Enlarge image

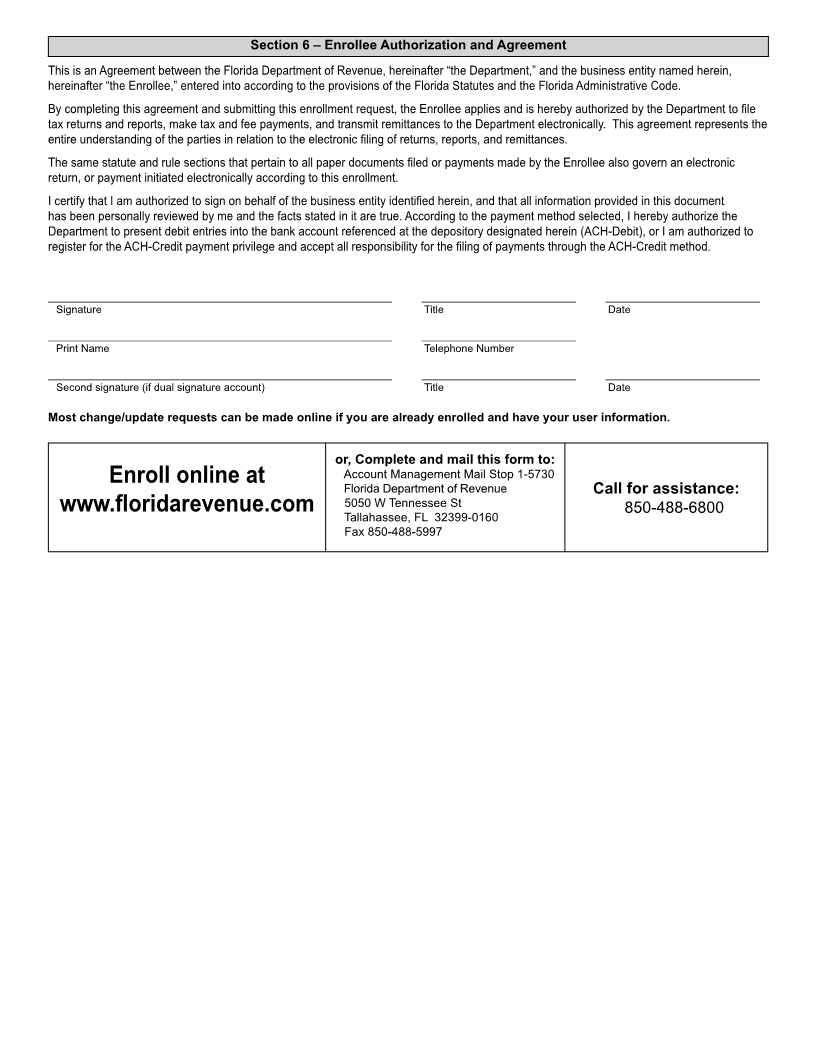

DR-600

Enrollment and Authorization for eServices R. 01/15

TC 05/24

This form can be completed online To enroll for multiple taxes or fees, you must Rule 12-24.011, F.A.C.

Effective 01/15

at www.floridarevenue.com use a separate form for each tax or fee or

you can enroll online all at once.

Section 1 – Check the Box That Applies

Initial enrollment Change in filing/ payment method Bank change Contact information change

Complete all sections Complete sections 2, 4, 5, and 6 Complete sections 2, 5, and 6 Complete sections 2, 3, & 6

If you wish to enroll for multiple taxes or accounts, you must use a separate form for each one or enroll online using our Internet site. The online

application allows you to enroll for all taxes at one time.

Section 2 – Business Information

Business entity name Type of tax (Note: Only 1 tax type per form)

FEIN/SSN* Tax account/certificate number (if different from FEIN/SSN)

*Social security numbers (SSNs) are used by the Florida Department of Revenue as unique identifiers for the administration of Florida’s taxes. SSNs obtained for tax

administration purposes are confidential under sections 213.053 and 119.071, Florida Statutes, and not subject to disclosure as public records. Collection of your SSN

is authorized under state and federal law. Visit our Internet site at www.floridarevenue.com and select “Privacy Notice” for more information regarding the state and

Federal law governing the collection, use, or release of SSNs, including authorized exceptions.

Section 3 – Contact Information

Electronic Payment Contact Person’s Information Electronic Return Contact Person’s Information

Name Name

Mailing address Mailing address

City/State/ZIP City/State/ZIP

Telephone number (include area code) Fax number (include area code) Telephone number (include area code) Fax number (include area code)

E-mail address E-mail address

Contact is a: company employee non-related tax preparer Contact is a: company employee non-related tax preparer

If tax preparer, provide Preparer Taxpayer Identification Number (PTIN): If tax preparer, provide Preparer Taxpayer Identification Number (PTIN):

If reemployment (RT) agent, provide RT Agent Number If reemployment (RT) agent, provide RT Agent Number

Section 4 – Filing/Payment Method Selection and Descriptions

ACH–Debit (e-check) is the action taken when the Department’s bank withdraws a tax payment from the taxpayer’s bank account upon payers re-

quest; the taxpayer’s account is debited.

ACH–Credit is the action taken when the taxpayer’s bank transfers a tax payment to the Department’s bank account; the Department’s account is

credited. This is not a credit card payment.

Electronically File Electronically Pay (select one): ACH Debit (e-check) ACH Credit

Section 5 – Banking Information (not required for ACH-Credit)

Bank Name _____________________________________ ABA Routing/Transit No.

Bank Account No. ________________________________

Account Type Business Checking Personal Checking Business Savings Personal Savings

Note: Due to federal security requirements, we cannot process international ACH transactions. If any portion of the money used in

payments you will make will come from financial institutions located outside of the US or its territories for the purpose of funding these

payments, please contact us to make other payment arrangements. If you are unsure, please contact your financial institution.