Enlarge image

1 1

2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 32 34 36 38 40 42 44 46 48 50 52 54 56 58 60 62 64 66 68 70 72 74 76 78 80 82 84 86

3 3

4 NEAR FINAL DRAFT — 6/24/24 4

5 5

6 6

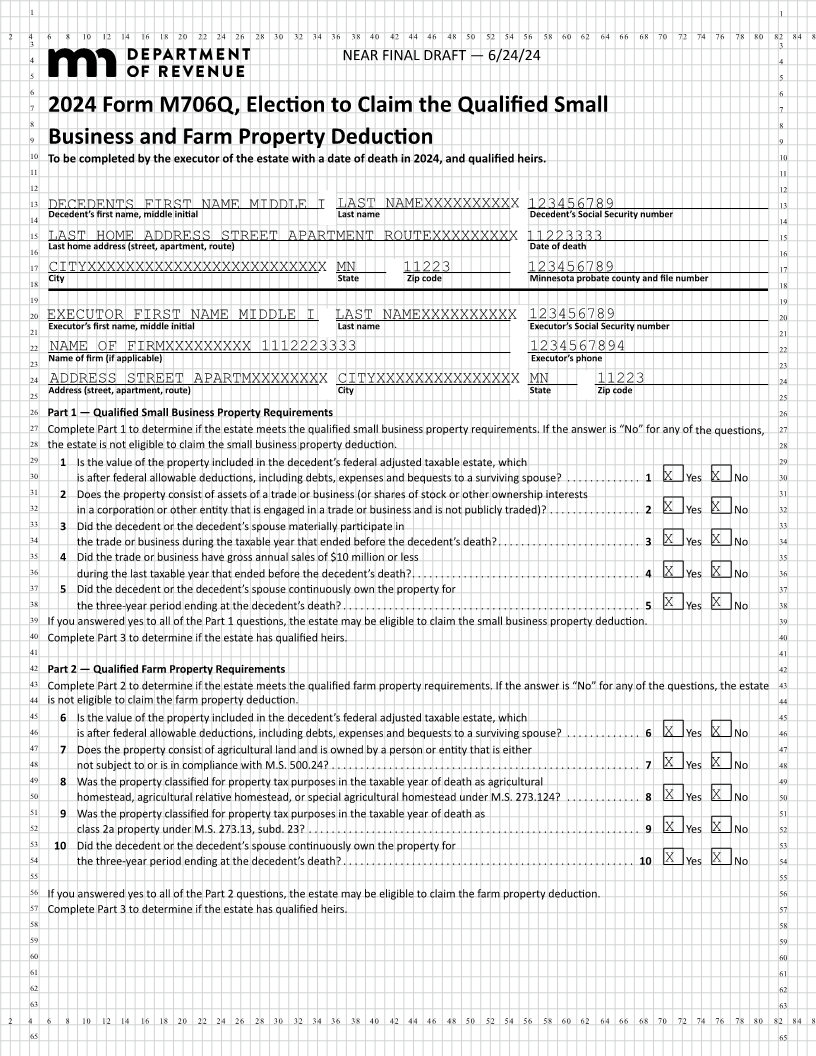

7 2024 Form M706Q, Election to Claim the Qualified Small 7

8 8

9 Business and Farm Property Deduction 9

10 To be completed by the executor of the estate with a date of death in 2024, and qualified heirs. 10

11 11

12 12

14 Decedent’s first name, middle initial Last name 123456789Decedent’s Social Security number 14

13 DECEDENTS FIRST NAME MIDDLE I LAST NAMEXXXXXXXXXX 13

15 15

16 LASTLast home address (street, apartment,HOMEroute) ADDRESS STREET APARTMENT ROUTEXXXXXXXXX 11223333Date of death 16

17 CITYXXXXXXXXXXXXXXXXXXXXXXXXX MN 11223 123456789 17

18 City State Zip code Minnesota probate county and file number 18

19 19

20 EXECUTOR FIRST NAME MIDDLE I LAST NAMEXXXXXXXXXX 123456789 20

21 Executor’s first name, middle initial Last name Executor’s Social Security number 21

22 NAME OF FIRMXXXXXXXXX 1112223333 1234567894 22

23 Name of firm (if applicable) Executor’s phone 23

24 ADDRESS STREET APARTMXXXXXXXX CITYXXXXXXXXXXXXXXX MN 11223 24

25 Address (street, apartment, route) City State Zip code 25

26 Part 1 — Qualified Small Business Property Requirements 26

27 Complete Part 1 to determine if the estate meets the qualified small business property requirements. If the answer is “No” for any of the questions, 27

28 the estate is not eligible to claim the small business property deduction. 28

29 1 Is the value of the property included in the decedent’s federal adjusted taxable estate, which 29

30 is after federal allowable deductions, including debts, expenses and bequests to a surviving spouse? . ...... ..... . 1 X Yes X No 30

31 2 Does the property consist of assets of a trade or business (or shares of stock or other ownership interests 31

32 in a corporation or other entity that is engaged in a trade or business and is not publicly traded)? ... ..... ...... .. 2 X Yes X No 32

33 3 Did the decedent or the decedent’s spouse materially participate in 33

34 the trade or business during the taxable year that ended before the decedent’s death?... ...... ..... ....... .... 3 X Yes X No 34

35 4 Did the trade or business have gross annual sales of $10 million or less 35

36 during the last taxable year that ended before the decedent’s death?... ...... ..... ....... ..... ...... ..... ... 4 X Yes X No 36

37 5 Did the decedent or the decedent’s spouse continuously own the property for 37

38 the three-year period ending at the decedent’s death? ... ...... ..... ....... ..... ...... ..... ..... ...... .... 5 X Yes X No 38

39 If you answered yes to all of the Part 1 questions, the estate may be eligible to claim the small business property deduction. 39

40 Complete Part 3 to determine if the estate has qualified heirs. 40

41 41

42 Part 2 — Qualified Farm Property Requirements 42

43 Complete Part 2 to determine if the estate meets the qualified farm property requirements. If the answer is “No” for any of the questions, the estate 43

44 is not eligible to claim the farm property deduction. 44

45 6 Is the value of the property included in the decedent’s federal adjusted taxable estate, which 45

46 is after federal allowable deductions, including debts, expenses and bequests to a surviving spouse? . ...... ..... . 6 X Yes X No 46

47 7 Does the property consist of agricultural land and is owned by a person or entity that is either 47

48 not subject to or is in compliance with M.S. 500.24? .... ...... ...... ..... ..... ...... ...... ...... ...... .... 7 X Yes X No 48

49 8 Was the property classified for property tax purposes in the taxable year of death as agricultural 49

50 homestead, agricultural relative homestead, or special agricultural homestead under M.S. 273.124? ..... ...... .. 8 X Yes X No 50

51 9 Was the property classified for property tax purposes in the taxable year of death as 51

52 class 2a property under M.S. 273.13, subd. 23? ...... ..... ...... ..... ....... ..... ..... ...... ..... ...... .. 9 X Yes X No 52

53 10 Did the decedent or the decedent’s spouse continuously own the property for 53

54 the three-year period ending at the decedent’s death? ... ...... ..... ....... ..... ...... ..... ..... ...... ... 10 X Yes X No 54

55 55

56 If you answered yes to all of the Part 2 questions, the estate may be eligible to claim the farm property deduction. 56

57 Complete Part 3 to determine if the estate has qualified heirs. 57

58 58

59 59

60 60

61 61

62 62

63 63

2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 32 34 36 38 40 42 44 46 48 50 52 54 56 58 60 62 64 66 68 70 72 74 76 78 80 82 84 86

65 65