Enlarge image

1 1

2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 32 34 36 38 40 42 44 46 48 50 52 54 56 58 60 62 64 66 68 70 72 74 76 78 80 82 84 86

3 3

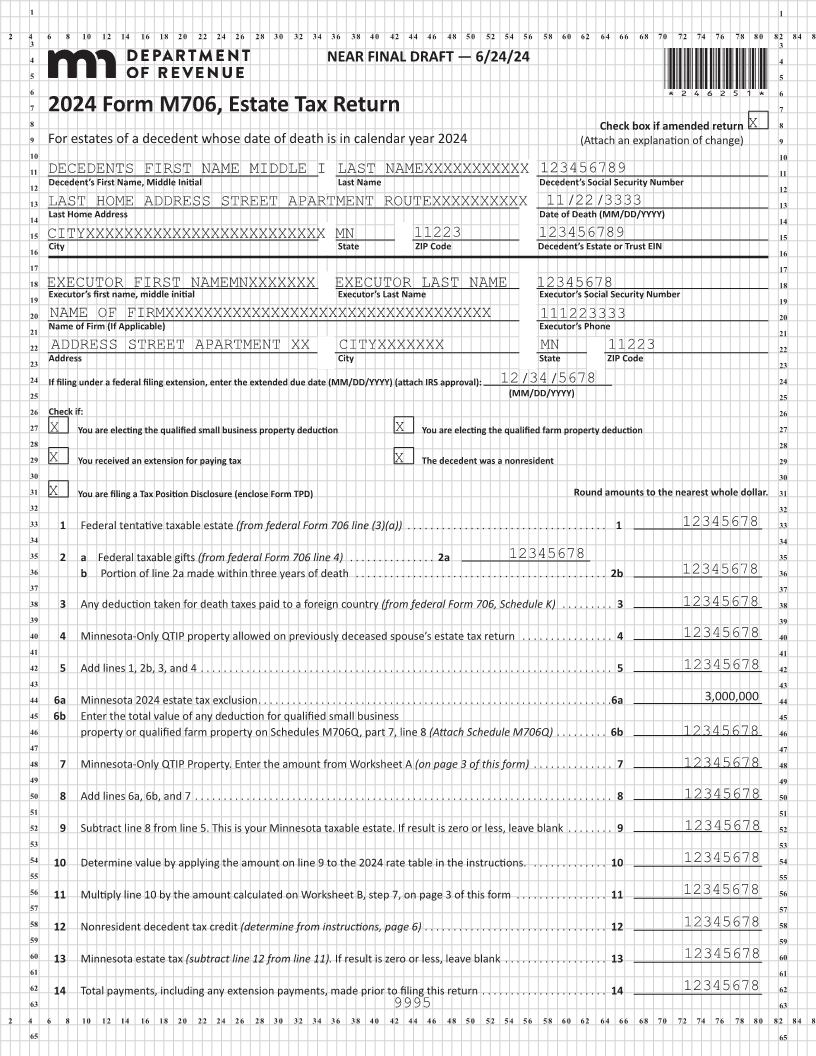

4 NEAR FINAL DRAFT — 6/24/24 4

5 5

6 *246251*6

7 2024 Form M706, Estate Tax Return 7

8 Check box if amended return X 8

9 For estates of a decedent whose date of death is in calendar year 2024 (Attach an explanation of change) 9

10 10

11 DECEDENTS FIRST NAME MIDDLE I LAST NAMEXXXXXXXXXXX 123456789 11

12 Decedent’s First Name, Middle Initial Last Name Decedent’s Social Security Number 12

13 11/ / 22 3333 13

LAST HOME ADDRESS STREET APARTMENT ROUTEXXXXXXXXXX

14 Last Home Address Date of Death (MM/DD/YYYY) 14

15 CITYXXXXXXXXXXXXXXXXXXXXXXXXX MN 11223 123456789 15

16 City State ZIP Code Decedent’s Estate or Trust EIN 16

17 17

18 EXECUTOR FIRST NAMEMNXXXXXXX EXECUTOR LAST NAME 12345678 18

19 Executor’s first name, middle initial Executor’s Last Name Executor’s Social Security Number 19

20 NAME OF FIRMXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 111223333 20

21 Name of Firm (If Applicable) Executor’s Phone 21

22 ADDRESS STREET APARTMENT XX CITYXXXXXXX MN 11223 22

23 Address City State ZIP Code 23

24 If filing under a federal filing extension, enter the extended due date (MM/DD/YYYY) (attach IRS approval): 12/ / 34 5678 24

25 (MM/DD/YYYY) 25

26 Check if: 26

27 X You are electing the qualified small business property deduction X You are electing the qualified farm property deduction 27

28 28

29 X You received an extension for paying tax X The decedent was a nonresident 29

30 30

31 X You are filing a Tax Position Disclosure (enclose Form TPD) Round amounts to the nearest whole dollar. 31

32 32

33 1 Federal tentative taxable estate (from federal Form 706 line (3)(a)) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 12345678 33

34 34

35 2 a Federal taxable gifts (from federal Form 706 line 4) . . . . . . . . . . . . . . . 2a 12345678 35

36 b Portion of line 2a made within three years of death . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2b 12345678 36

37 37

38 3 Any deduction taken for death taxes paid to a foreign country (from federal Form 706, Schedule K) . . . . . . . . . 3 12345678 38

39 39

40 4 Minnesota-Only QTIP property allowed on previously deceased spouse’s estate tax return . . . . . . . . . . . . . . . . 4 12345678 40

41 41

42 5 Add lines 1, 2b, 3, and 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 12345678 42

43 43

44 6a Minnesota 2024 estate tax exclusion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .6a 3,000,000 44

45 6b Enter the total value of any deduction for qualified small business 45

46 property or qualified farm property on Schedules M706Q, part 7, line 8 (Attach Schedule M706Q) . . . . . . . . . 6b 12345678 46

47 47

48 7 Minnesota-Only QTIP Property. Enter the amount from Worksheet A (on page 3 of this form) . . . . . . . . . . . . . . 7 12345678 48

49 49

50 8 Add lines 6a, 6b, and 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8 12345678 50

51 51

52 9 Subtract line 8 from line 5. This is your Minnesota taxable estate. If result is zero or less, leave blank . . . . . . . . 9 12345678 52

53 53

54 10 Determine value by applying the amount on line 9 to the 2024 rate table in the instructions. . . . . . . . . . . . . . 10 12345678 54

55 55

56 11 Multiply line 10 by the amount calculated on Worksheet B, step 7, on page 3 of this form . . . . . . . . . . . . . . . . 11 12345678 56

57 57

58 12 Nonresident decedent tax credit (determine from instructions, page 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12 12345678 58

59 59

60 13 Minnesota estate tax (subtract line 12 from line 11). If result is zero or less, leave blank . . . . . . . . . . . . . . . . . . 13 12345678 60

61 61

62 14 Total payments, including any extension payments, made prior to filing this return . . . . . . . . . . . . . . . . . . . . . . 14 12345678 62

63 9995 63

2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 32 34 36 38 40 42 44 46 48 50 52 54 56 58 60 62 64 66 68 70 72 74 76 78 80 82 84 86

65 65