Enlarge image

1 1

2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 32 34 36 38 40 42 44 46 48 50 52 54 56 58 60 62 64 66 68 70 72 74 76 78 80 82 84 86

3 NEAR FINAL DRAFT 8/1/24 3

4 4

5 5

6 *248011* 6

7 7

8 Do not use staples on anyting you submit. 8

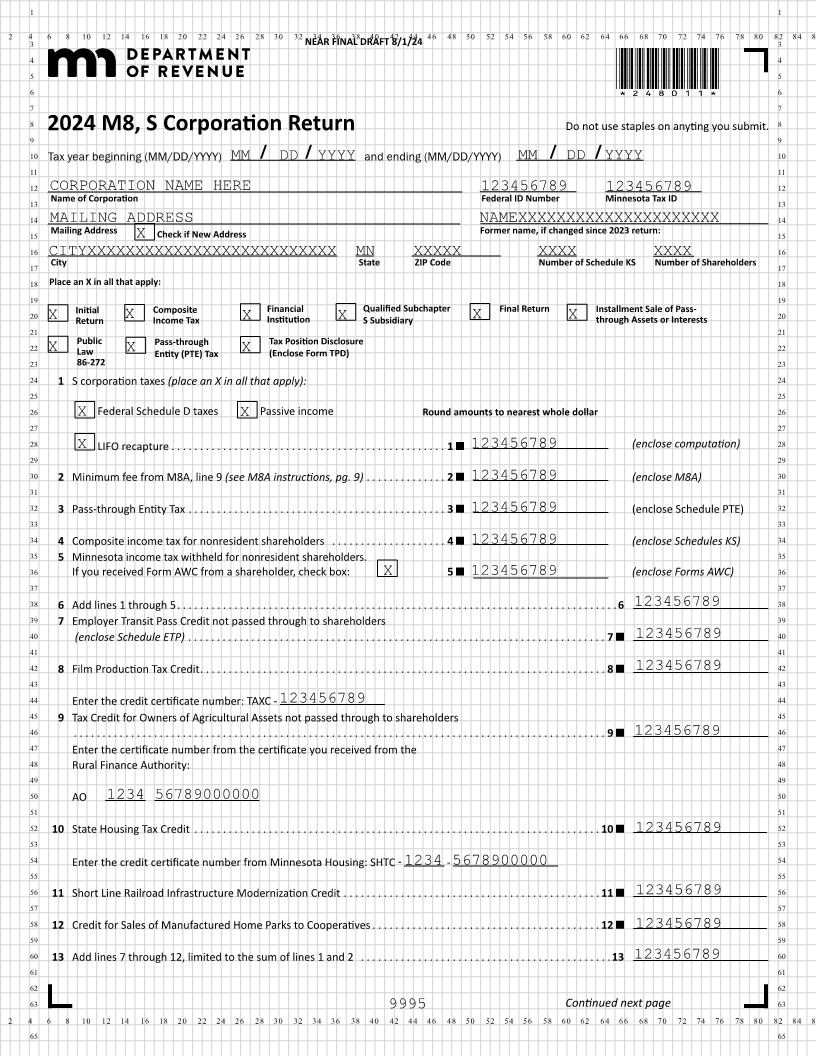

2024 M8, S Corporation Return

9 9

10 Tax year beginning (MM/DD/YYYY) MM / DD / YYYY and ending (MM/DD/YYYY) MM / DD /YYYY 10

11 11

12 CORPORATION NAME HERE 123456789 123456789 12

13 Name of Corporation Federal ID Number Minnesota Tax ID 13

14 MAILING ADDRESS NAMEXXXXXXXXXXXXXXXXXXXXX 14

15 Mailing Address Check if New Address Former name, if changed since 2023 return: 15

X

16 CITYXXXXXXXXXXXXXXXXXXXXXXXXXX MN XXXXX XXXX XXXX 16

17 City State ZIP Code Number of Schedule KS Number of Shareholders 17

18 Place an X in all that apply: 18

19 19

20 Initial Composite Financial Qualified Subchapter Final Return Installment Sale of Pass- 20

X Return X Income Tax X Institution X S Subsidiary X X through Assets or Interests

21 21

22 Public Pass-through Tax Position Disclosure 22

X Law X Entity (PTE) Tax X (Enclose Form TPD)

23 86-272 23

24 1 S corporation taxes (place an X in all that apply): 24

25 25

26 X Federal Schedule D taxes X Passive income Round amounts to nearest whole dollar 26

27 27

28 X LIFO recapture . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 123456789 (enclose computation) 28

29 29

30 2 Minimum fee from M8A, line 9 (see M8A instructions, pg. 9) . . . . . . . . . . . . . . 2 123456789 (enclose M8A) 30

31 31

32 3 Pass-through Entity Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 123456789 (enclose Schedule PTE) 32

33 33

34 4 Composite income tax for nonresident shareholders . . . . . . . . . . . . . . . . . . . . 4 123456789 (enclose Schedules KS) 34

35 5 Minnesota income tax withheld for nonresident shareholders. 35

36 If you received AWCForm from a shareholder, check box: X 5 123456789 (enclose Forms AWC) 36

37 37

38 6 Add lines 1 through 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 123456789 38

39 7 Employer Transit Pass Credit not passed through to shareholders 39

40 (enclose Schedule ETP) ... ...... ....... ..... ..... ...... ..... ...... ...... ...... ..... ...... ..... .. 7 123456789 40

41 41

42 8 Film Production Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8 123456789 42

43 43

44 Enter the credit certificate number: TAXC - 123456789 44

45 9 Tax Credit for Owners of Agricultural Assets not passed through to shareholders 45

46 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9 123456789 46

47 Enter the certificate number from the certificate you received from the 47

48 Rural Finance Authority: 48

49 49

50 AO 1234 56789000000 50

51 51

52 10 State Housing Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10 123456789 52

53 53

54 Enter the credit certificate number from Minnesota Housing: SHTC - 1234 -5678900000 54

55 55

56 11 Short Line Railroad Infrastructure Modernization Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11 123456789 56

57 57

58 12 Credit for Sales of Manufactured Home Parks to Cooperatives . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12 123456789 58

59 59

60 13 Add lines 7 through 12, limited to the sum of lines 1 and 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13 123456789 60

61 61

62 62

63 Continued next page 63

9995

2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 32 34 36 38 40 42 44 46 48 50 52 54 56 58 60 62 64 66 68 70 72 74 76 78 80 82 84 86

65 65