Enlarge image

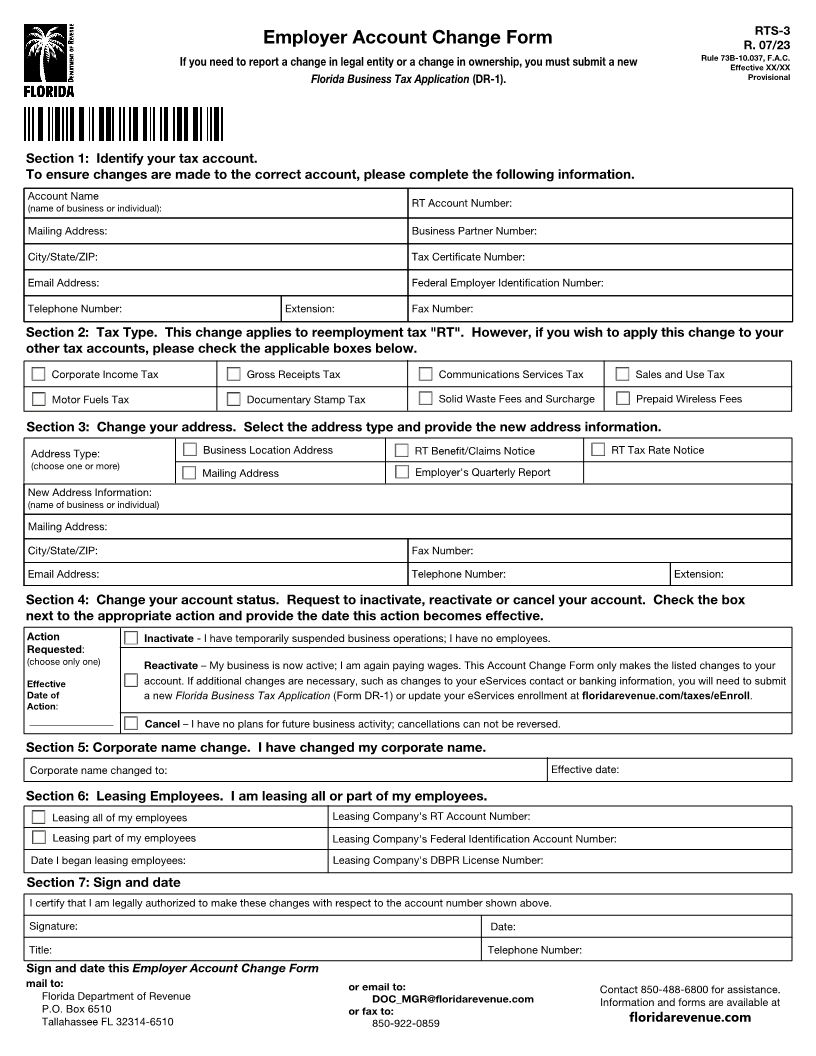

RTS-3

Employer Account Change Form R. 07/23

If you need to report a change in legal entity or a change in ownership, you must submit a new Rule 73B-10.037, F.A.C.

Effective XX/XX

Florida Business Tax Application (DR-1). Provisional

Section 1: Identify your tax account.

To ensure changes are made to the correct account, please complete the following information.

Account Name

(name of business or individual): RT Account Number:

Mailing Address: Business Partner Number:

City/State/ZIP: Tax Certificate Number:

Email Address: Federal Employer Identification Number:

Telephone Number: Extension: Fax Number:

Section 2: Tax Type. This change applies to reemployment tax "RT". However, if you wish to apply this change to your

other tax accounts, please check the applicable boxes below.

Corporate Income Tax Gross Receipts Tax Communications Services Tax Sales and Use Tax

Motor Fuels Tax Documentary Stamp Tax Solid Waste Fees and Surcharge Prepaid Wireless Fees

Section 3: Change your address. Select the address type and provide the new address information.

Address Type: Business Location Address RT Benefit/Claims Notice RT Tax Rate Notice

(choose one or more)

Mailing Address Employer's Quarterly Report

New Address Information:

(name of business or individual)

Mailing Address:

City/State/ZIP: Fax Number:

Email Address: Telephone Number: Extension:

Section 4: Change your account status. Request to inactivate, reactivate or cancel your account. Check the box

next to the appropriate action and provide the date this action becomes effective.

Action Inactivate - I have temporarily suspended business operations; I have no employees.

Requested:

(choose only one) Reactivate – My business is now active; I am again paying wages. This Account Change Form only makes the listed changes to your

Effective account. If additional changes are necessary, such as changes to your eServices contact or banking information, you will need to submit

Date of a new Florida Business Tax Application (Form DR-1) or update your eServices enrollment at floridarevenue.com/taxes/eEnroll.

Action:

__________________ Cancel – I have no plans for future business activity; cancellations can not be reversed.

Section 5: Corporate name change. I have changed my corporate name.

Corporate name changed to: Effective date:

Section 6: Leasing Employees. I am leasing all or part of my employees.

Leasing all of my employees Leasing Company's RT Account Number:

Leasing part of my employees Leasing Company's Federal Identification Account Number:

Date I began leasing employees: Leasing Company's DBPR License Number:

Section 7: Sign and date

I certify that I am legally authorized to make these changes with respect to the account number shown above.

Signature: Date:

Title: Telephone Number:

Sign and date this Employer Account Change Form

mail to: or email to: Contact 850-488-6800 for assistance.

Florida Department of Revenue DOC_MGR@floridarevenue.com Information and forms are available at

P.O. Box 6510 or fax to:

Tallahassee FL 32314-6510 850-922-0859 floridarevenue.com