Enlarge image

1 1

2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 32 34 36 38 40 42 44 46 48 50 52 54 56 58 60 62 64 66 68 70 72 74 76 78 80 82 84 86

3 3

4 NEAR FINAL DRAFT 8/6/24 4

5 5

6 *247611*6

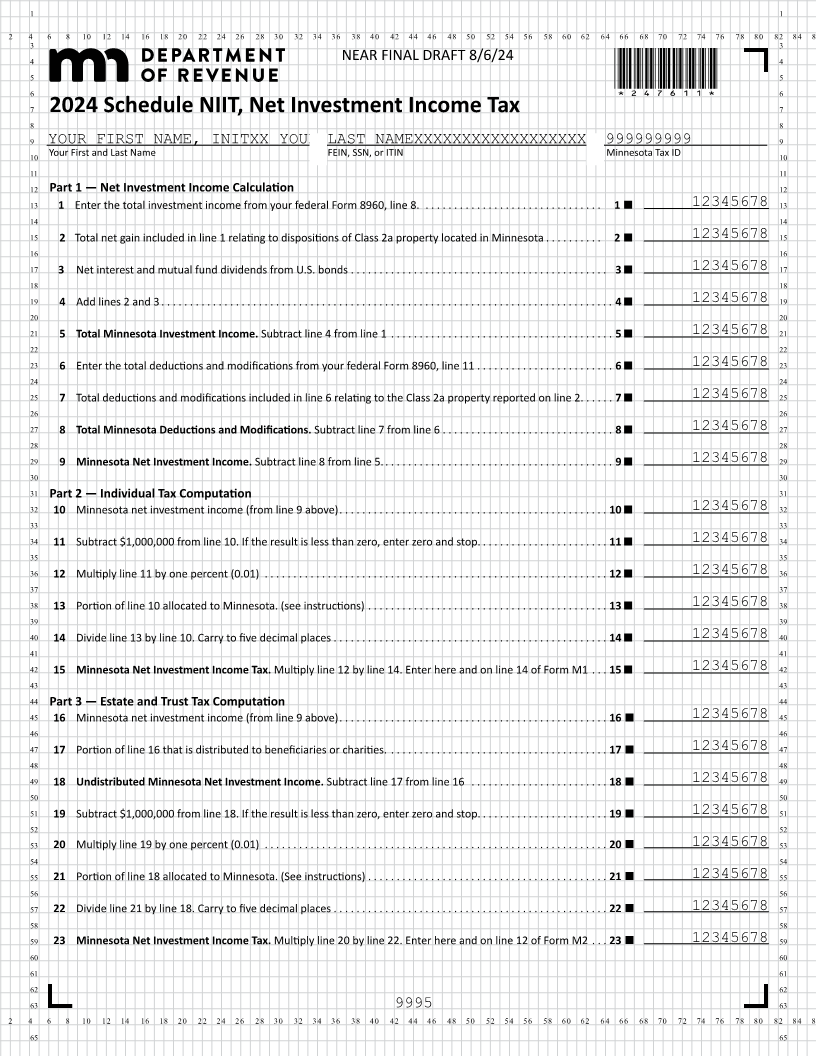

7 2024 Schedule NIIT, Net Investment Income Tax 7

8 8

9 YOUR FIRST NAME, INITXX YOUR LAST NAMEXXXXXXXXXXXXXXXXXX 999999999 9

10 Your First and Last Name FEIN, SSN, or ITIN Minnesota Tax ID 10

11 11

12 Part 1 — Net Investment Income Calculation 12

13 1 Enter the total investment income from your federal Form 8960, line 8. . ..... ...... ...... ..... ...... .. 1 12345678 13

14 14

15 2 Total net gain included in line 1 relating to dispositions of Class 2a property located in Minnesota ... ...... . 2 12345678 15

16 16

17 3 Net interest and mutual fund dividends from U.S. bonds . ...... ...... ...... ..... ..... ...... ...... .... 3 12345678 17

18 18

19 4 Add lines 2 and 3 ... ...... ..... ....... ..... ...... ..... ..... ...... ...... ...... ..... ...... ..... ... 4 12345678 19

20 20

21 5 Total Minnesota Investment Income. Subtract line 4 from line 1 .... ....... ..... ..... ....... .... ...... . 5 12345678 21

22 22

23 6Enter the total deductions and modifications federalyour from Form 8960, line 11 . . . . . . . . . . . . . . . . . . . . . . . . 6 12345678 23

24 24

25 7Total deductions and modifications in included line relating6 to the Class 2a property reported 2on line ... ... 7 12345678 25

26 26

27 8 Total Minnesota Deductions and Modifications. Subtract line 7 from line 6 .... ..... ...... ..... ....... ... 8 12345678 27

28 28

29 9 Minnesota Net Investment Income. Subtract line 8 from line 5.... ...... ..... ....... ..... ...... ..... ... 9 12345678 29

30 30

31 Part 2 — Individual Tax Computation 31

32 10 Minnesota net investment income (from line 9 above)... ...... ..... ....... ..... ...... ..... ..... ..... 10 12345678 32

33 33

34 11 Subtract $1,000,000 from line 10. If the result is less than zero, enter zero and stop. ... ...... ..... ....... . 11 12345678 34

35 35

36 12 Multiply line 11 by one percent (0.01) .. ..... ...... ...... ..... ...... ...... ..... ...... ..... ...... .. 12 12345678 36

37 37

38 13 Portion of line 10 allocated to Minnesota. (see instructions) ... ...... ..... ....... ..... ...... ..... ..... 13 12345678 38

39 39

40 14 Divide line 13 by line 10. Carry to five decimal places ... ...... ..... ....... ..... ...... ..... ..... ...... 14 12345678 40

41 41

42 15 Minnesota Net Investment Income Tax. Multiply by12 line 14. Enterline here and of 14 M1Form on line . .. 15 12345678 42

43 43

44 Part 3 — Estate and Trust Tax Computation 44

45 16 Minnesota net investment income (from line 9 above)... ...... ..... ....... ..... ...... ..... ..... ..... 16 12345678 45

46 46

47 17 Portion of line 16 that is distributed to beneficiaries or charities. ..... ...... ...... ..... ...... ..... ..... 17 12345678 47

48 48

49 18 Undistributed Minnesota Net Investment Income. Subtract line 17 from line 16 ... ...... ..... ...... .... 18 12345678 49

50 50

51 19 Subtract $1,000,000 from line 18. If the result is less than zero, enter zero and stop. ... ...... ..... ....... . 19 12345678 51

52 52

53 20 Multiply line 19 by one percent (0.01) .. ..... ...... ...... ..... ...... ...... ..... ...... ..... ...... .. 20 12345678 53

54 54

55 21 Portion of line 18 allocated to Minnesota. (See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21 12345678 55

56 56

57 22 Divide line 21 by line 18. Carry to five decimal places ... ...... ..... ....... ..... ...... ..... ..... ...... 22 12345678 57

58 58

59 23 Minnesota Net Investment Income Tax. Multiply line by20 line 22. Enter here and 12 of Form M2line on . .. 23 12345678 59

60 60

61 61

62 62

63 9995 63

2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 32 34 36 38 40 42 44 46 48 50 52 54 56 58 60 62 64 66 68 70 72 74 76 78 80 82 84 86

65 65