Enlarge image

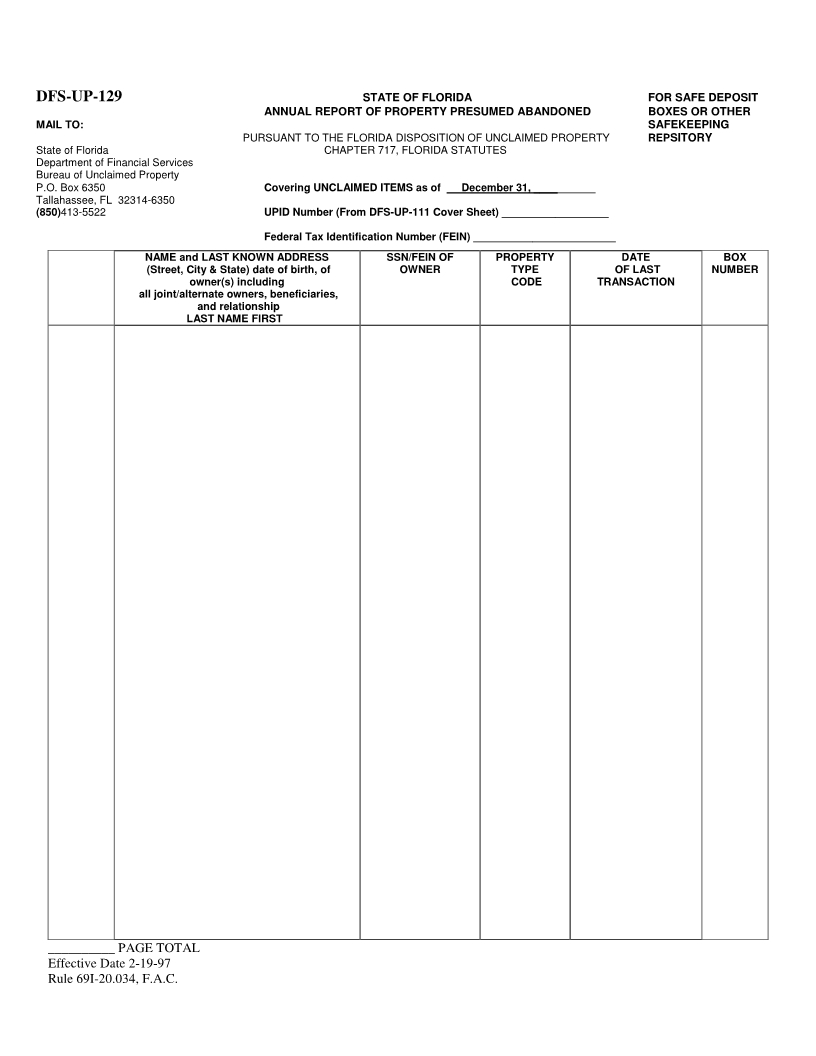

DFS-UP-129 STATE OF FLORIDA FOR SAFE DEPOSIT

ANNUAL REPORT OF PROPERTY PRESUMED ABANDONED BOXES OR OTHER

MAIL TO: SAFEKEEPING

PURSUANT TO THE FLORIDA DISPOSITION OF UNCLAIMED PROPERTY REPSITORY

State of Florida CHAPTER 717, FLORIDA STATUTES

Department of Financial Services

Bureau of Unclaimed Property

P.O. Box 6350 Covering UNCLAIMED ITEMS as of December 31, __________

Tallahassee, FL 32314-6350

(850)413-5522 UPID Number (From DFS-UP-111 Cover Sheet) __________________

Federal Tax Identification Number (FEIN) ________________________

NAME and LAST KNOWN ADDRESS SSN/FEIN OF PROPERTY DATE BOX

(Street, City & State) date of birth, of OWNER TYPE OF LAST NUMBER

owner(s) including CODE TRANSACTION

all joint/alternate owners, beneficiaries,

and relationship

LAST NAME FIRST

__________ PAGE TOTAL

Effective Date 2-19-97

Rule 69I-20.034, F.A.C.