Enlarge image

FINAL DRAFT — 8/19/24

2024 Estate Tax Form M706 Instructions

For estates of decedents whose dates of death are in calendar year 2024

Estate Tax Exclusion and Filing Requirement

Questions? For 2024 decedents, the exclusion amount and tax filing threshold is $3,000,000. The exclusion

You can find forms and information,

amount is subtracted on Form M706, Line 6a.

including answers to frequently asked

questions and options for paying For 2024 decedents, the maximum qualified small business property and farm property deduction

electronically, on our website at: amount is $2,000,000. The combined exclusion amount, and deduction for qualified small business

www.revenue.state.mn.us property and farm property remains $5,000,000.

Send us an email at: Filing Requirements

BusinessIncome.tax@state.mn.us If the decedent was a resident of Minnesota at the time of death, the estate is required to file Form

Call us at: M706 if the federal gross estate plus federal adjusted taxable gifts made within three years of the

decedent’s death exceeds $3,000,000 on the date of death or if the estate is required to file a federal

651-556-3075

estate tax return.

Weekdays, 8:00 a.m. to 4:30 p.m.

If the decedent was a nonresident of Minnesota, the estate is required to file Form M706 if property

Or write to: with situs in Minnesota is included in the federal gross estate and the federal gross estate plus federal

Minnesota Department of Revenue adjusted taxable gifts made within three years of the decedent’s death exceeds $3,000,000 on the date

Mail Station 1315 of death or if the estate is required to file a federal estate tax return.

600 N. Robert St. The federal gross estate is determined by completing the federal Form 706 (see page 5). The federal

St. Paul, MN 55146-1315 adjusted taxable gifts are defined in section 2001(b) of the Internal Revenue Code. (M.S. 289A.10,

subd. 1)

Forms You May Need Who Must File?

M706 Estate Tax Return If the decedent’s estate is being probated, the Probate Court or Probate Registrar will appoint some-

M706Q Election to Claim the Quali- one as personal representative — also called executor or administrator — of the decedent’s estate.

fied Small Business and Farm That person is then responsible for filing Form M706 for the estate.

Property Deduction In some cases, the Probate Court or Probate Registrar will appoint more than one person as executor.

In such cases, all persons appointed as executors are jointly responsible for filing the return.

Need Forms? If the estate is not being probated, all persons who will receive assets included in the decedent’s fed-

Go to www.revenue.state.mn.us to eral gross estate (line 1 of federal Form 706) are responsible for filing the Minnesota return. If more

download forms and other information,

than one person will receive the assets, all persons receiving the assets should choose a mutually

including a Revenue Notice regarding

agreeable person among them to file the estate tax returns. If one person cannot be agreed on, each

the alternative value, special use valua-

person must file a Minnesota return for the decedent’s estate. Each person must include on the return

tion and administrative deductions.

This information is available in alternate not only the assets he or she is receiving, but also all of the decedent’s assets being received by other

formats. persons and the names of the other persons. (M.S. 289A.10 and M.S. 291.12)

Who Must Pay?

Contents The executor is responsible for paying the Minnesota estate tax.

General Information ..... ...... 1–4

However, if the assets were distributed without reserving enough to pay the various taxes, the ex-

Filing and Paying Requirements . 1–2 ecutor and beneficiaries are personally responsible for payment to the extent of the value of assets

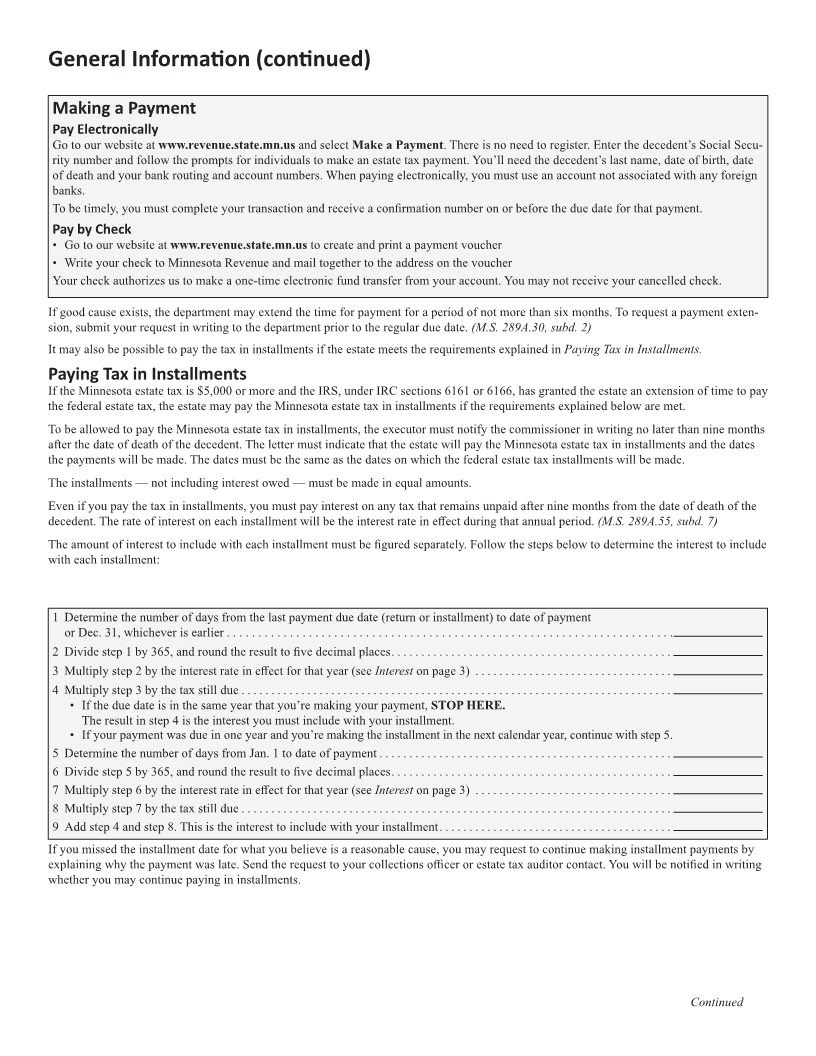

Making a Payment ... ...... ..... 2 received respectively. (M.S. 270C.585 and M.S. 291.12)

Line Instructions ... ...... ..... . 5–7

Deadline for Filing

Tax Table ... ...... ..... ....... .. 6 The regular due date for filing Form M706 is nine months after the date of death. (M.S. 289A.18,

Checklist .... ...... ...... ..... .. 7 subd. 3)

Mailing Label ... ...... ..... ..... 7 Filing extensions. The automatic extended due date for filing Form M706 is 6 months after the regu-

lar due date or the amount of time granted by the Internal Revenue Service (IRS) to file the federal

estate tax return, whichever is longer. (M.S. 289A.19, subd. 4)

Any tax not paid by the regular due date is subject to penalties and interest (see Penalties on page 3).

Deadline for Paying

The Minnesota estate tax must be paid no later than nine months after the date of death of the dece-

dent. (M.S. 289A.20, subd. 3)

Continued