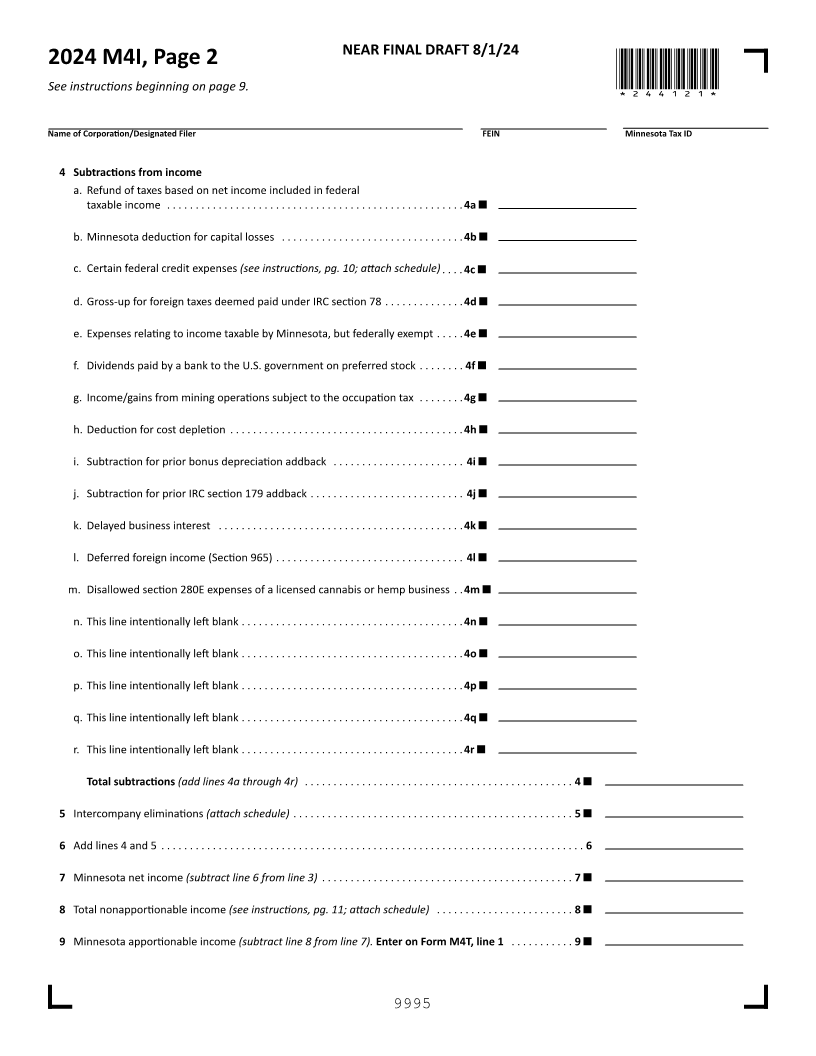

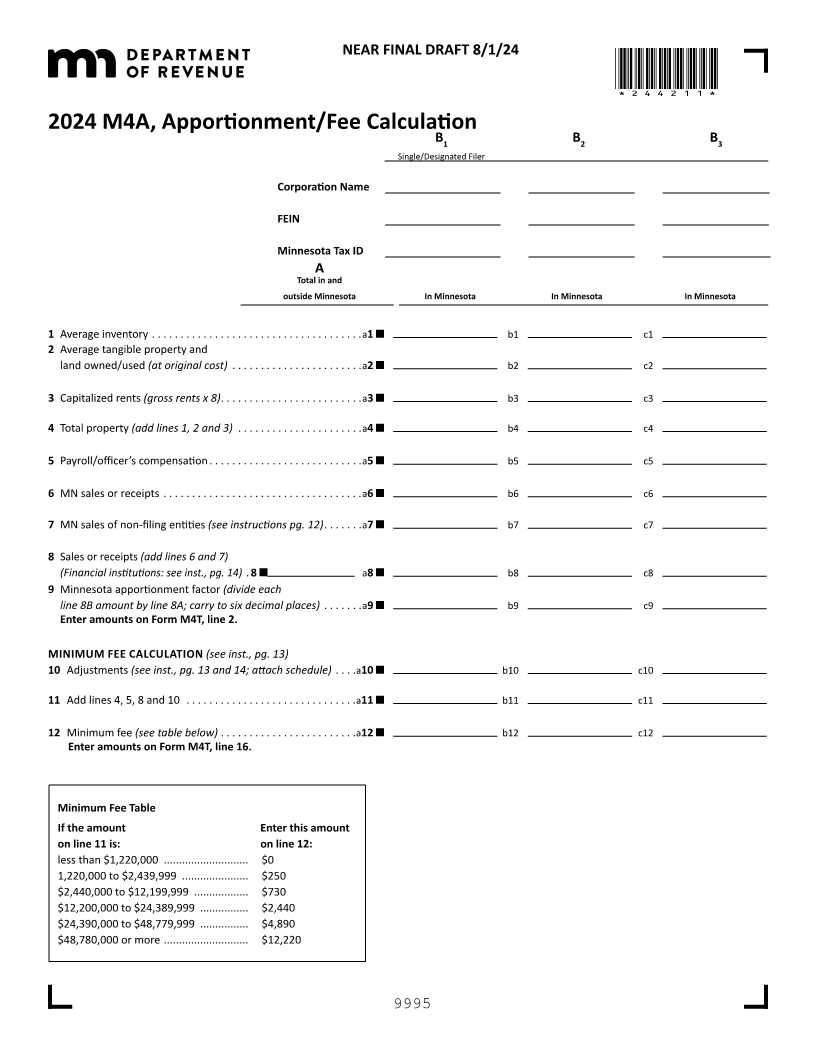

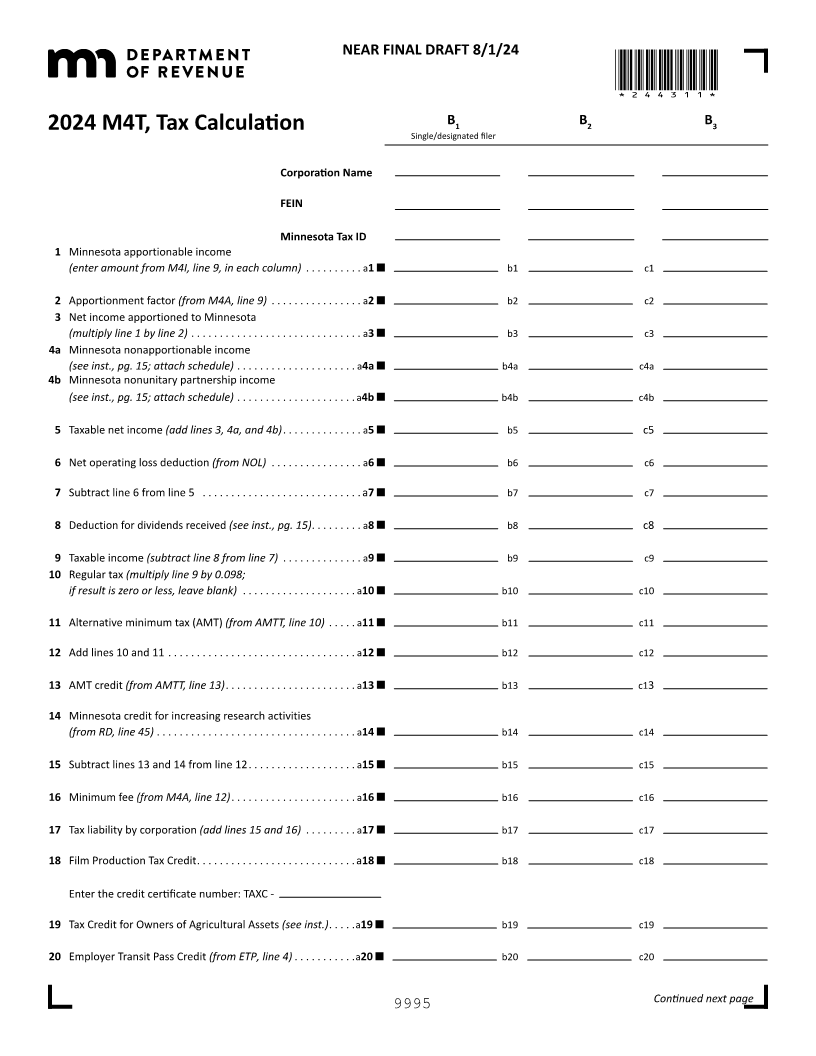

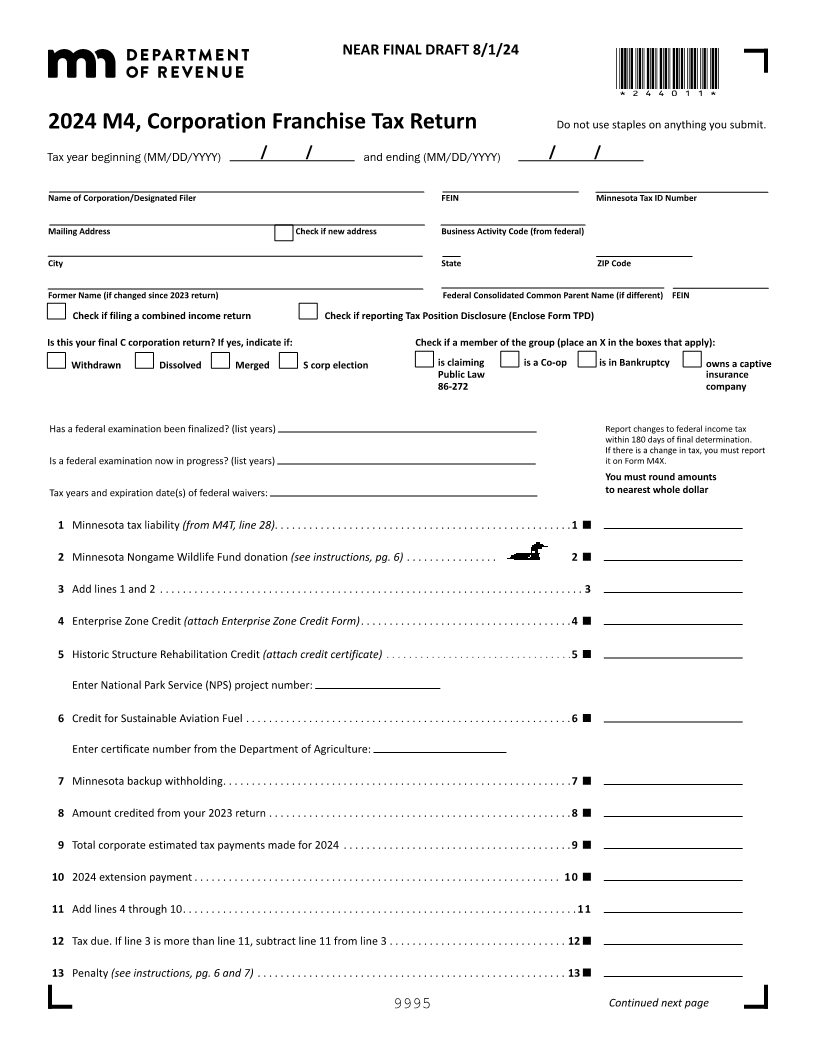

NEAR FINAL DRAFT 8/1/24

*244011*

2024 M4, Corporation Franchise Tax Return Do not use staples on anything you submit.

Tax year beginning (MM/DD/YYYY) / / and ending (MM/DD/YYYY) / /

Name of Corporation/Designated Filer FEIN Minnesota Tax ID Number

Mailing Address Check if new address Business Activity Code (from federal)

City State ZIP Code

Former Name (if changed since 2023 return) Federal Consolidated Common Parent Name (if different) FEIN

Check if filing a combined income return Check if reporting Tax Position Disclosure (Enclose Form TPD)

Is this your final C corporation return? If yes, indicate if: Check if a member of the group (place an X in the boxes that apply):

Withdrawn Dissolved Merged S corp election is claiming is a Co-op is in Bankruptcy owns a captive

Public Law insurance

86-272 company

Has a federal examination been finalized? (list years) Report changes to federal income tax

within 180 days of final determination .

If there is a change in tax, you must report

Is a federal examination now in progress? (list years) it on Form M4X .

You must round amounts

Tax years and expiration date(s) of federal waivers: to nearest whole dollar

1 Minnesota tax liability (from M4T, line 28) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Minnesota Nongame Wildlife Fund donation (see instructions, pg. 6) . . . . . . . . . . . . . . . . 2

3 Add lines 1 and 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .3. . . . .

4 Enterprise Zone Credit (attach Enterprise Zone Credit Form) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .4

5 Historic Structure Rehabilitation Credit (attach credit certificate) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .5

Enter National Park Service (NPS) project number:

6 Credit for Sustainable Aviation Fuel . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

Enter certificate number from the Department of Agriculture:

7 Minnesota backup withholding . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Amount credited from your 2023 return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Total corporate estimated tax payments made for 2024 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10 2024 extension payment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Add lines 4 through 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Tax due . If line 3 is more than line 11, subtract line 11 from line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Penalty (see instructions, pg. 6 and 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

9995 Continued next page