Enlarge image

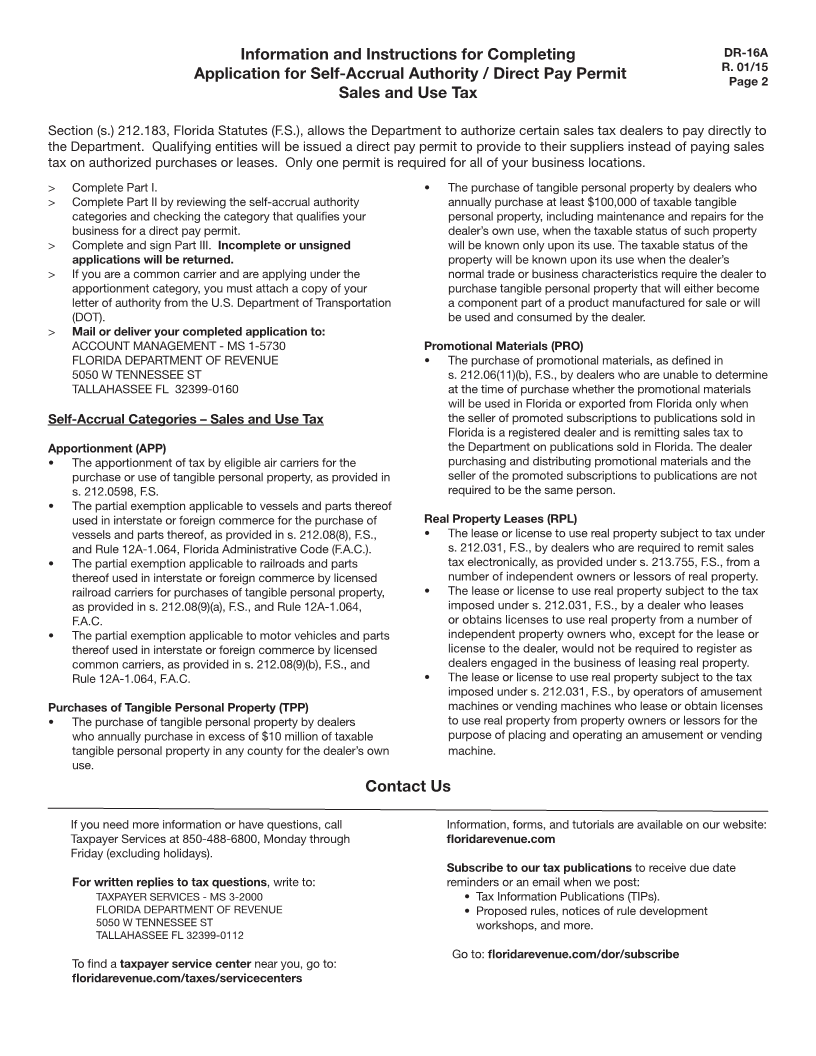

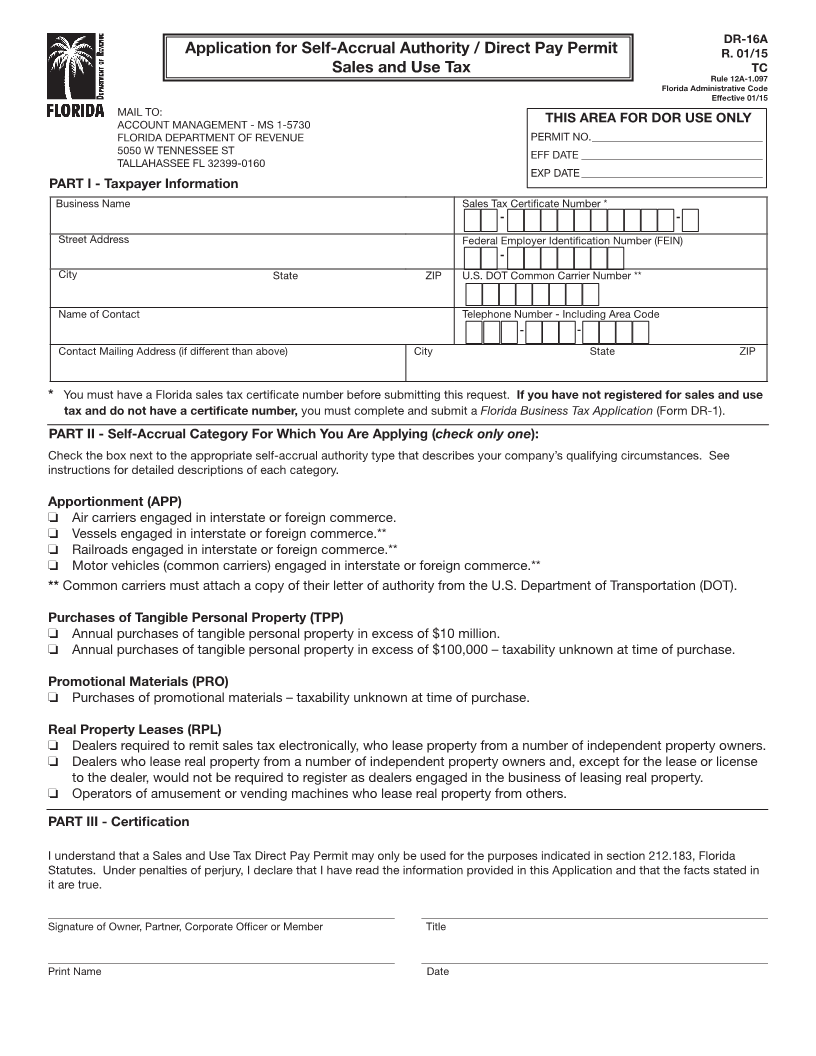

DR-16A

Application for Self-Accrual Authority / Direct Pay Permit R. 01/15

Sales and Use Tax TC

Rule 12A-1.097

Florida Administrative Code

Effective 01/15

MAIL TO:

ACCOUNT MANAGEMENT - MS 1-5730 THIS AREA FOR DOR USE ONLY

FLORIDA DEPARTMENT OF REVENUE PERMIT NO. ________________________________

5050 W TENNESSEE ST EFF DATE __________________________________

TALLAHASSEE FL 32399-0160

EXP DATE __________________________________

PART I - Taxpayer Information

Business Name Sales Tax Certificate Number *

- -

Street Address Federal Employer Identification Number (FEIN)

-

City State ZIP U.S. DOT Common Carrier Number **

Name of Contact Telephone Number - Including Area Code

- -

Contact Mailing Address (if different than above) City State ZIP

* You must have a Florida sales tax certificate number before submitting this request. If you have not registered for sales and use

tax and do not have a certificate number, you must complete and submit a Florida Business Tax Application (Form DR-1).

PART II - Self-Accrual Category For Which You Are Applying (check only one):

Check the box next to the appropriate self-accrual authority type that describes your company’s qualifying circumstances. See

instructions for detailed descriptions of each category.

Apportionment (APP)

o Air carriers engaged in interstate or foreign commerce.

o Vessels engaged in interstate or foreign commerce.**

o Railroads engaged in interstate or foreign commerce.**

o Motor vehicles (common carriers) engaged in interstate or foreign commerce.**

** Common carriers must attach a copy of their letter of authority from the U.S. Department of Transportation (DOT).

Purchases of Tangible Personal Property (TPP)

o Annual purchases of tangible personal property in excess of $10 million.

o Annual purchases of tangible personal property in excess of $100,000 – taxability unknown at time of purchase.

Promotional Materials (PRO)

o Purchases of promotional materials – taxability unknown at time of purchase.

Real Property Leases (RPL)

o Dealers required to remit sales tax electronically, who lease property from a number of independent property owners.

o Dealers who lease real property from a number of independent property owners and, except for the lease or license

to the dealer, would not be required to register as dealers engaged in the business of leasing real property.

o Operators of amusement or vending machines who lease real property from others.

PART III - Certification

I understand that a Sales and Use Tax Direct Pay Permit may only be used for the purposes indicated in section 212.183, Florida

Statutes. Under penalties of perjury, I declare that I have read the information provided in this Application and that the facts stated in

it are true.

____________________________________________________ ____________________________________________________

Signature of Owner, Partner, Corporate Officer or Member Title

____________________________________________________ ____________________________________________________

Print Name Date