Enlarge image

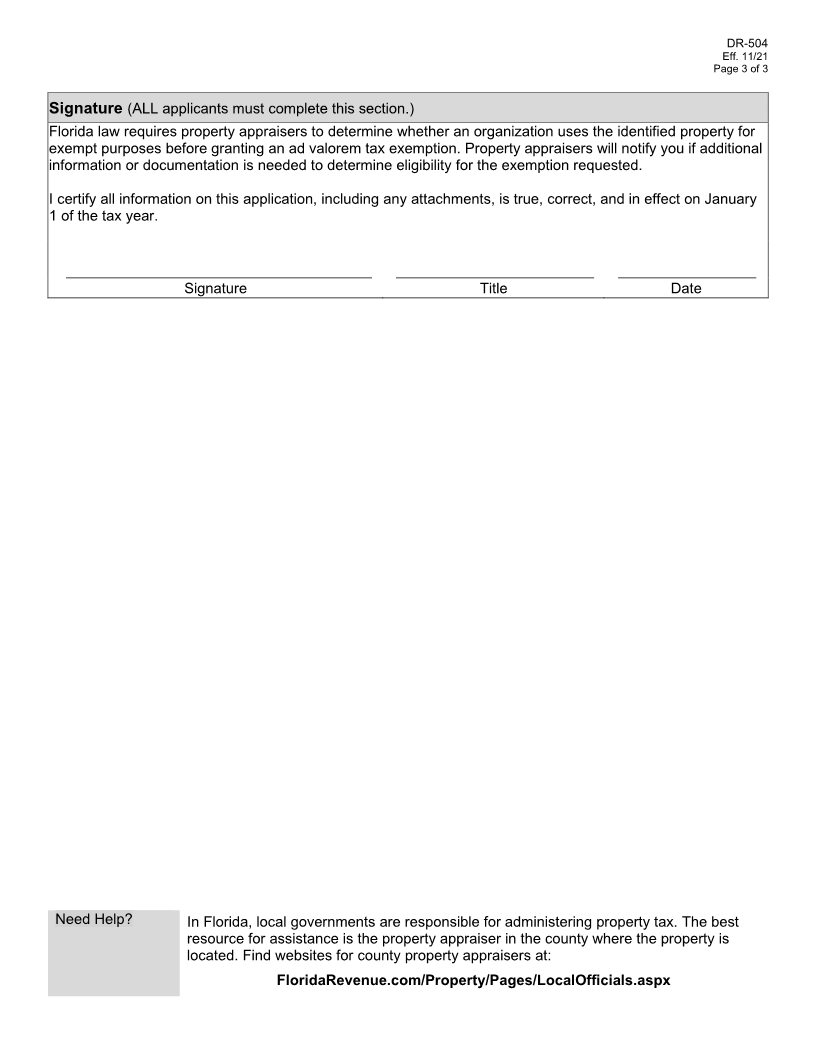

DR-504

R. 11/21

AD VALOREM TAX EXEMPTION APPLICATION Rule 12D-16.002

AND RETURN FOR CHARITABLE, RELIGIOUS, SCIENTIFIC, FAC

Eff. 11/21

LITERARY ORGANIZATIONS, HOSPITALS, NURSING Page 1 of 3

HOMES, AND HOMES FOR SPECIAL SERVICES

Sections 196.195, 196.196 and 196.197, Florida Statutes

This application is for use by nonprofit organizations to apply for an ad valorem tax exemption for property

used predominantly for an exempt purpose, as provided in sections (ss.) 196.195, 196.196, and 196.197,

Florida Statutes (F.S.) (select all that apply):

Charitable Religious Scientific Literary

Hospital Nursing Home Homes for Special Services

This completed application, including all required attachments, must be filed with the county property appraiser

on or before March 1 of the current tax year.

General Information (All applicants must complete this section.)

Applicant name Facility name

Mailing address Physical

address, if

different

Business phone County where property is located Select County

Parcel identification number or legal description

1. On January 1 of the current year, was the applicant a Florida not-for-profit corporation? Yes No

If yes, attach a copy of the filing confirmation letter from the Florida Department of State, a copy of the Articles

of Incorporation, as amended, and a copy of the Bylaws, as amended. If qualified as charitable under

section 501(c)(3) of the Internal Revenue Code, attach a copy of the determination letter issued by the

Internal Revenue Service.

If no, attach a copy of the applicant’s Articles of Organization, as amended, and other organizing documents

evidencing the organization’s purpose.

2. How is the property used? (Attach additional pages if needed.)

3. Is any portion of the property rented or leased? Yes No

If yes, attach a copy of all rental and lease contracts in effect during the last calendar year.

4. Is any portion of the property used for non-exempt purposes as provided in ss. 196.196 and 196.197, F.S.?

Yes No

If yes, provide a detailed explanation. (Attach additional pages if needed.)

For use by property appraisers Application Number ______________________