Enlarge image

1 1

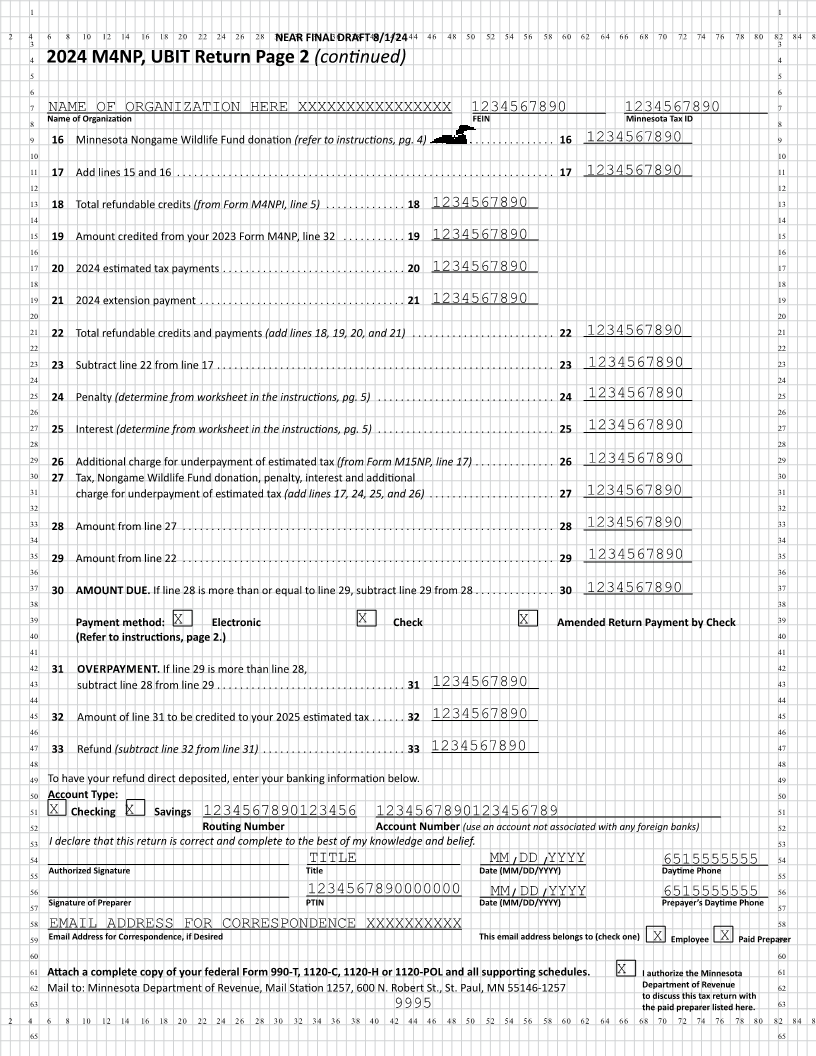

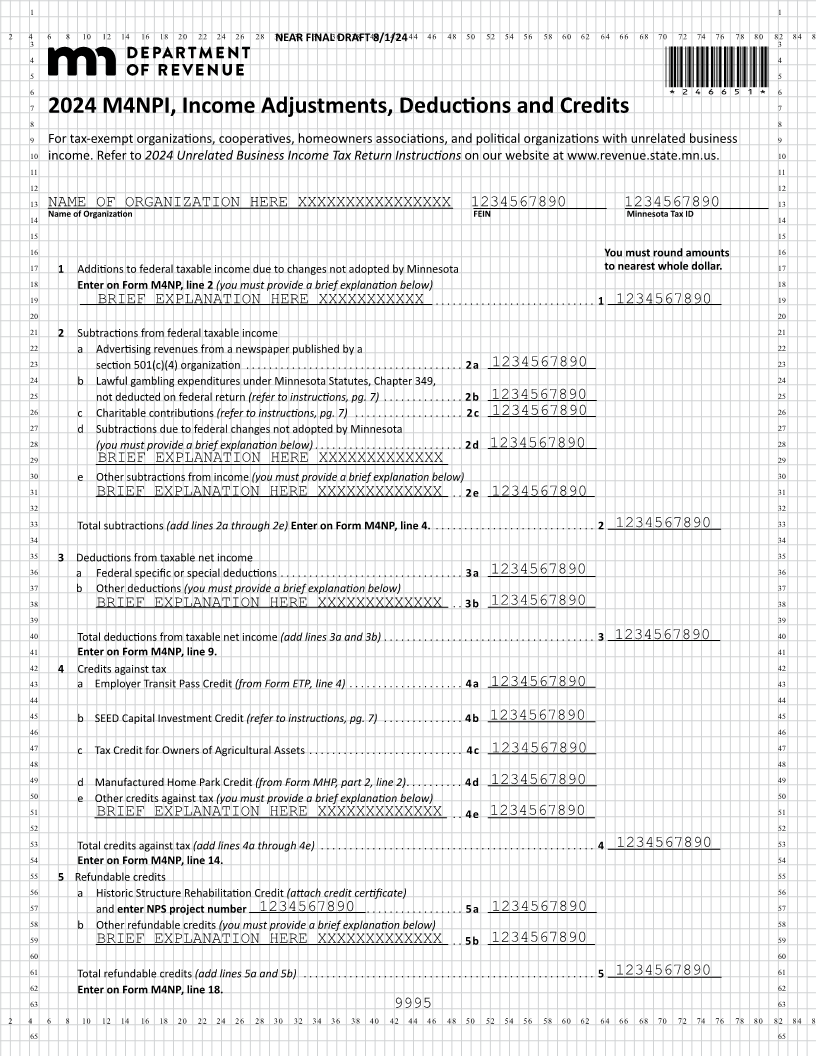

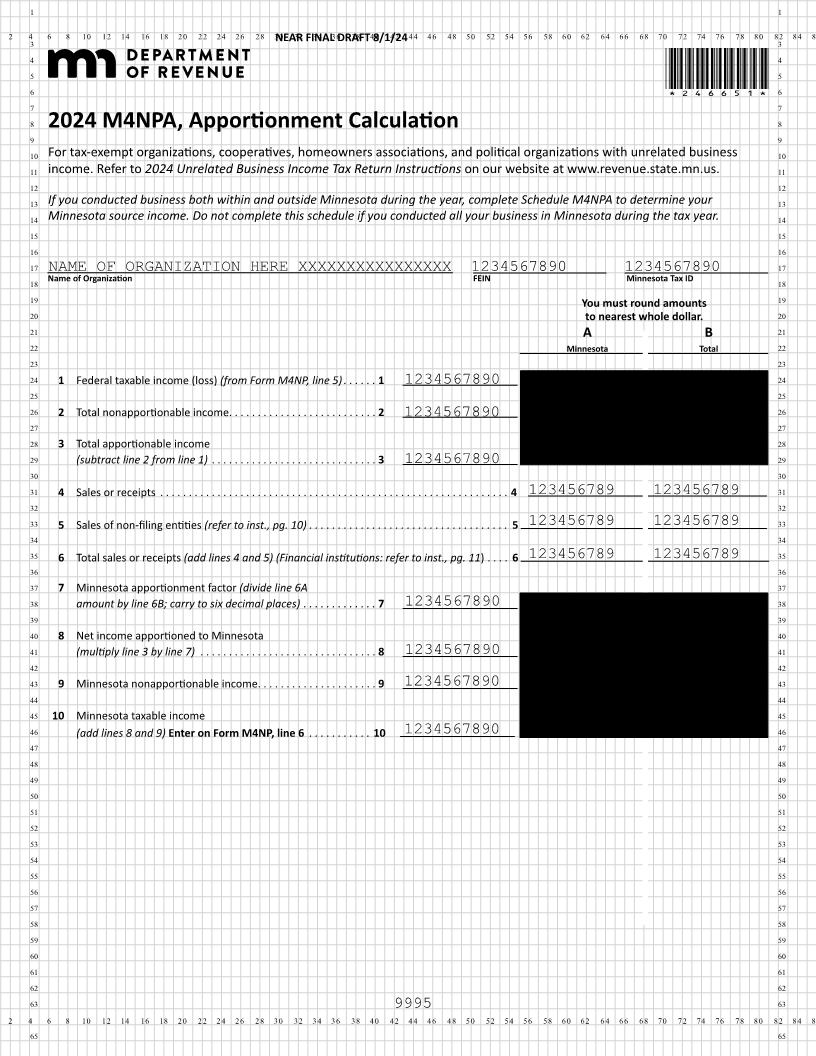

2 4 6 8 10 12 14 16 18 20 22 24 26 28 30NEAR32 FINAL34 36 DRAFT38 408/1/2442 44 46 48 50 52 54 56 58 60 62 64 66 68 70 72 74 76 78 80 82 84 86

3 3

4 4

5 5

6 *246651*6

7 7

2024 M4NP, Unrelated Business Income Tax (UBIT) Return

8 8

9 For tax-exempt organizations, cooperatives, homeowners associations, and political organizations with unrelated business 9

10 income. Refer to 2024 Unrelated Business Income Tax Return Instructions on our website at www.revenue.state.mn.us. 10

11 11

12 Tax year beginning (MM/DD/YYYY) MM/ DD /YYYY , and ending (MM/DD/YYYY) MM/ DD /YYYY (required) 12

13 13

14 NAME OF CORPORATIONXXXXXXXXXXXXXXXXXXX 1234567890 1234567890 14

15 Name of Organization FEIN Minnesota Tax ID (Required) 15

16 MAILING ADDRESSXXXXXXXXXXXX 16

17 Mailing Address X Check if New Address This Organization Files Federal Form (Check one) 17

18 CITYXXXXXXXXXX COUNTYXX MN 55555 X 990-T X 1120-C X 1120-H X 1120-POL 18

19 City County State ZIP Code Exempt Under IRS Section (Check one) 19

20 Check All Amended Under Filing Final Return to(refer inst., 4)pg. X 501(c)( XXX) X 528 X Other:XXXXXX20

21 That Apply: X Return X an Extension X Enter Close Date: XXXXX Enter your NAICS Codes (Refer to inst., pg. 4) 21

22 / 22

12345678900000 00000000000000

23 Are you filing a combined income return? X Yes X No 23

24 Was any business conducted outside of Minnesota? 24

25 Check reportingif Tax Position (Enclose Disclosure TPD) Form X X Yes (Complete and attach schedule M4NPA) X No 25

26 26

27 1 Federal taxable income before net operating loss and specific deduction You must round amounts to nearest whole dollar. 27

28 (total from all federal Form 990-T Schedule As, Part II line 16; 1120-C, line 25c; 28

29 1120-H, line 17; or 1120-POL, line 17c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 1234567890 29

30 30

31 2 Total additions to federal taxable income (from Form M4NPI, line 1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 1234567890 31

32 32

33 3 Federal taxable income after additions (add lines 1 and 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 1234567890 33

34 34

35 4 Total subtractions from federal taxable income (from Form M4NPI, line 2) . . . . . . . . . . . . . . . . . . . . . . 4 1234567890 35

36 36

37 5 Federal taxable income (loss) after subtractions (refer to instructions). If you conducted business both 37

38 within and outside Minnesota, complete Form M4NPA (refer to to instructions, pg. 4). If 100% of your 38

39 activities were conducted in Minnesota, do not complete Form M4NPA. Enter line 5 on line 6. . . . . . 5 1234567890 39

40 40

41 6 Minnesota taxable net income (loss) (from Form M4NPA, line 10.) If 100% of your activities 41

42 were conducted in Minnesota, enter amount from line 5 above. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 1234567890 42

43 43

44 7 Minnesota net operating loss deduction (from Form M4NP NOL) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 1234567890 44

45 45

46 8 Subtract line 7 from line 6 (if zero or less, enter zero) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8 1234567890 46

47 47

48 9 Total deductions from taxable net income (from Form M4NPI, line 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9 1234567890 48

49 49

50 10 Taxable income (subtract line 9 from line 8; if zero or less, enter zero) . . . . . . . . . . . . . . . . . . . . . . . . . .10 1234567890 50

51 51

52 11 Regular tax (multiply line 10 by 9.8% [0.098]; if zero or less, enter zero) . . . . . . . . . . . . . . . . . . . . . . . . .11 1234567890 52

53 53

54 12 Proxy tax (refer to instructions, pg. 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12 1234567890 54

55 55

56 13 Tax before credits (add lines 11 and 12) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13 1234567890 56

57 57

58 14 Total credits against tax (from Form M4NPI, line 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14 1234567890 58

59 59

60 15 Minnesota tax liability (subtract line 14 from line 13; if zero or less, enter zero) . . . . . . . . . . . . . . . . . 15 1234567890 60

61 61

62 Continued next page 62

63 9995 63

2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 32 34 36 38 40 42 44 46 48 50 52 54 56 58 60 62 64 66 68 70 72 74 76 78 80 82 84 86

65 65