Enlarge image

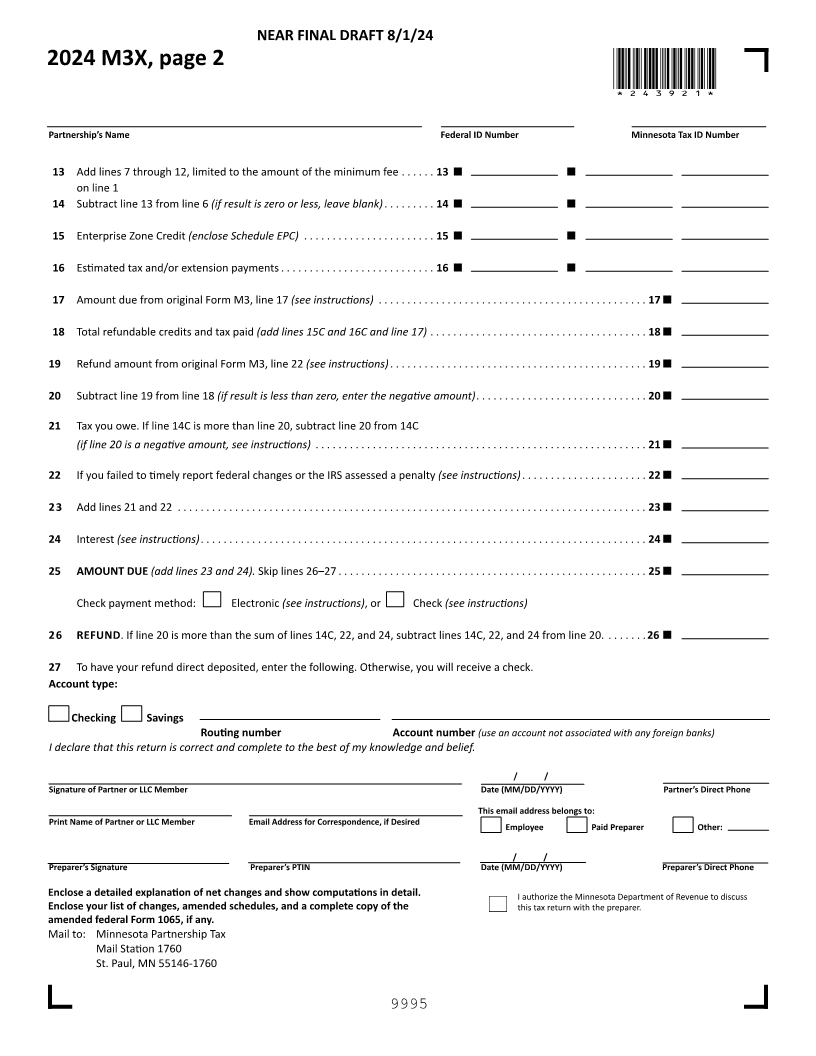

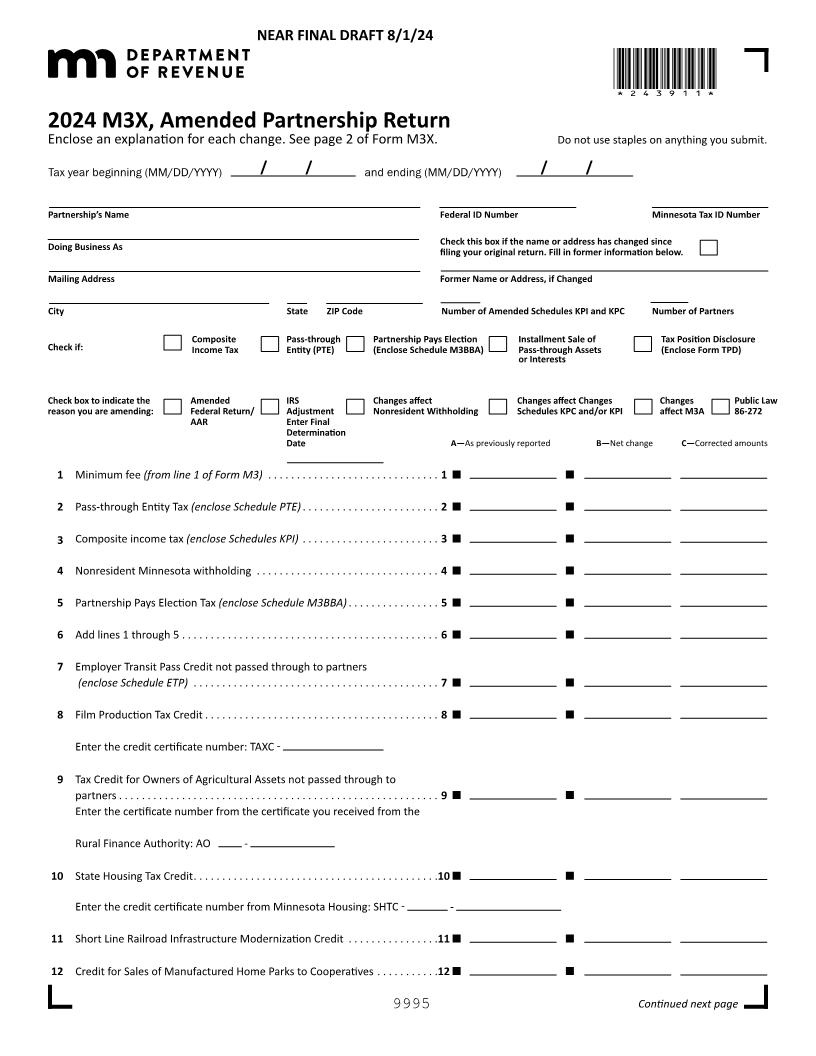

NEAR FINAL DRAFT 8/1/24

*243911*

2024 M3X, Amended Partnership Return

Enclose an explanation for each change. See page 2 of Form M3X. Do not use staples on anything you submit.

Tax year beginning (MM/DD/YYYY) / / and ending (MM/DD/YYYY) / /

Partnership’s Name Federal ID Number Minnesota Tax ID Number

Check this box if the name or address has changed since

Doing Business As filing your original return. Fill in former information below.

Mailing Address Former Name or Address, if Changed

City State ZIP Code Number of Amended Schedules KPI and KPC Number of Partners

Composite Pass-through Partnership Pays Election Installment Sale of Tax Position Disclosure

Check if: Income Tax Entity (PTE) (Enclose Schedule M3BBA) Pass-through Assets (Enclose Form TPD)

or Interests

Check box to indicate the Amended IRS Changes affect Changes affect Changes Changes Public Law

reason you are amending: Federal Return/ Adjustment Nonresident Withholding Schedules KPC and/or KPI affect M3A 86-272

AAR Enter Final

Determination

Date A—As previously reported B—Net change C—Corrected amounts

1 Minimum fee (from line 1 of Form M3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Pass-through Entity Tax (enclose Schedule PTE) . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Composite income tax (enclose Schedules KPI) . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Nonresident Minnesota withholding . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Partnership Pays Election Tax (enclose Schedule M3BBA) . . . . . . . . . . . . . . . . 5

6 Add lines 1 through 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Employer Transit Pass Credit not passed through to partners

(enclose Schedule ETP) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Film Production Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

Enter the credit certificate number: TAXC -

9 Tax Credit for Owners of Agricultural Assets not passed through to

partners . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

Enter the certificate number from the certificate you received from the

Rural Finance Authority: AO -

10 State Housing Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .10

Enter the credit certificate number from Minnesota Housing: SHTC - -

11 Short Line Railroad Infrastructure Modernization Credit . . . . . . . . . . . . . . . .11

12 Credit for Sales of Manufactured Home Parks to Cooperatives . . . . . . . . . . .12

9995 Continued next page