Enlarge image

1 1

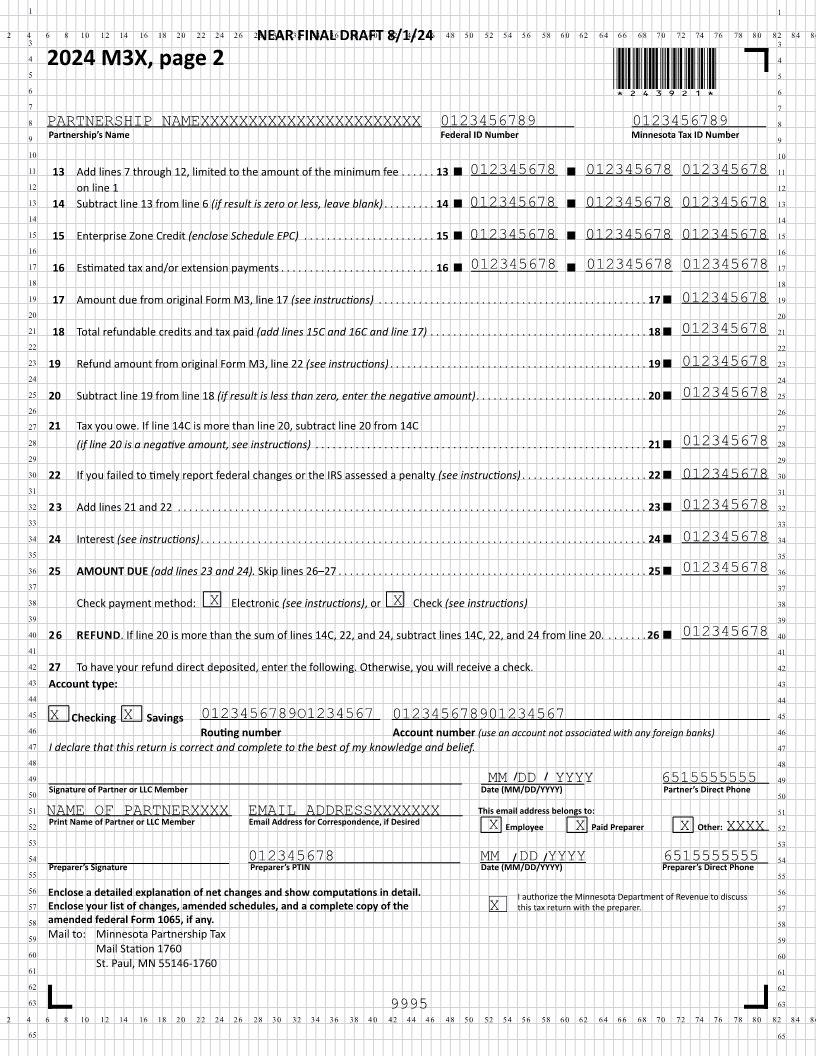

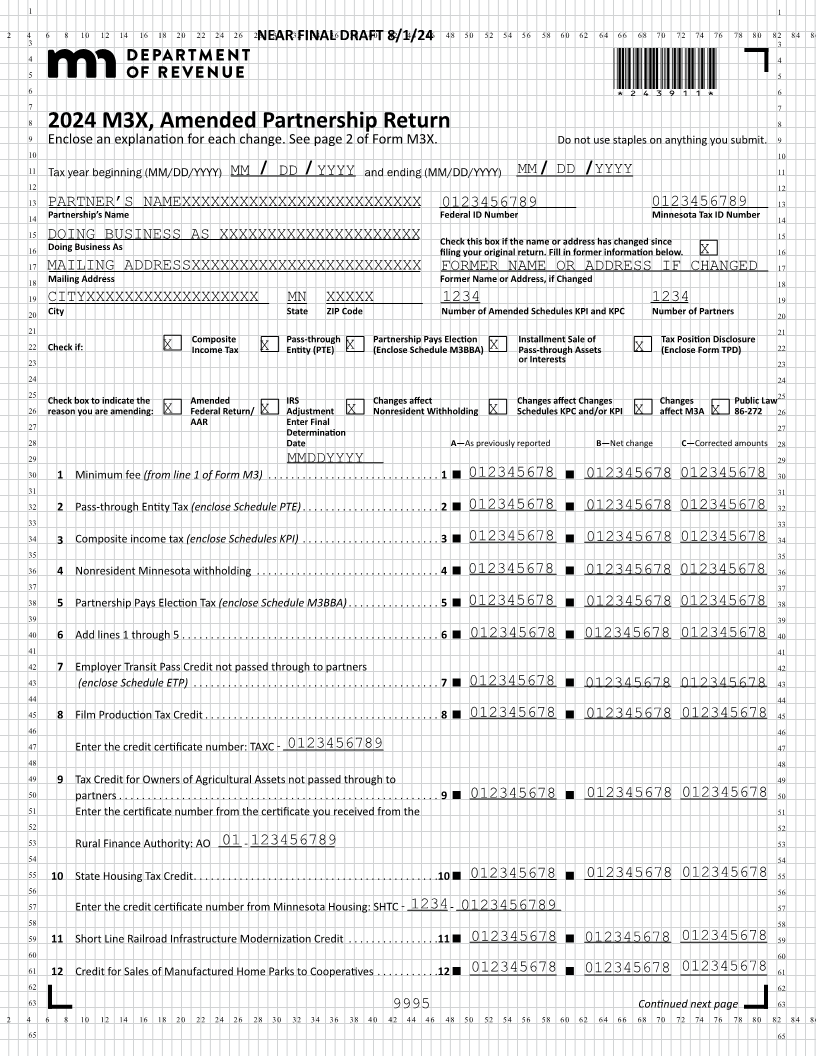

2 4 6 8 10 12 14 16 18 20 22 24 26 28 NEAR30 FINAL32 DRAFT 8/1/2434 36 38 40 42 44 46 48 50 52 54 56 58 60 62 64 66 68 70 72 74 76 78 80 82 84 86

3 3

4 4

5 5

6 *243911*6

7 7

8 8

2024 M3X, Amended Partnership Return

9 Enclose an explanation for each change. See page 2 of Form M3X. Do not use staples on anything you submit. 9

10 10

11 Tax year beginning (MM/DD/YYYY) MM / / DD YYYY and ending (MM/DD/YYYY) MM / DD /YYYY 11

12 12

13 PARTNER’S NAMEXXXXXXXXXXXXXXXXXXXXXXXXX 0123456789 0123456789 13

14 Partnership’s Name Federal ID Number Minnesota Tax ID Number 14

15 DOING BUSINESS AS XXXXXXXXXXXXXXXXXXXXX 15

Check this box if the name or address has changed since

16 Doing Business As filing your original return. Fill in former information below. 16

X

17 MAILING ADDRESSXXXXXXXXXXXXXXXXXXXXXXXX FORMER NAME OR ADDRESS IF CHANGED 17

18 Mailing Address Former Name or Address, if Changed 18

19 CITYXXXXXXXXXXXXXXXXXX MN XXXXX 1234 1234 19

20 City State ZIP Code Number of Amended Schedules KPI and KPC Number of Partners 20

21 21

22 Composite Pass-through Partnership Pays Election Installment Sale of Tax Position Disclosure 22

Check if: X Income Tax X Entity (PTE) X (Enclose Schedule M3BBA) X Pass-through Assets (Enclose Form TPD)

23 or Interests X 23

24 24

25 Amended IRS Changes affect Changes affect Changes Changes Public Law 25

Check box to indicate the

26 reason you are amending: X Federal Return/ X Adjustment X Nonresident Withholding X Schedules KPC and/or KPI X affect M3A X 86-272 26

27 AAR Enter Final 27

Determination

28 Date A—As previously reported B—Net change C—Corrected amounts 28

29 29

MMDDYYYY

30 1 Minimum fee(from line 1 of Form M3) . . . . . . . . . . . . . . . . . . . . . . . . . . . .1 . . 012345678 012345678 012345678 30

31 31

32 2Pass-through Entity Tax (enclose Schedule PTE) . . . . . . . . . . . . . . . . . . . . . .2 . . 012345678 012345678 012345678 32

33 33

34 3 Composite income tax (enclose Schedules KPI) . . . . . . . . . . . . . . . . . . . . . . .3 . 012345678 012345678 012345678 34

35 35

36 4 Nonresident Minnesota withholding . . . . . . . . . . . . . . . . . . . . . . . 4 . . . 012345678. . . . . . 012345678 012345678 36

37 37

38 5Partnership Pays Election Tax (enclose Schedule M3BBA) . . . . . . . . . . . . . . .5 . 012345678 012345678 012345678 38

39 39

40 6 Add lines 1 through 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 012345678 012345678 012345678 40

41 41

42 7 Employer Transit Pass Credit not passed through to partners 42

43 (enclose Schedule ETP) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 012345678 012345678 012345678 43

44 44

45 8 Film Production Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8 012345678 012345678 012345678 45

46 46

47 Enter the credit certificate number: TAXC - 0123456789 47

48 48

49 9 Tax Credit for Owners of Agricultural Assets not passed through to 49

50 partners . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9 012345678 012345678 012345678 50

51 Enter the certificate number from the certificate you received from the 51

52 52

53 Rural Finance Authority: AO 01 -123456789 53

54 54

55 10 State Housing Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .10 012345678 012345678 012345678 55

56 56

57 Enter the credit certificate number from Minnesota Housing: SHTC - 1234 - 0123456789 57

58 58

59 11 Short Line Railroad Infrastructure Modernization Credit . . . . . . . . . . . . . . . .11 012345678 012345678 012345678 59

60 60

61 12 Credit for Sales of Manufactured Home Parks to Cooperatives . . . . . . . . . . .12 012345678 012345678 012345678 61

62 62

63 9995 Continued next page 63

2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 32 34 36 38 40 42 44 46 48 50 52 54 56 58 60 62 64 66 68 70 72 74 76 78 80 82 84 86

65 65