- 15 -

Enlarge image

|

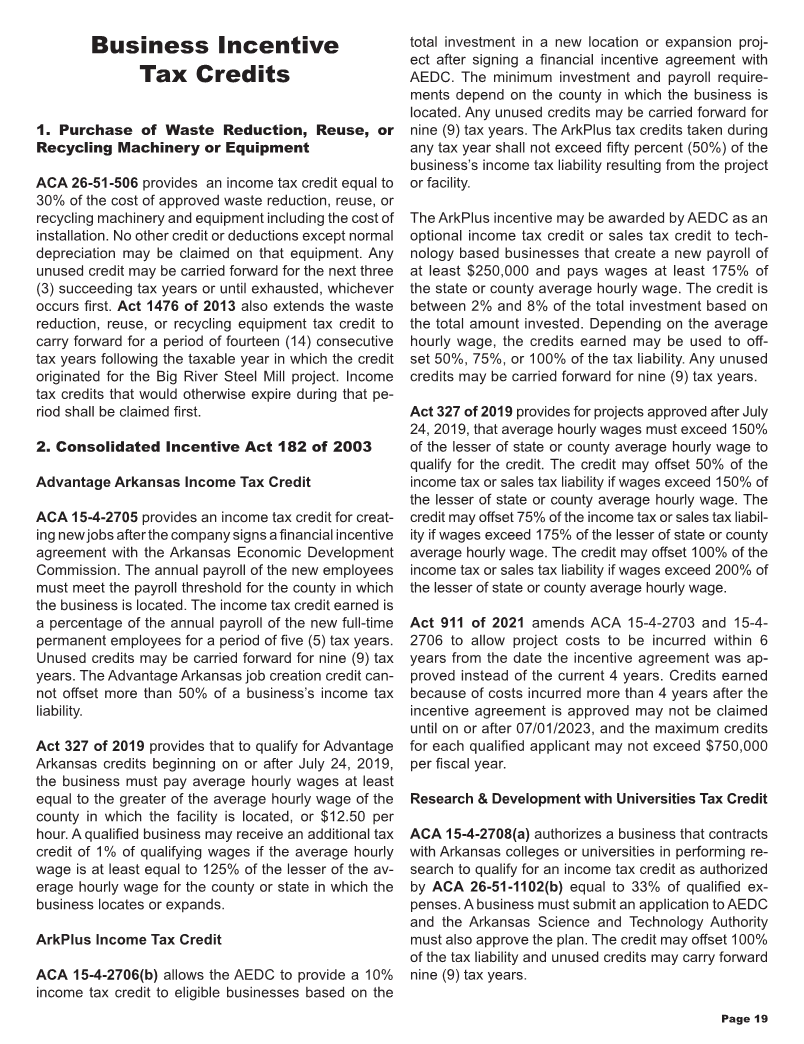

Line 2: Enter Salaries, Wages, Commissions and Gross receipts from transactions other than sales of

Other Compensation Related to the Production of tangible personal property are attributed to Arkansas if:

Business Income. 1) The income producing activity is performed entirely

within Arkansas or,

Sales/Receipts Factor: The receipts factor is a fraction,

the numerator of which is the total sales of the taxpayer 2) If the income producing activity is performed both

in this State during the tax period, and the denominator inside and outside of Arkansas, the income reportable

of which is the total sales of the taxpayer everywhere to Arkansas is determined by calculating the property,

during the tax period. The method of calculating re- payroll, and sales factor excluding sales from trans-

ceipts for purposes of the denominator is the same as actions other than the sale of tangible personal prop-

the method used in determining receipts for purposes erty and applying the resulting percentage to the

of the numerator. The receipts factor shall include only Arkansas sales factor numerator for gross receipts

those receipts which constitute business income and from transactions other than sales of tangible personal

are included in the computation of the apportionable property.

income base for the taxable year. Arkansas requires re-

ceipts to be gross receipts instead of net receipts. (f) Enter Total Sales/Receipts: (Add Lines 3a through

3e). Divide Line 3f in Column A by Line 3f in Column B to

Sales of tangible personal property are in this state if: arrive at the percentage for Line 3f in Column C.

(a) the property is delivered or shipped to a purchaser,

other than the United States Government, within this (g) Enter Double Weighted: Applies only to taxpayers

State regardless of the f.o.b. point or other conditions reporting under the three factor special industry regu-

of the sale or: (b) the property is shipped from an of- lations. Taxpayers using a single sales factor appor-

fice, store, warehouse, factory, or other place of stor- tionment or a single factor apportionment method for

age in this State and: (1) the purchaser is the United special industries do not double weight sales.

States Government or: (2) the taxpayer is not taxed in

the State of the purchaser. Line 4: Enter Sum of Percentages: (Single Weighted:

Add Column C, Lines 1c, 2a and 3f) (Double Weighted:

Add Column C, Lines 1c, 2a and 3g).

Line 3: Sales/Receipt

Line 5: Enter Percentage Attributable to Arkansas:

(a) Enter Destination Shipped from Within Arkansas:

For Part B, Line 5, divide Line 4 by number of entries oth-

Sale of property that is delivered or shipped by a seller

er than zero which you make on Part B, Column B, Lines

located in Arkansas to a purchaser located in Arkansas.

(1c), (2a), and (3f). Also, if Double Weighted Sales Factor

applies, any entry other than zero in Part B, Column B,

(b) Enter Destination Shipped from Without Arkansas:

Sale of property that is delivered or shipped to a pur- Line (3f), counts as two (2) entries. For taxpayers using

chaser located in Arkansas regardless of the f.o.b. point the sales factor only or a single factor apportionment

or other conditions of the sale. method under the special industry regulations, enter

the percentage on Line 3 F, Column C.

(c) Enter Origin Shipped from Within Arkansas to

U.S.Govt.: Gross receipts from sales of tangible per- Part C - Arkansas Taxable Income

sonal property to the United States Government are in

this state if the property is shipped from an office, store, Line 1: Enter Income Apportioned to Arkansas. (Part

warehouse, factory, or other place of storage in this A, Line 4) x (Part B, Line 5, Column C).

state and the purchaser is the U.S. Government.

Line 2: Enter Direct Income Allocated to Arkansas:

(d) Enter Origin Shipped from Within Arkansas to Include non-business income and partnership income/

Other Non-Taxable Jurisdictions: Sales of property loss that are sourced to Arkansas. Arkansas Regula-

that is shipped from an office, store, warehouse, factory tion 1.26-51-802(b) requires taxpayers to directly allo-

or other place of storage in Arkansas to a taxpayer that cate partnership Arkansas income or loss to Arkansas

is not taxable in the state of the purchaser. rather than including partnership income and apportion-

ment factors in the taxpayer’s apportionment formula.

(e) Enter Other Gross Receipts: Includes items such Multistate taxpayers with partnership income should

as interest income, other income, proceeds from sales deduct all partnership income on Part A, Line 3 (Deduct

of assets, rental income. (Attach schedule) Adjustments). Partnership losses should be added on

Part A, Line 2 (Add Adjustments). The taxpayer’s Arkan-

Page 15

|