Enlarge image

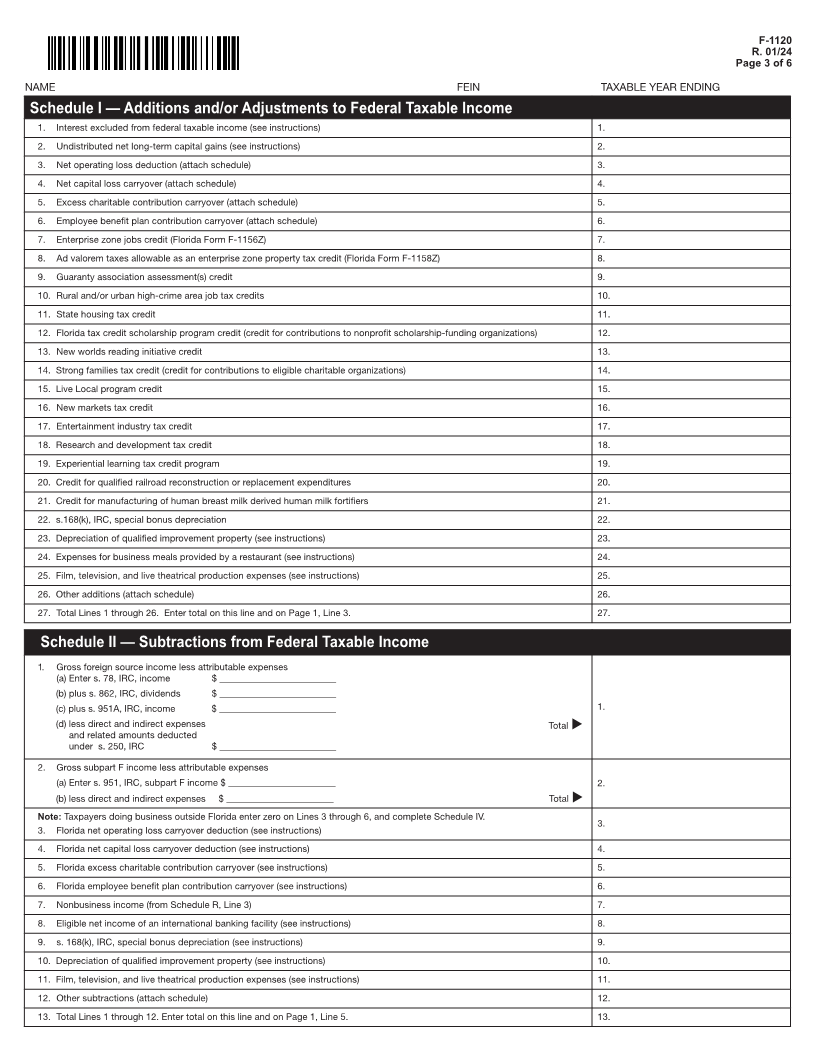

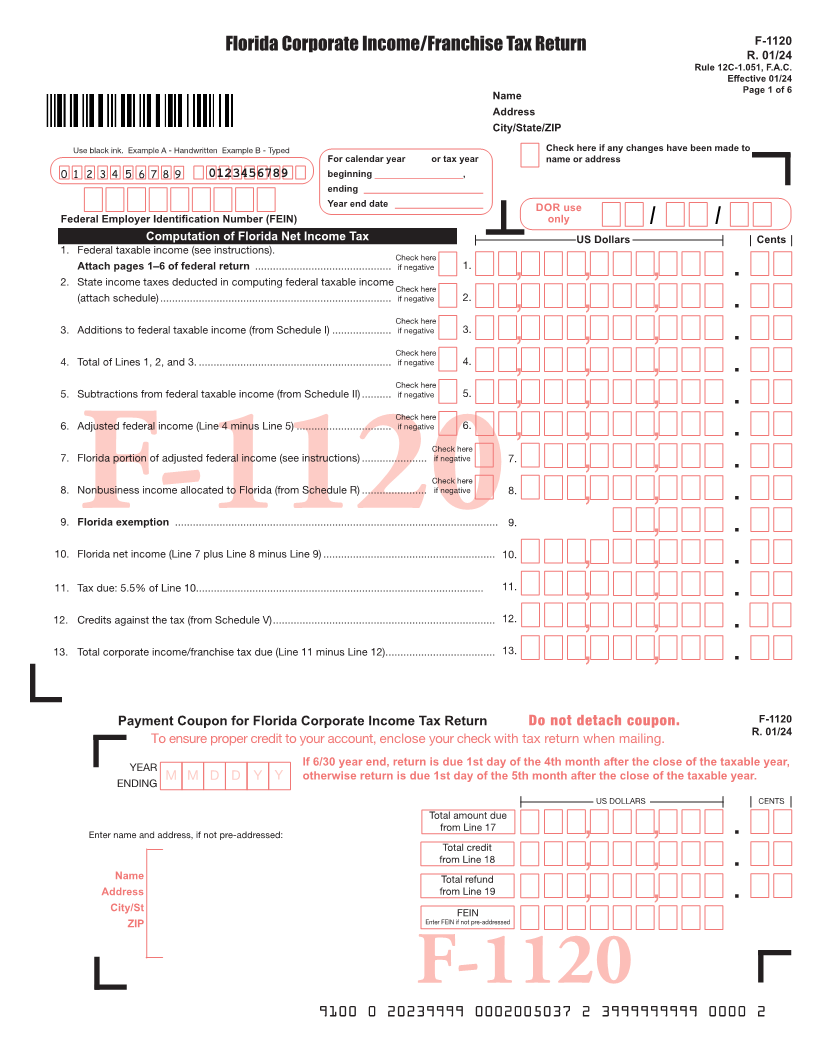

F-1120

Florida Corporate Income/Franchise Tax Return

R. 01/24

Rule 12C-1.051, F.A.C.

Effective 01/24

Page 1 of 6

Name

Address

City/State/ZIP

Use black ink. Example A - Handwritten Example B - Typed Check here if any changes have been made to

For calendar year 2015 or tax year name or address

0 1 2 3 4 5 6 7 8 9 0123456789 beginning _________________, 2015

ending _______________________

Year end date _________________ DOR use

Federal Employer Identification Number (FEIN) only / /

Computation of Florida Net Income Tax US Dollars Cents

1. Federal taxable income (see instructions). Check here

Attach pages 1–6 of federal return .............................................. if negative 1.

, , , .

2. State income taxes deducted in computing federal taxable income Check here

(attach schedule) .............................................................................. if negative 2.

, , , .

Check here

3. Additions to federal taxable income (from Schedule I) .................... if negative 3.

, , , .

Check here

4. Total of Lines 1, 2, and 3. ................................................................. if negative 4.

, , , .

Check here

5. Subtractions from federal taxable income (from Schedule II) .......... if negative 5.

, , , .

Check here

6. Adjusted federal income (Line 4 minus Line 5) ................................ if negative 6.

, , , .

Check here

7. Florida portion of adjusted federal income (see instructions) ...................... if negative 7.

, , .

Check here

8. Nonbusiness income allocated to Florida (from Schedule R) ...................... if negative 8.

, , .

9. Florida exemption ............................................................................................................. 9.

, .

F-1120

10. Florida net income (Line 7 plus Line 8 minus Line 9) .......................................................... 10.

, , .

11. Tax due: 5.5% of Line 10................................................................................................. 11.

, , .

12. Credits against the tax (from Schedule V) ........................................................................... 12.

, , .

13. Total corporate income/franchise tax due (Line 11 minus Line 12). .................................... 13.

, , .

Payment Coupon for Florida Corporate Income Tax Return Do not detach coupon. F-1120

To ensure proper credit to your account, enclose your check with tax return when mailing. R. 01/24

YEAR If 6/30 year end, return is due 1st day of the 4th month after the close of the taxable year,

ENDING M M D D Y Y otherwise return is due 1st day of the 5th month after the close of the taxable year.

US DOLLARS CENTS

Total amount due

from Line 17

Enter name and address, if not pre-addressed: , , .

Total credit

from Line 18

, , .

Name Total refund

Address from Line 19 , , .

City/St FEIN

ZIP Enter FEIN if not pre-addressed

F-1120

9100 0 20239999 0002005037 2 3999999999 0000 2