Enlarge image

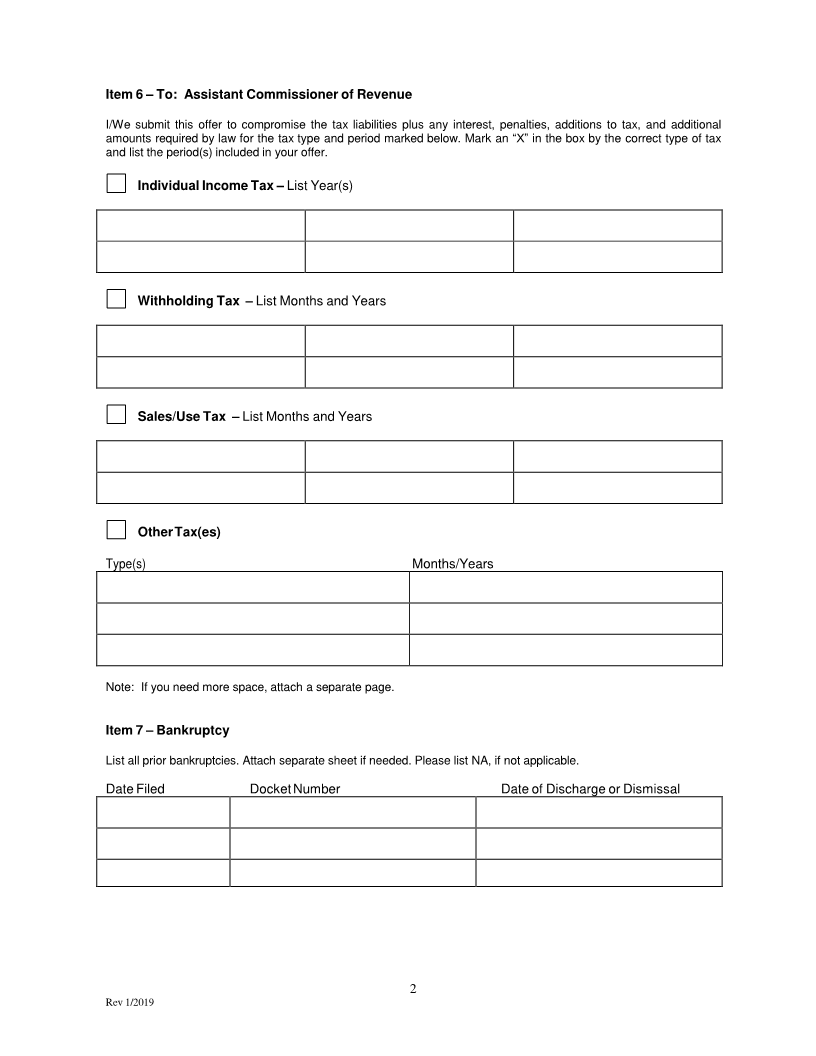

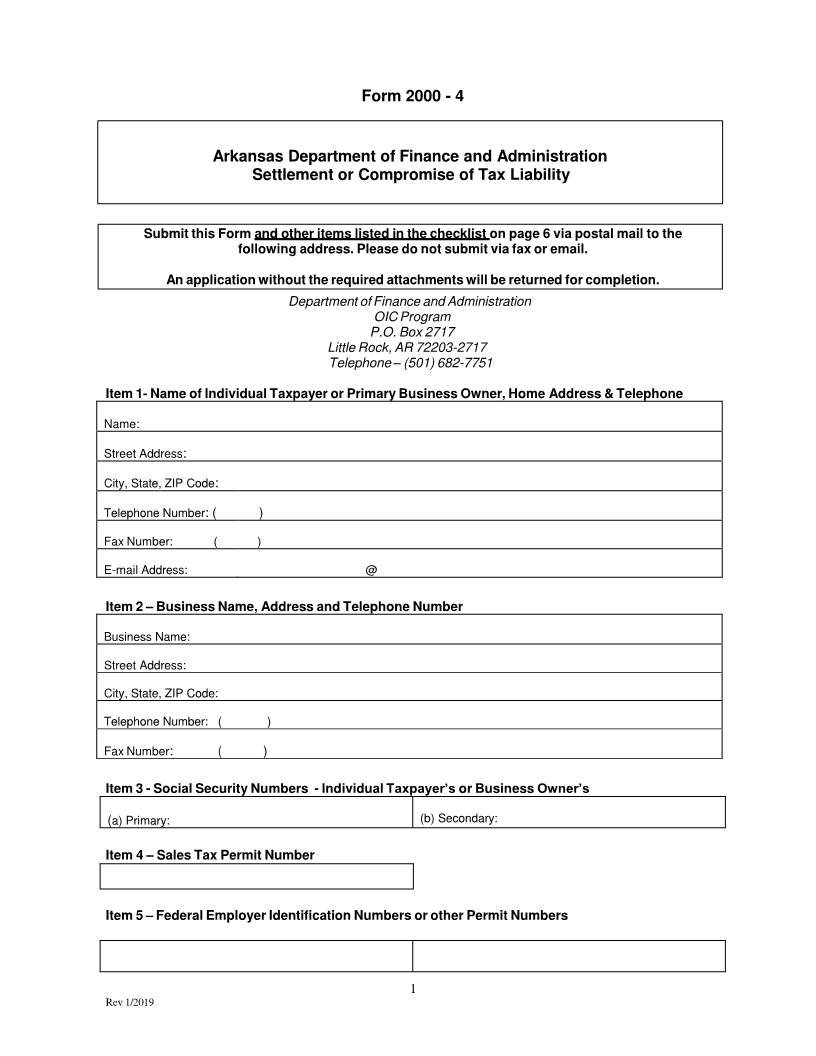

Form 2000 - 4

Arkansas Department of Finance and Administration

Settlement or Compromise of Tax Liability

Submit this Form and other items listed in the checklist on page 6 via postal mail to the

following address. Please do not submit via fax or email.

An application without the required attachments will be returned for completion.

Department of Finance and Administration

OIC Program

P.O. Box 2717

Little Rock, AR 72203-2717

Telephone –(501) 682-7751

Item 1- Name of Individual Taxpayer or Primary Business Owner, Home Address & Telephone

Name:

Street Address:

City, State, ZIP Code:

Telephone Number: ( )

Fax Number: ( )

E-mail Address: @

Item 2 –Business Name, Address and Telephone Number

Business Name:

Street Address:

City, State, ZIP Code:

Telephone Number: ( )

Fax Number: ( )

Item 3 - Social Security Numbers - Individual Taxpayer’s or Business Owner’s

(a) Primary: (b) Secondary:

Item 4 –Sales Tax Permit Number

Item 5 –Federal Employer Identification Numbers or other Permit Numbers

1

Rev 1/2019